Brighter milk prices and income margins mean U.S. dairy producers may be climbing out of the shadows of 2015-16. Based on USDA’s monthly reports, the U.S. average milk price and milk income over feed cost margin hit 24-month highs in December.

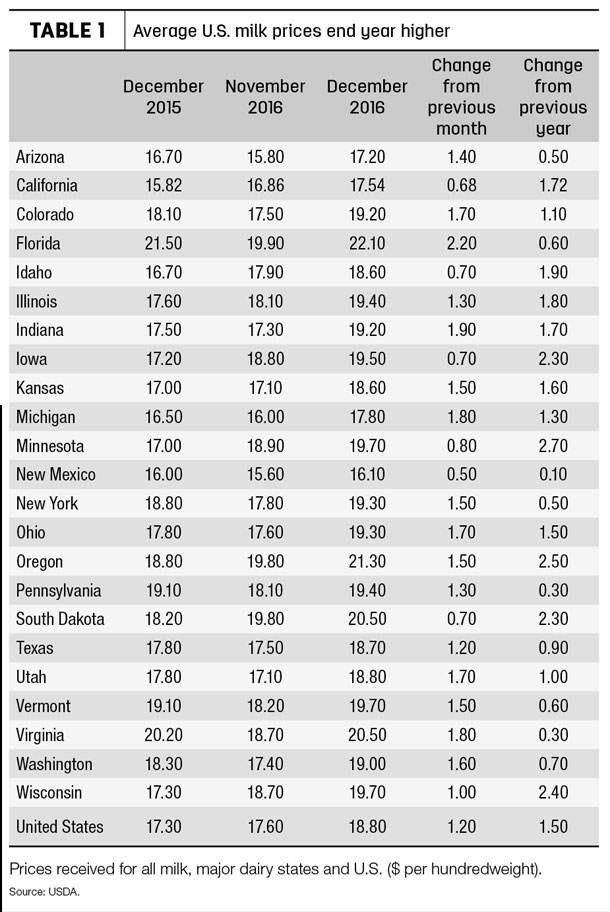

The December 2016 U.S. average all-milk price was $18.80 per hundredweight (cwt), up $1.20 per cwt from November and $1.50 per cwt more than December 2015’s average of $17.30 per cwt (Table 1). It’s the highest since December 2014, but left the 2016 average at $16.24 per cwt, which was 86 cents (5 percent) less than 2015.

All major dairy states saw price improvement in December. Compared to a month earlier, largest gains were in Florida, Indiana and Virginia. Producers in seven states saw increases of $1.70 per cwt or more.

Compared to a year earlier, the largest gains were in Minnesota, Oregon, Wisconsin and Iowa, all up at least $2.30 per cwt.

Producers in four states (Florida, Oregon, South Dakota and Virginia) saw December milk prices at more than $20 per cwt. Florida had the highest average price during the month, at $22.10 per cwt; New Mexico had the lowest, at $16.10 per cwt.

Margin largest since November 2014

The higher milk prices combined with steady-to-lower alfalfa hay and soybean meal prices, pushing the monthly average U.S. margin to $11.10 per hundredweight (cwt), the largest since November 2014.

The U.S. average corn price was $3.33 per bushel in December, up 10 cents from November, but that was offset by a $1 per ton decline in the average alfalfa hay price ($129 per ton); the soybean meal price was $321.02 per ton, down $1.39 from November, the lowest since April. Under the Margin Protection Program for Dairy (MPP-Dairy) formula, that resulted in an average feed cost of $7.70 per cwt in December, up about 8 cents per cwt from November (Table 2).

Combined with November’s margin, the November-December 2016 MPP-Dairy pay period margin averaged $10.54 per cwt, well above the trigger for any indemnity payments.

Based on current milk and feed futures prices, the Program on Dairy Markets and Policy website puts MPP-Dairy margins between $10-$11 per cwt through the first nine months of 2017, with the potential of moving above $11 in the final quarter of the year.

2017 outlook

Milk prices are forecast to improve in 2017, although there will be some backsliding early in the year, according to University of Wisconsin-Madison professor emeritus Bob Cropp.

The December 2016 Class III price was $17.40 per cwt, but Chicago Mercantile Exchange January Class III futures closed at $16.75 per cwt on Jan. 31, with February futures closing at $16.71 per cwt.

Although futures prices are more optimistic, Cropp projects the Class III should stay in the $16s per cwt through May or June, and then move into the $17s for the remainder of the year, yielding an average more than $2 per cwt higher than 2016.

How much milk prices improve will depend on whether domestic and global demand can keep pace with production. USDA’s latest forecast expects U.S. cow numbers to increase 0.4 percent in 2017, with milk per cow to increase 1.8 percent. That would result in another 2.2 percent milk production gain in 2017.

Outside the U.S., milk production for four of the major exporters—the European Union, New Zealand, Australia and Argentina—is expected to be lower than a year ago, and not expected to increase before the second half of the year.

Cull cow, replacement cow prices continue slide

Other prices of note in the USDA monthly summary concerned cull and replacement cows.

The December U.S. average cull cow price (dairy and beef cows combined) was $61.10 per cwt, down about $14 from a year ago and the lowest since 2010.

Despite improving milk prices, average U.S. dairy replacement cow prices trended lower for a sixth consecutive quarter.

Preliminary January 2017 U.S. quarterly replacement dairy cow prices averaged $1,620 per head, $70 less than October 2016 and $210 per head less than January 2016.

National average replacement cow prices had peaked at $2,120 per head in October 2014, when milk prices had reached their zenith. Since then, U.S. average prices have declined in eight of nine quarters, and are down about 24 percent.

California: 2015 cheese yields higher

One final report crossing my desk at the end of January. Thanks to higher milk butterfat and solids not fat (SNF) content, California’s cheddar cheese makers saw higher yields in 2015, according to annual data from the Department of Food and Agriculture (CDFA).

The average cheese yield increased to 13.31 pounds per cwt of milk in 2015, compared to 12.4 pounds per cwt in 2014. Milk used in 2015 cheese production had an average composition of 4.73 percent butterfat and 9.62 percent SNF, the highest since 2010.

The cheese yield analysis is part of CDFA’s annual survey of cheese, butter and nonfat dry milk manufacturing costs. That survey of four large cheese plants showed costs to produce cheddar cheese averaged 23.94 cents per pound in 2015, up from 23.55 cents per pound in 2014.

Cheese plant workers averaged $67,855 in annual income in 2015, up 1.33 percent from 2014.

The average cost to produce nonfat dry milk was 20.78 cents per pound, compared to 20.11 cents per pound in 2014.

The 2015 average cost of manufacturing bulk butter was 18.42 cents per pound, nearly unchanged from 18.43 cents per pound in 2014.

The processing cost data does not include the cost of raw product (milk), nor does it include marketing costs. The full report is available on the CDFA Dairy Marketing Branch website.![]()

-

Dave Natzke

- Editor

- Progressive Dairyman

- Email Dave Natzke