Here in the U.S., dairy farms continue to harvest a bountiful supply of milk. Elsewhere, lower production is lending support to global prices.

First, some domestic numbers. October U.S. milk production was estimated at 17.55 billion pounds, up 2.5 percent from the same month a year earlier, according to USDA’s monthly milk production report released Nov. 18. Milk cow numbers were estimated at 9.34 million head, 15,000 more than a year ago, but 2,000 head less than September 2016.

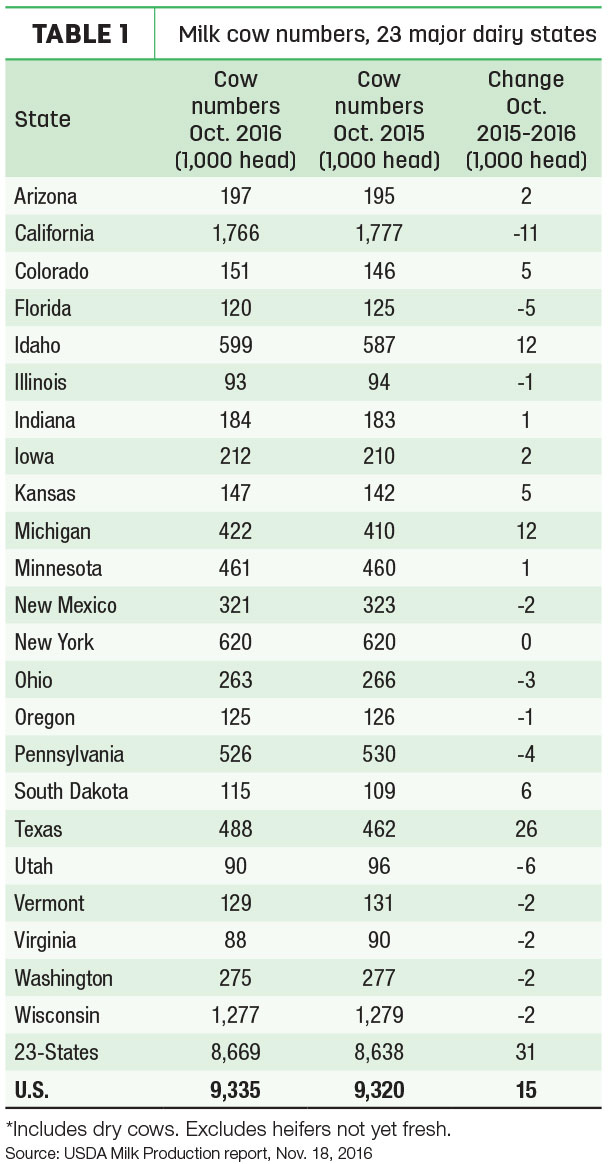

October 2016 milk production in the 23 major dairy states was estimated at 16.49 billion pounds, up 2.7 percent from October 2015. Milk cow numbers were estimated at 8.67 million head, 31,000 head more than October 2015, but 2,000 head less than September 2016.

U.S. milk cow numbers have been declining, down 6,000 head since peaking in August. Of the 23 major dairy states, 12 had fewer cows this October compared to a year ago (Table 1).

While cow numbers are down, they’re more productive

Good feed quality and quantity at lower prices – combined with ideal “cow weather” – continues to boost milk production per cow. Both nationally and in the 23 major dairy states, October milk output per cow was up more than 40 pounds compared to a year earlier, the highest differential of 2016. Year-to-date milk per cow is averaging about 1.7 percent more than a year earlier.

Milk production was up across the country, with only three of the top 23 milk-producing states – Florida, Utah and Virginia – producing less milk than the same month a year earlier. All had fewer cows than a year earlier, and had minimal gains in milk production per cow.

Texas and, to a lesser extent New Mexico, continue their year-long recovery from last December’s Snowstorm Goliath. Texas cow numbers are up 33,000 and New Mexico cow numbers are up 11,000 since crashing in January.

Strong regional growth continued from the Northeast through the Midwest. Even California, which posted milk-production declines from year-earlier levels for 23 consecutive months, saw output increase 1.8 percent in October. Like the rest of the country, that growth came from more productive cows, as cow numbers were down 11,000 from a year earlier.

Global factors supporting prices

On the surface, the biggest year-over-year jump in monthly U.S. milk production of 2016 should provide bearish market news. However, global factors are providing some buffer. Outside the U.S., milk production growth has slowed or reversed due to weather and policy efforts to cap production growth.

Overall milk production was on the decline in the European Union even before a voluntary milk reduction program kicked in.

New Zealand’s Fonterra recently reported a wetter-than-normal spring could result in a 7 percent decline in milk collections compared to a year ago. Marvin Hoekema, president of Dairy Decisions Consulting, said monthly Australian production is down 10 percent.

Price projections

In their monthly podcast, Mark Stephenson, director of dairy policy analysis at the University of Wisconsin-Madison, and Bob Cropp, dairy economics professor emeritus, forecast price improvements in 2017. Both are more optimistic than USDA projections.

While post-holiday dairy product sales declines could mean weakness extending into the first part of the year, Stephenson projects overall 2017 prices to be up $2 per cwt compared to 2016. Cropp forecasts prices to increase each quarter, from the high $15s at the start of 2017 to $17s by the fourth quarter. If Cropp’s forecasts hold true, the 2017 average Class III price would be about $16.50 per cwt., up from 2016’s current average of about $14.75 per cwt.

USDA’s latest forecast expects U.S. milk production to grow 2.1 percent in 2017. However, world dairy demand has picked up, tightening the global supply-demand balance and boosting prices. Dairy product prices on the Global Dairy Trade (GDT) platform have strengthened in seven of the past eight auctions, improving U.S. price competitiveness. U.S. dairy export volumes are improving.

Based on futures prices as of early November, Penn State University dairy economist Jim Dunn forecasted a 2017 Pennsylvania all-milk price of $19.57 per cwt., up $2.33 (13.5 percent) from 2016.

-

Dave Natzke

- Editor

- Progressive Dairyman

- Email Dave Natzke