Improved sales of milk powder to Mexico and whey to China, plus rebounding world commodity prices, led U.S. dairy exports to post their first year-over-year value increase in more than two years. Overall exports were valued at $402.6 million, up 3 percent from last August.

Exporters shipped 172,764 tons of milk powders, cheese, butterfat, whey and lactose during the month, 23 percent more than the prior year and the most since May 2015. Exports of milk powder to Mexico were a record high 32,883, up 80 percent from last year.

Exports of whey products to China were more than double year-ago levels and accounted for 45 percent of total U.S. whey shipments. Dry whey volume was the most since May 2015; exports of whey protein concentrate reached the second-most ever.

Cheese exports were 22,710 tons, up fractionally from last August, marking the first year-over-year gain since September 2014.

U.S. butterfat remained priced out of the world market in August, and, coupled with heavier butterfat imports, turned in a net trade deficit.

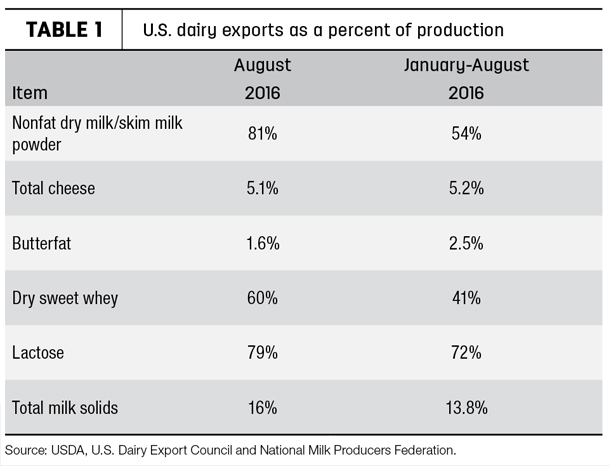

On a total milk solids basis, U.S. exports were equivalent to 16 percent of U.S. milk production in August (Table 1), the highest since April 2015. Imports were equivalent to 4.2 percent of production.

According to the USDA Economic Research Service, fiscal year 2016 (October 2015-August 2016) dairy product exports were valued at $4.26 billion, down 19 percent from the same period a year earlier. Imports were valued at $3.15 billion, down 6 percent from the same period a year ago.

The year-to-date milk equivalent of dairy products exported through the Cooperatives Working Together (CWT) reached nearly 700 million pounds as of the week ending Sept. 30. As of that date, cheese exports topped 39.7 million pounds; butter exports topped 7.5 million pounds; and whole milk powder topped 21.3 million pounds.

Dairy cattle exports still slumber

Dairy cattle exports continued to sleep walk. About 684 female dairy cattle replacements found homes outside the U.S. in August, the lowest total in three months. All of the cattle went to our closest neighbors: Canada imported 365, with Mexico taking 319 head. The cattle were valued at $1.13 million.

Gerardo Quaassdorff, DVM, sales and management consultant with TK Exports Inc., TKE Agri-Tech Services Inc., Culpeper, Virginia, said there’s positive news, even though exports of live dairy cattle remain in a slump.

Quaassdorff said he is seeing increased interest in dairy heifers, feeder cattle and beef heifers.

“The main disadvantage continues to be the unfavorable exchange rate dollar versus local currency of the importing country compared to the Euro and Australian dollar,” he said.

Dairy heifers from the European Union are the main U.S. competitors for delivery into Middle East and Asian countries.

“We expect a resumption of exports for live dairy cattle late this year and/or early next year, once the supply of EU heifers ends or get to price levels we can compete with them.”

Tony Clayton, Clayton Agri-Marketing Inc., Jefferson City, Missouri, also sees some positives ahead.

“Live dairy exports still continue to be slow, but many countries continue to inquire,” Clayton said. He noted a tender for 2,000 head of Holstein heifers was just released from Vietnam for shipment in early 2017.

“Sales to Mexico still hinge on the U.S. dollar and Mexican peso relationship,” he continued. ”When the peso stays close to P$20 to a USD $1, there is little consideration to importing cattle.”

There’s also positive news on the beef cattle market, where China has opened its door to U.S. beef. After new health protocols are negotiated, live U.S. beef cattle could also be headed that way.

Foreign sales of U.S. dairy embryos totaled just 585 in August 2016, the smallest total since February. Exports were valued at $700,000. Japan was the leading market for the month, purchasing 235 dairy embryos, followed by France (124) and Brazil (100).

August alfalfa hay exports set volume record

With three major foreign markets setting highs for the year, U.S. alfalfa hay exports volume grew in August, nearing 250,000 metric tons (MT) for the first time ever. Exports have now topped 200,000 metric tons for four consecutive months.

Clouds were forming over the hay export market in September, but those factors were not yet reflected in August numbers.

Alfalfa hay exports to China, Japan and Saudi Arabia were substantially higher, pushing the monthly world total to 247,888 MT. Despite lower prices, the jump in volume pushed the value of August alfalfa hay exports to nearly $74.7 million, the highest total of the year.

At 120,015 MT, August exports of other hay continued a small increase for a second straight month. Exports of alfalfa cubes and meal also improved slightly.

U.S. ag trade balance gaining strength

The U.S. agricultural trade balance continued to gain strength in August. Monthly ag exports were valued at $11.25 billion, the highest since November 2015; imports were $9.42 billion, resulting in a trade surplus of about $1.84 billion, the strongest since December 2015. Fiscal year 2016 year-to-date (October 2015-August 2016) exports are estimated at $118.61 billion, compared to $104.23 billion in imports, for a trade surplus of $14.38 billion. ![]()

-

Dave Natzke

- Editor

- Progressive Dairyman

- Email Dave Natzke