The U.S. dairy herd has a head start on what is expected to be a growth year in 2017, based on the USDA’s semi-annual estimate of dairy cows and heifers. However, dairy replacement heifers numbers are down slightly, and more heifers will be exported in 2017.

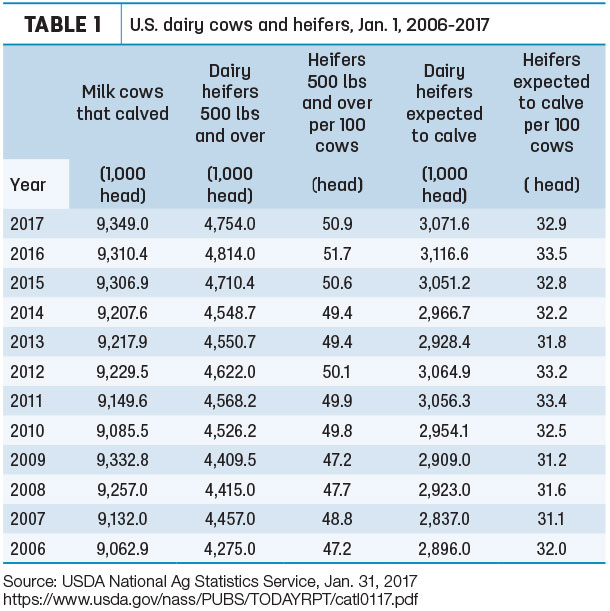

The USDA released its semi-annual Cattle report in late January, including estimates of U.S. dairy cows, replacement heifers and heifers expected to calve within the next year (Table 1).

The full report, which includes both beef and dairy cattle inventory estimates, summarizes January 2017 surveys of about 38,000 livestock operations across the U.S.

As of Jan. 1, 2017, dairy cows calving during the previous year were estimated at 9.349 million head, up 38,600 head from Jan. 1, 2016 and the highest Jan. 1 total in two decades. There were an estimated 9.416 million cows in U.S. herds on Jan. 1, 1996.

While cow numbers were up, dairy replacement heifers weighing more than 500 pounds were estimated at 4.754 million head, down about 60,000 head from a year ago. There were 50.9 heifers greater than 500 pounds per 100 cows as of Jan. 1, 2017, down about 0.8 heifer per 100 cows compared to 2016’s revised estimate.

Of those total dairy replacement heifers, 3.072 million head are expected to calve in 2017, down about 45,000 from 2016. As of Jan. 1, 2017, there were 32.9 replacements expected to calve in 2017 for every 100 cows currently in the U.S. herd, slightly less than a year ago.

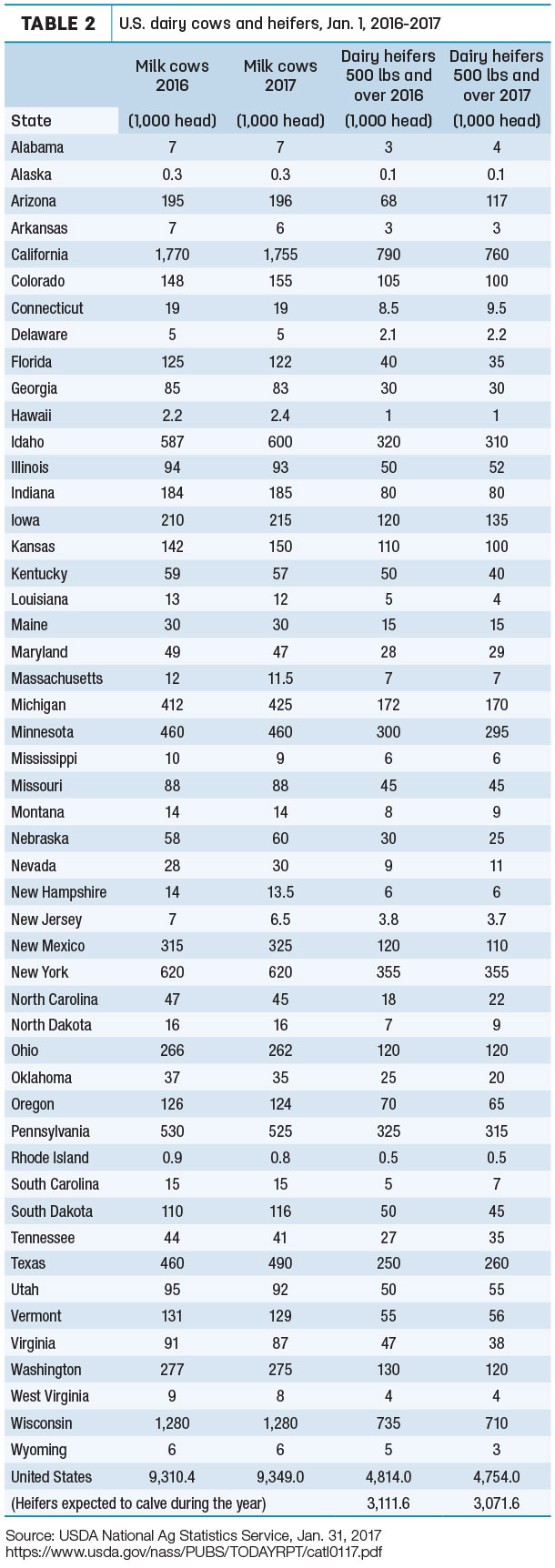

Leading states based on cow population were California, Wisconsin, New York, Idaho and Pennsylvania (Table 2).

Replacement cow prices continue to weaken

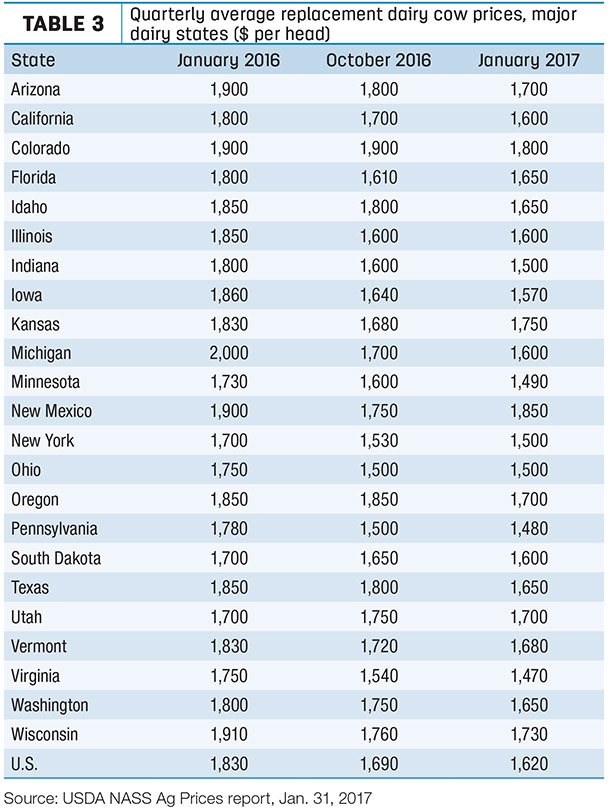

Despite improving milk prices to end 2016, average U.S. dairy replacement cow prices trended lower for a sixth consecutive quarter.

Preliminary January 2017 U.S. quarterly replacement dairy cow prices averaged $1,620 per head, $70 less than October 2016 and $210 per head less than January 2016 (Table 3).

National average replacement cow prices had peaked at $2,120 per head in October 2014, when milk prices had reached their zenith. Since then, U.S. average prices have declined in eight of nine quarters and are down about 24 percent.

The USDA estimates are based on quarterly surveys (January, April, July and October) of dairy farmers in 23 major dairy states, as well as an annual survey (February) in all states, according to Mike Miller with the USDA’s National Ag Statistics Service.

The prices reflect those paid or received for cows that have had at least one calf and are sold for replacement purposes, not as cull cows. The report does not summarize auction market prices.

Among major dairy states, January 2017 average prices ranged from highs of $1,850 per head in New Mexico and $1,800 in Colorado to less than $1,500 in Minnesota, Pennsylvania and Virginia.

Compared to the previous quarter, prices were higher in Florida, Kansas and New Mexico.

Regionally, staff with Northwest Farm Credit Services reported replacement cow prices were showing some weakness in the Pacific Northwest. However, demand for Jerseys remained steady, as some producers were adding Jersey cows to their milking herd to improve milk components and receive quality bonuses on their milk.

In California, the impact of declining land values and weaker equity positions stretched all the way to replacement heifer prices, according to Bob Matlick with the accounting firm of Frazer LLP.

Canada’s demand for short-bred heifers is helping support dairy heifer prices in U.S. states along the Canadian-U.S. border, according to Gerardo Quaassdorff, DVM, sales and management consultant with TK Exports Inc., Boston, Virginia.

Dairy replacement cattle exports close 2016 stronger

U.S. producers in search of replacements could find increasing competition from foreign buyers.

U.S. dairy cattle exporters moved 4,771 replacement heifers offshore in the final two months of 2016, but that wasn’t enough to avert the weakest export year since 2007.

About 12,216 dairy heifers were exported in 2016, just 17 percent of the record-high total of 73,442 head exported in 2011. The 2016 exports were valued at $23.7 million. U.S. North American Free Trade Agreement partners were the biggest customers last year. Mexico purchased more than two-thirds of the 2016 total at 8,226 head, with Canada a destination for 3,161 head.

Despite the weak year, replacement heifer export numbers and interest are gaining strength in emerging countries and Asia, Quaassdorff said.

There’s also greater interest from buyers in Mexico and Canada, seeking to replenish dairy herds and ensure domestic milk supplies in preparation for the potential renegotiation of the North American Free Trade Agreement.

Tony Clayton, Clayton Agri-Marketing Inc., Jefferson City, Missouri, said a large shipment of East Coast heifers departed for Turkey in early February, and his company had just loaded 1,500 head of dairy cattle on a ship for Sudan. At least two other ship loads of heifers were headed to Vietnam in February-April.

Clayton expects Mexico’s interest to remain high into spring, pending any change in U.S.-Mexico trade relations. There’s also renewed interest from Russia, with potential for a summer shipment. ![]()

PHOTO: Dairy cows heading out to graze. Photo by Mike Dixon.

-

Dave Natzke

- Editor

- Progressive Dairyman

- Email Dave Natzke