Milk prices were lower in March, but quarterly replacement cow prices were steady. The first half of the next Margin Protection Program for Dairy (MPP-Dairy) pay period shows income margins grew slimmer. This and other U.S. dairy economic news can be found here.

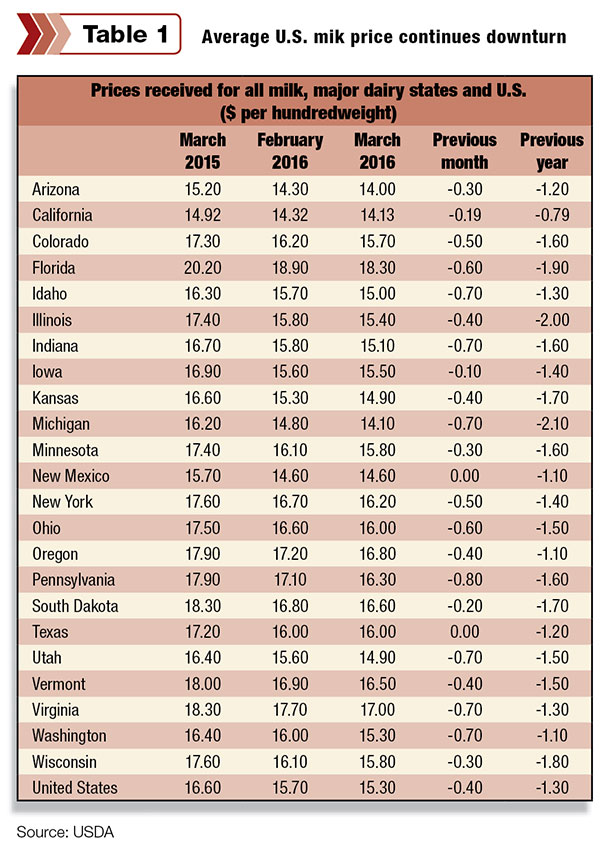

U.S. average milk price continues downturn

The U.S. average all-milk price declined again in March, falling to the lowest level since May 2010, according to the USDA/NASS Ag Prices report, released April 29.

USDA estimated the March 2016 U.S. average all-milk price at $15.30 per hundredweight, down $0.40 from February and $1.30 less than March 2015’s average of $16.60 per hundredweight.

Through the first quarter of the year, 2016 prices averaged $15.70 per hundredweight, about $1.30 less than the same period a year earlier.

Compared to February, month-to-month prices declined at least $0.50 per hundredweight in 11 of the major dairy states surveyed.

The highest March 2016 average price was in Florida, at $18.30 per hundredweight, with the lowest average in Arizona at $14.00 per hundredweight (Table 1).

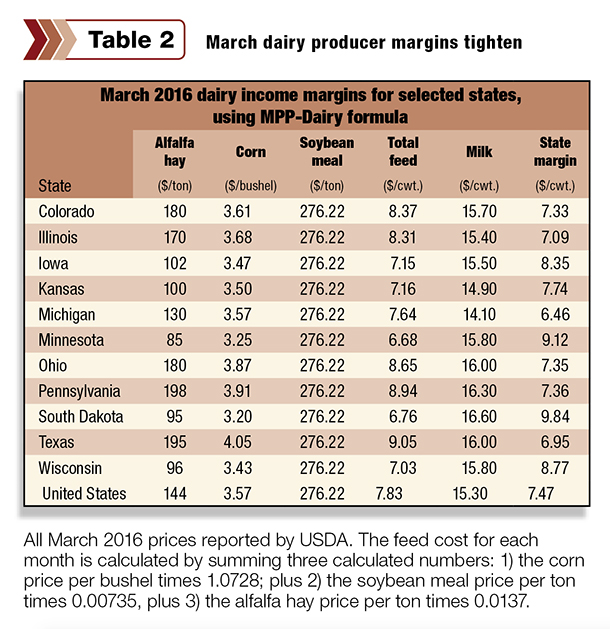

March dairy producer margins shrink under MPP-Dairy

Slightly higher U.S. soybean meal and alfalfa hay prices combined with lower milk prices, shrinking U.S. average dairy producers’ income under USDA’s Margin Protection Program for Dairy (MPP-Dairy) formula.

Producers will have to wait another month to see if the tightening margins trigger an indemnity payment for the March-April MPP-Dairy pay period.

USDA’s Farm Service Agency (FSA) announced a March 2016 MPP-Dairy margin of about $7.47 per hundredweight, down about $0.45 from February.

Based on current projections by the Program on Dairy Markets and Policy, MPP-Dairy margins could dip to near $6.50 hundredweight for the period of April-July 2016, before trending higher later in the year.

March margins tightened due to a $0.40 per hundredweight decline in the U.S. average milk price. While corn prices held steady, alfalfa hay and soybean meal prices rose.

March margin factors

• Corn: $3.57 per bushel, unchanged

• Soybean meal: $276.22 per ton, up $2.61

• Alfalfa hay: $144 per ton, up $3

• Final feed costs: $7.833 per hundredweight, up about 4.7 cents from February.

• All-milk price: $15.30 per hundredweight, down $0.40

• Milk margin minus feed costs: $7.467 per hundredweight, down $0.447 from February.

State differences

USDA uses national average milk, corn and alfalfa hay prices, along with a central soybean meal price, to calculate the monthly national MPP-Dairy income margin.

Selected state margins (Table 2) for March 2016, using the MPP-Dairy formula and state prices for corn, alfalfa hay and milk reported by USDA, range from a high of $9.12 per hundredweight in South Dakota to a low of $6.46 per hundredweight in Michigan, a difference of $2.66, according to Progressive Dairyman calculations.

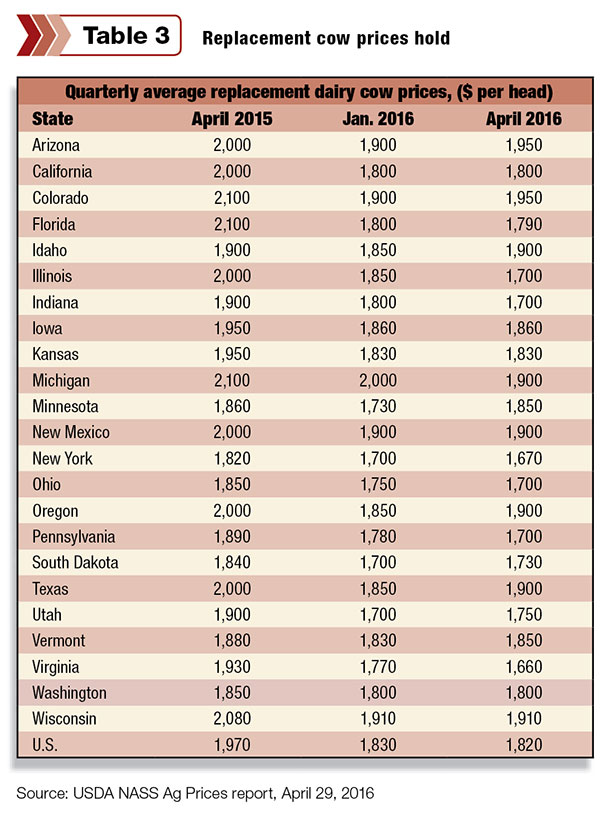

Replacement, cull cow prices hold

Despite slumping milk prices, average U.S. dairy herd replacement cow prices are holding their own, based on data in the USDA’s monthly Ag Prices report, released April 29, 2016.

Preliminary April 2016 U.S. quarterly replacement dairy cow prices averaged $1,820 per head, just $10 less than January 2016, but about $150 less than April a year ago.

April 2016 average prices ranged from a high of $1,950 per head in Arizona and Colorado to lows of $1,660 in Virginia and $1,670 in New York (Table 3).

Meanwhile, estimated U.S. March 2016 cull cow prices (beef and dairy combined) averaged $80.00 per hundredweight, the first month-to-month increase since March-April a year ago. The average is up $2.50 from February 2016, but $24 per hundredweight less than March 2015. Through the first quarter of 2016, cull cow prices averaged $77.25 per hundredweight, about $34.75 less then the same period a year earlier.

California Class 4a/4b milk prices

California's April 2016 Class 4a/4b milk prices were announced April 29. Class 4a saw a small increase, boosted by surprisingly strong butter prices, but Class 4b fell on a declining cheese market.

California Class 4a ($ per hundredweight)

April 2016 – $12.54

March 2016 – $12.41

April 2015 – $13.36

January-April 2016 – $12.87

January-April 2015 – $13.33

California Class 4b ($ per hundredweight)

April 2016 – $12.71

March 2016 – $13.24

April 2015 – $14.22

January-April 2016 – $13.20

January-April 2015 – $13.95

Source: California Department of Food and Agriculture

April FMMO prices dip

April 2016 federal milk marketing order (FMMO) Class III and Class IV minimum prices were announced May 4. Both were down slightly from March and below a year earlier.

FMMO Class III ($ per hundredweight)

April 2016 – $13.63

March 2016 – $13.74

April 2015 – $15.81

January-April 2016 – $13.72

January-April 2015 – $15.75

FMMO Class IV ($ per hundredweight)

April 2016 – $12.68

March 2016 – $12.74

April 2015 – $13.51

January-April 2016 – $13.06

January-April 2015 – $13.59

Source: USDA Ag Marketing Service

Dairy Margin Watch: April ends weaker

Dairy margins continued to weaken over the last half of April due to a combination of higher feed costs and lower milk prices, according to the latest CIH Margin Watch report from Commodity & Ingredient Hedging LLC. Margins remain negative through year-end and into 2017, and are well below average from a historical perspective.

Continuing strength in both corn and soybean meal prices are attributed to South American weather and crop concerns. Brazil’s second corn crop is likely to be much lower than previous projections due to late-season dryness and hot weather. Excessive moisture in Argentina is cutting soybean yields.

Milk prices continue to be pressured by increased production and building stocks. The U.S. cow herd is the largest since December 2008, and dairy cow culling is down. February European Union-28 collections of milk were up 5.5 percent compared to the previous year.

Visit the Margin Manager website. PD

-

Dave Natzke

- Editor

- Progressive Dairyman

- Email Dave Natzke