Summer doldrums characterized U.S. milk prices, but dairy replacement cow prices held fairly steady, and foreign demand for U.S. heifers is picking up steam heading into fall.

Replacement cow prices

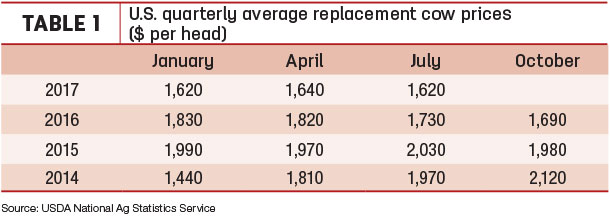

Preliminary July 2017 U.S. quarterly replacement dairy cow prices averaged $1,620 per head, $20 less than April but $110 per head less than July 2016 (Table 1).

National average replacement cow prices had peaked at $2,120 per head in October 2014, when milk prices had reached their zenith. Since then, U.S. average prices have declined in nine of 11 quarters, and are down about 24 percent.

The USDA estimates are based on quarterly surveys (January, April, July and October) of dairy farmers in 23 major dairy states, as well as an annual survey (February) in all states, according to Mike Miller with USDA’s National Ag Statistics Service. The prices reflect those paid or received for cows that have had at least one calf and are sold for replacement purposes, not as cull cows. The report does not summarize auction market prices.

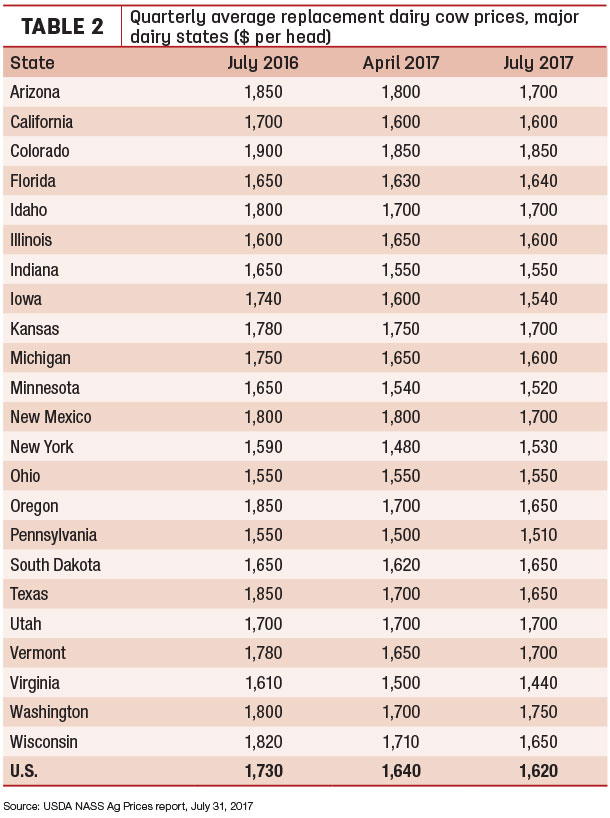

Among major dairy states, July 2017 average prices ranged from highs of $1,850 per head in Colorado to $1,440 in Virginia (Table 2).

Compared with the previous quarter, prices were slightly higher in Florida, New York, Pennsylvania, South Dakota, Vermont and Washington.

Compared with a year earlier, July prices were down $200 per head in Iowa, Oregon and Texas.

In recent weeks, replacement cattle prices have been slightly stronger in the western part of the U.S. in comparison to the east, according to Tony Clayton, Clayton Agri-Marketing Inc., Jefferson City, Missouri. Prices for pregnant heifers have increased a bit, although some cash-strapped dairy farmers looking to sell cattle are willing to negotiate.

Dairy replacement exports gaining momentum

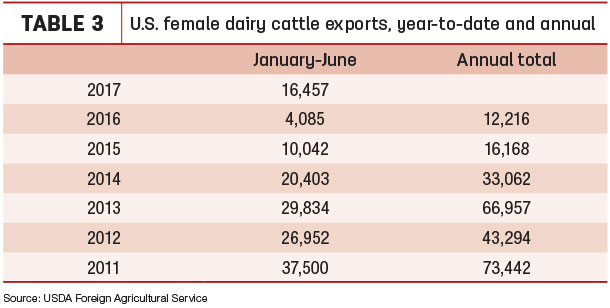

Exports of dairy replacement heifers started to rebound late last year, gathering momentum into 2017. The USDA’s Foreign Ag Service estimated 3,479 head were exported in June, the second-highest monthly total for the year.

Vietnam was the leading market for the month, taking 1,634 head. Vietnam has now imported 5,040 female dairy replacements so far in 2017, surpassing Mexico as the leading buyer. Mexico was the destination for another 1,488 head in June, bringing the year-to-date total to 4,577.

Year-to-date 2017 U.S. dairy replacement heifer exports stand at 16,457 head, on pace to hit the highest total since 2014, and already surpassing the total of 12,216 for all of 2016 and 16,171 for all of 2015 (Table 3).

The foreign market is picking up slowly and steadily, said Gerardo Quaassdorff, DVM, sales and management consultant with TK Exports Inc., TKE Agri-Tech Services Inc., Boston, Virginia. He expects more orders from Asian countries later this year. However, he doesn’t foresee 2017 export totals reaching levels seen in 2011-2014 quite yet. The U.S. set a record high of 73,442 female dairy replacements exported in 2011, with 43,294 in 2012 and 66,957 in 2013.

One thing the U.S. does offer emerging markets is heifer quality, he said. The belief among many foreign buyers is that China is taking the best quality heifers from New Zealand and Australia, leaving lesser quality heifers for other markets.

“It seems emerging markets are looking for dairy cattle that ‘have higher milk production and they milk in an efficient and profitable way,’” Quaassdorff quoted a foreign buyer as saying.

One competitor for foreign buyers is the U.S. itself, Quaassdorff said. As U.S. dairy farmers seek to make genetic improvements, they’re increasingly using heifers as embryo recipients through in vitro fertilization (IVF). That reduces the number of available heifers for export.

Other potential impediments to U.S. dairy cattle export growth are political.

"[The] drums of war or retaliation to economic sanctions might create uncertainties, causing buyers from Russia, Turkey and Asia to postpone imports,” he said.

Mexico, Canada in the market

Clayton has seen more interest for U.S. dairy heifers from both near and far. Foreign sales are being aided by a weaker U.S. dollar, which makes U.S. cattle prices more competitive. Many foreign buyers are looking to improve dairy quality quickly, asking for genomic-tested U.S. cattle.

Clayton said his company has recently facilitated large shipments of cattle to Vietnam and Sudan, and expects both countries to be back for more cattle later this year and into 2018.

Closer to home, Mexico, in the midst of a summer lull, will be back in the market for a September-November run. And, with a recent quota increase, more Canadian dairy farmers are crossing the border in search of U.S. dairy cattle.

“The Canadians are in the U.S. market buying cattle in a big way,” Clayton said.

To meet growing demand for butter, dairy farmers in five eastern Canadian provinces approved a five percent dairy quota increase, effective July 1. It’s the largest one-time quota increase since the system was implemented nearly two decades ago.

According to AgCanada.com, the quota policy covering Prince Edward Island, New Brunswick, Nova Scotia, Quebec and Ontario – collectively called P5 – previously implemented incremental quota increases totaling 7 percent between August-December 2016.

Read: Canadian provinces raise milk quota, ire of other dairy exporters

On Aug. 1, Canada also announced a dairy support program meant to increase productivity and competitiveness, while cushioning Canadian dairy farmers and processors from the potential impacts of increased cheese imports under the Canada–European Union Comprehensive Economic and Trade Agreement (CETA).

A $250 million, five-year Dairy Farm Investment Program will provide targeted funding to help Canadian dairy farmers update farm technologies and systems and improve productivity, including the adoption of robotic milkers, automated feeding systems and herd management tools. The program will provide up to $250,000 ($ Canadian) per licensed dairy farm.

Pakistan, Qatar show potential

Other countries looking for replacement dairy animals – possibly in large numbers – are Pakistan and Qatar, Clayton said.

Pakistan imports about 10,000 to 12,000 head of dairy replacements annually, mostly from Australia. While the price difference between Australian and U.S. heifers is substantial, Clayton said dairy processor Nestlé is advancing dairy farmers $800 to $1,000 per head for the purchase of high-quality U.S. cattle.

Qatar, isolated by its neighbors, is looking to fill its dairy needs internally. Prior to implementing export sanctions and cutting transportation links in June, Saudi Arabia had provided most of the fresh milk consumed in Qatar.

In response to the sanctions, Qatari businessman Moutaz Al Khayyat, chairman of Power International Holding, has begun airlifting dairy cows into the country. He intends to source 4,000 cattle from Australia, the Netherlands and the U.S., enough to meet 30-35 percent of Qatar's dairy demand, according to Bloomberg.

U.S. herd still growing

Nationally, U.S. milk cow numbers have increased for nine consecutive months, dating back to last October. Based on preliminary USDA estimates, U.S. dairy cow numbers were estimated at 9.4 million head in June, up 4,000 since May and up 78,000 head since June 2016.

Based on cattle inventories at the beginning of the year, the U.S. dairy herd had the capacity to grow to the highest level in more than two decades. The USDA’s semiannual estimate of dairy cows and heifers seems to bear that out.

As of July 1, USDA estimated the number of dairy cows calving in the past year at 9.4 million head, up about 51,000 head from Jan. 1. (There were about 9.416 million cows in U.S. herds on Jan. 1, 1996.) Dairy replacement heifers weighing more than 500 pounds were estimated at 4.2 million on July 1, 2017, down 50,000 from Jan. 1. ![]()

-

Dave Natzke

- Editor

- Progressive Dairyman

- Email Dave Natzke