October 2016 U.S dairy product exports rose to their highest value in 16 months, according to Alan Levitt, with the U.S. Dairy Export Council (USDEC). Contributing to the strength were improved sales of nonfat dry milk/skim milk powder (NDM/SMP) to Southeast Asia, whey to China, cheese to South Korea and butter to Canada, plus a recovery in world commodity prices.

Overall export value was $426 million in October, up 5 percent from the depressed levels of a year ago. U.S. dairy exporters shipped 172,245 tons of milk powders, cheese, butterfat, whey and lactose in October, topping year-ago levels for the fifth straight month.

Whey exports continued their resurgence, and exports of whey protein concentrate continued at a record pace. Cheese exports had the best month since March, though year-to-date volumes are still 13 percent below 2015 levels. U.S. butterfat exports were more than triple year-ago volume, with more than 80 percent of October shipments going to Canada.

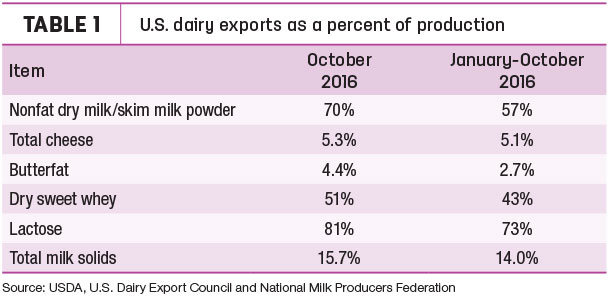

On a total milk solids basis, U.S. exports were equivalent to 15.7 percent of U.S. milk production in October, bringing the year-to-date proportion to 14 percent. Imports were equivalent to 3.4 percent of production, the lowest since April.

Read the full USDEC summary.

Trade outlook: Dairy expectations improve

There’s a better year ahead for dairy product exports, according to USDA’s November’s quarterly Ag Trade Outlook report.

USDA raised fiscal year 2017 (FY’17) U.S. dairy product export projections about $500 million and now expects fiscal year exports to reach $5.3 billion.

Weaker U.S. export values in FY’15 and FY’16 were attributed to strong competition in an oversupplied market.

Despite an ongoing border battle over U.S. ultrafiltered milk, USDA expects FY’17 dairy exports to Canada to rise. Exports to Korea and Japan, the fourth- and fifth-largest U.S. ag export markets, respectively, are also expected to be strong.

The FY ’17 U.S. dairy import forecast was estimated at $3.5 billion, up about $200 million from August projections. It compares to $3.4 billion in FY’16 and $3.5 billion in FY’15.

FY’17 cheese imports are projected at $1.4 billion, compared to $1.3 billion in both FY’15 and FY’16.

U.S. ag trade surplus hits 23-month high

The October 2016 U.S. agricultural trade balance posted its largest monthly surplus since November 2014.

Monthly ag exports were valued at $14.2 billion, also the highest since November 2014. Imports were valued at $9.4 billion, resulting in a U.S. ag trade surplus of more than $4.8 billion.

Dairy replacement sales picking up the pace

U.S. dairy replacement cattle exports turned in pedestrian numbers in October, but they’re breaking into a sprint to end the year. Buyers from Mexico have been active in the dairy heifer market dairy heifers since the U.S. presidential election, said Tony Clayton, Clayton Agri-Marketing Inc., Jefferson City, Missouri.

“A couple of thousand” dairy heifers were purchased from the Midwest, with a push to get them across the border by Dec. 22, when Mexico closes the border for the holidays, Clayton said. The border reopens to cattle crossings in early January.

“I believe there will be another push to buy heifers in early January and get them across the border before Donald Trump is sworn in as president on Jan. 20,” Clayton said.

Interest is coming from elsewhere around the globe. Clayton’s company will send about 1,500 Holstein heifers to Sudan in late January. The heifers are sourced primarily from Idaho.

Read Before the wall: U.S. dairy heifers moving to Mexico

Alfalfa exports steady

Total alfalfa hay exports were up 4,515 metric tons (MT) in October compared to September. At 206,249 MT, October marked the sixth consecutive month alfalfa hay exports have topped 200,000 MT.

October 2016 alfalfa hay sales were down from October 2015 in China and the United Arab Emirates, but those were offset by increases to Japan and Saudi Arabia. South Korea was virtually unchanged.

October 2016 exports of other hay were down slightly from September, but still the second-highest volume in 2016.

Exports of dehydrated and sun-dried alfalfa cubes were down slightly from September. However, exports of all forms of alfalfa meal were up. Dehydrated alfalfa meal exports were the highest monthly volume since November of 2008. ![]()

-

Dave Natzke

- Editor

- Progressive Dairyman

- Email Dave Natzke