On the football field, it’s about pulling everything together to finish strong. In the milking parlor, whether it’s the genetics, feed, weather, facilities, management or all of the above, it looks like the cows are “owning” the fourth quarter.

As in recent months, milk per cow continues to be a main storyline in USDA’s monthly production estimates. U.S. November milk output per cow was up about 40 pounds compared to the same month a year earlier. If the pace continues, October-December 2016 milk output per cow will have grown more than 2 percent compared to the same period a year earlier, among the strongest quarterly stretches in the past decade.

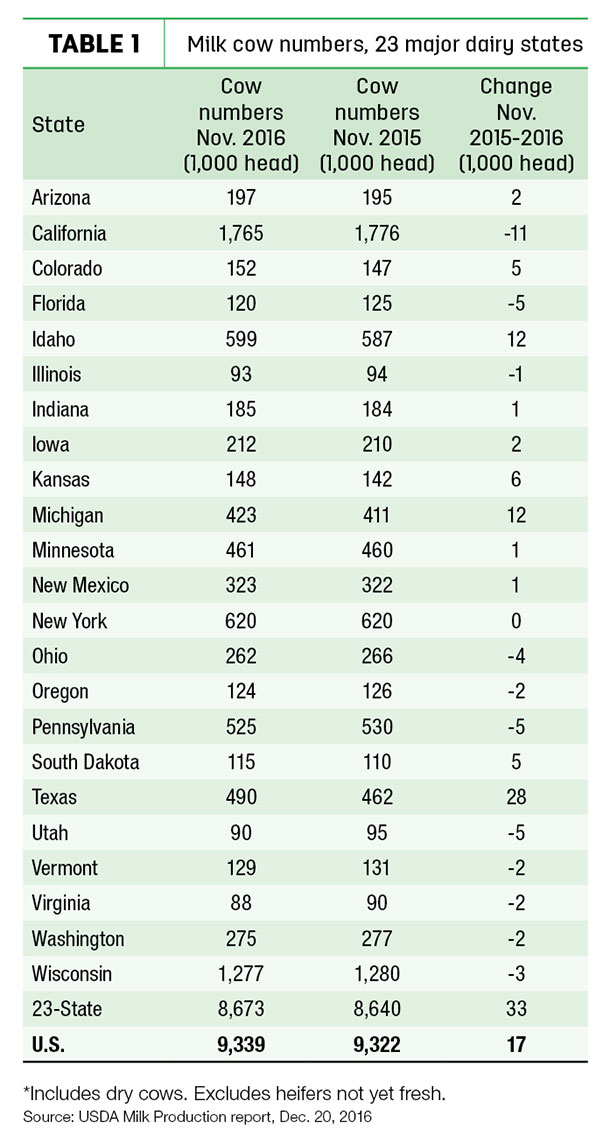

The second storyline is cow numbers. After a two-month decline, USDA estimated milk cow numbers increased slightly in November (Table 1). Among the major dairy states, cow numbers grew in 11 states and declined in 11 others, with New York unchanged.

According to Marvin Hoekema, president of Dairy Decisions Consulting, LLC, the state cow numbers represent more of a relocation rather than outright expansion. Animals are moving from high-cost to low-cost feed areas. Specifically, animals are moving from California to Texas, Idaho and Kansas.

The box score

November U.S. milk production was estimated at 17.09 billion pounds, up 2.4 percent from the same month a year earlier. Cow numbers were estimated at 9.39 million head, 17,000 more than a year ago and 4,000 head more than October 2016. Production per cow averaged 1,829 pounds for November, 39 pounds more than November 2015.

November 2016 milk production in the 23 major dairy states was estimated at 16.06 billion pounds, up 2.6 percent. Cow numbers, at 8.67 million head, were 33,000 head more than November 2015 and 4,000 head more than October 2016. Production per cow averaged 1,851 pounds for November, 40 pounds more than November 2015.

Compared to a year earlier, cow numbers were up 28,000 in Texas and 12,000 each in Idaho and Michigan. In contrast, cow numbers were down 11,000 in California.

Led by Kansas, Texas, Colorado and Michigan, milk production increases were up across the country, with only five major states – Florida, Ohio, Utah, Virginia and Washington – producing less milk than the same month a year earlier. Those states had fewer cows than a year earlier and, with the exception of Utah, posted minimal gains in milk production per cow.

November’s rate of milk production growth nearly matched October, and with similar increase anticipated in December, overall 2016 milk production will be up about 1.8 percent from 2015, according to Bob Cropp, dairy economics professor emeritus with the University of Wisconsin-Madison.

December is a good time to look back and forward, and milk prices ended the year on a stronger note, said Cropp. He expects December’s federal order Class III price will be near $17.30 per cwt, which would be the highest in two years. Due to the weak start to the year, however, the 2016 average will be about $14.85 per cwt, compared to $15.80 per cwt in 2015 and $22.34 per cwt for 2014.

“We should see continued improvement in milk prices as we move through 2017,” Cropp said in his monthly outlook. He sees the Class III price in a range of the low-$16s per cwt in the first quarter, move into the mid-$16s in the second quarter, and reaching the $17s by the end of the third quarter.

That would put the 2017 average near $16.85 per cwt, about $2 higher than 2016 and slightly better than USDA’s current forecast, but lower than current Chicago Mercantile Exchange futures prices.

That forecast could be dampened if milk production continues to grow at its current pace, Cropp warned. However, domestic butter and cheese sales should be strong, and exports are likely to strengthen.

In his latest outlook report, Jim Dunn, Pennsylvania State University dairy economist, estimated the average 2016 Pennsylvania all-milk price at $17.34 per cwt, down $1.14 (-6 percent) from 2015. His forecast for 2017 is $20.24 per cwt, up $2.90 (17 percent) from 2016.

The advanced federal order Class I base price got off to a strong start for January, up 57 cents from December to $17.45 per cwt. That’s up $1.41 from a year ago -- the highest since 2015.

One small sign of weakness appeared in the latest Global Dairy Trade (GDT) event, with the index down 0.5 percent. It’s the first decline since October. However, prices remain near the highest levels since July 2014. The next GDT auction is Jan. 3. ![]()

-

Dave Natzke

- Editor

- Progressive Dairyman

- Email Dave Natzke