USDA’s July World Ag Supply & Demand Estimates (WASDE) report cut the 2016 U.S. milk production estimate, helping boost the annual price outlook by about $0.50 to $0.65 per hundredweight compared to a month ago.

• 2016 milk production was reduced about 200 million pounds from last month’s forecast, to 212.4 billion pounds. If realized, production would be up about 1.8 percent from 2015. The revised milk production forecast was based on a slowdown in the growth of cow numbers.

• 2017 milk production was raised about 300 million pounds from last month’s forecast, to 215.6 billion pounds. If realized, production would be up about 1.5 percent from 2016’s estimates. The production forecast was raised due to an improving relationship between milk prices (higher) and feed costs (lower), leading to another bounce higher in cow numbers.

On a skim-solids basis, the export forecasts for 2016 and 2017 were raised on higher whole milk powder sales. Imports were unchanged on a fat basis, but raised on a skim-solids basis.

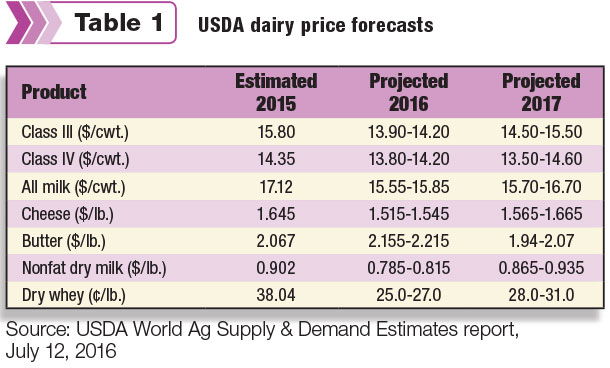

Cheese, butter, nonfat dry milk and whey prices for 2016 and 2017 were forecast higher due to robust domestic demand (Table 1).

As a result, Class III and Class IV price forecasts were raised for both 2016 and 2017, with the projected all-milk price at $15.55 to $15.85 per hundredweight for 2016 and $15.70 to $16.70 per hundredweight for 2017 (Table 1).

Beef outlook

Impacting cull cow prices, 2016 beef production was forecast higher, largely on the pace of slaughter in the second quarter, but also as feedlot marketings during the second half of the year are expected to remain relatively high.

Cattle price forecasts for second-half 2016 and all of 2017 were unchanged from last month, with 2016 prices to average $125 to $129 per hundredweight, and 2017 prices forecast in a range of $118 to $128 per hundredweight.

Feed situation

On the feed side of the equation, projected 2016-17 U.S. feed grain supplies were raised, with lower beginning stocks more than offset by increased production, resulting in higher-ending stocks.

Corn production for 2016-17 was projected 110 million bushels higher, reflecting the increased planted and harvested areas from the June 30 Acreage report.

Projected corn use was raised 30 million bushels, with increased prospects for exports and higher seed use more than offset by lower projected use for feed and residual categories and ethanol production.

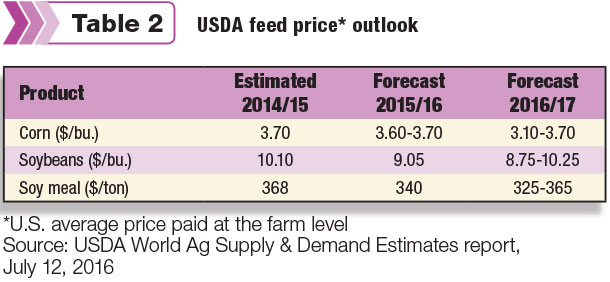

Compared to a month earlier, the 2015-16 season-average farm price for corn was cut $0.05 at the midpoint to a range of $3.60 to $3.70 per bushel (Table 2). The projected 2016-17 price was cut by $0.10 to $3.10 - $3.70 per bushel.

U.S. 2016-17 soybean production was projected at 3.880 billion bushels, up 80 million bushels due to increased harvested area. Soybean supplies were raised 60 million bushels, with lower beginning stocks partly offsetting production gains. Soybean ending stocks were projected at 290 million bushels, up 30 million from last month.

The U.S. season-average soybean price for 2016-17 was unchanged from last month. The soybean meal price was projected at $325 to $365 per ton, up $5 on both ends.

See the full World Ag Supply & Demand Estimates report. PD

-

Dave Natzke

- Editor

- Progressive Dairyman

- Email Dave Natzke