With milk prices slumping last October, average U.S. dairy replacement cow prices trended lower for a fifth consecutive quarter. However, foreign markets are showing increased interest in U.S. dairy genetics, and that demand could change price trends.

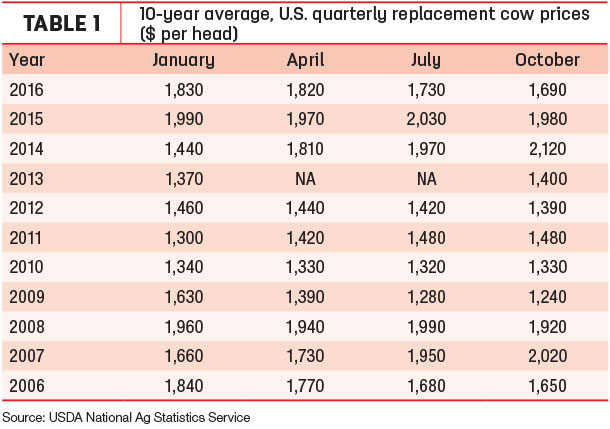

National average replacement cow prices had peaked at $2,120 per head in October 2014, when milk prices had reached their zenith. Since then, U.S. average prices have declined in seven of eight quarters and are down about 20 percent.

Preliminary October 2016 U.S. quarterly replacement dairy cow prices averaged $1,690 per head, $40 less than July 2016 and $290 per head less than October 2015 (Table 1).

The USDA estimates are based on quarterly surveys (January, April, July and October) of dairy farmers in 23 major dairy states as well as an annual survey (February) in all states, according to Mike Miller with the USDA’s National Ag Statistics Service.

The prices reflect those paid or received for cows that have had at least one calf and are sold for replacement purposes, not as cull cows. The report does not summarize auction market prices.

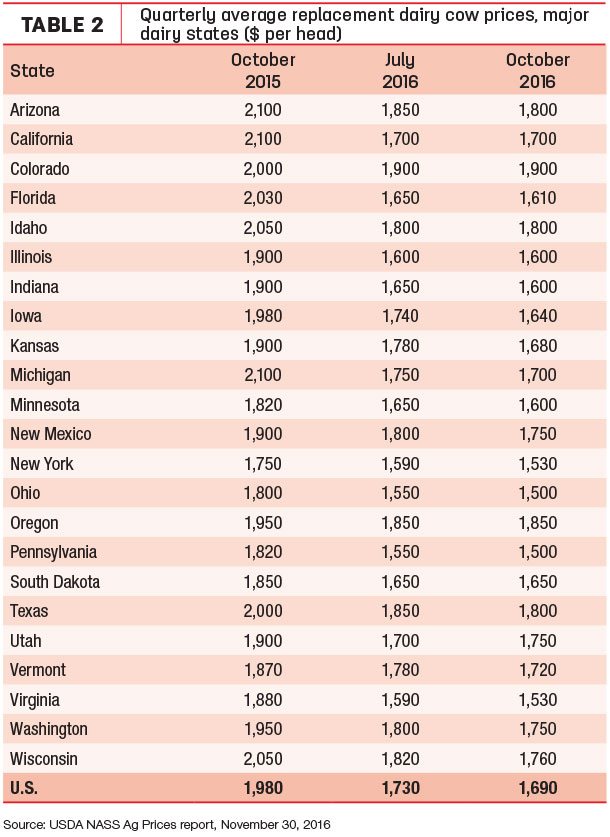

Among major dairy states, October 2016 average prices ranged from highs of $1,900 per head in Colorado and $1,850 in Oregon to lows of $1,500 in Ohio and $1,530 in New York (Table 2).

No major states reported October 2016 prices higher than the previous quarter or year. Iowa and Kansas saw the biggest quarterly declines, down $100 per head from July. Compared to a year earlier, prices declined $400 or more in California, Florida and Michigan.

Milk and feed prices have a big influence on dairy herd replacement prices, said Gerardo Quaassdorff, DVM, sales and management consultant with TK Exports Inc. and TKE Agri-Tech Services Inc., Boston, Virginia.

And, while sexed semen dramatically increased the number of available heifers, genomic information allows U.S. dairy producers to be more selective in the heifers they keep to replace older cows exiting the herd.

Geographic differences

The U.S. dairy cattle market is really two markets divided by the Mississippi River, said Tony Clayton, Clayton Agri-Marketing Inc., Jefferson City, Missouri.

“In the East, there are lots of cattle and low prices,” Clayton said. “In the West, it is a different market because of herd sizes, contracted cattle that are not available to the (auction) market and people already looking at 2018 futures prices.”

As a company serving the cattle export market, Clayton Agri-Marketing is currently finding adequate dairy cattle numbers. However, Clayton foresees a time when the company will have to place young, open heifers in yards and grow them to meet late 2017 and early 2018 demands.

Export demand picking up

Sleepwalking for most of the last two years, dairy cattle exports for January to October 2016 were estimated at 7,445 head, about half of the number marketed during the same period in 2015. Annual sales for 2016 were on pace to be the lowest since 2007.

U.S. dairy cattle exports peaked at 73,442 head in 2011 and hit 66,957 head in 2013. It’s been downhill since then due to a strong U.S. dollar.

However, Mexico has become a more active buyer since the U.S. presidential election, perhaps eyeing a short window of opportunity, Clayton said.

Since the election, “a couple of thousand” dairy heifers were purchased from the Midwest with a push to get them across the border.

Interest is coming from elsewhere around the globe. Clayton’s company will send about 1,500 Holstein heifers to Sudan in late January. The heifers are sourced primarily from Idaho.

There is also renewed interest from Turkey and Russia, two of the largest U.S. cattle markets between 2009 and 2014. A limiting factor for U.S. heifers may be stricter import documentation policies, however. The political situation in Russia still makes it a high-risk market.

“If the U.S. expands any sanctions, agriculture could be a pawn in the game of political chess,” Clayton said.

U.S. dairy cattle exporters are receiving more serious trade leads, said Quaassdorff. However, the strength of the U.S. dollar remains a hindrance to closing deals. U.S. dairy cattle exports are competing against the supply of lower-priced dairy heifers coming from the European Union, Australia and New Zealand.

Another challenge for U.S. exporters is the need to convince foreign buyers to improve feeding and management to optimize the performance of high-quality dairy cattle from the U.S.

From an export point of view, geographical differences in heifer-sourcing impact prices, Quaassdorff said. For example, heifers from areas perceived as having higher health standards from the Northwest, Midwest and into the Northeast attract better prices than heifers sourced from some other regions of the country. ![]()

-

Dave Natzke

- Editor

- Progressive Dairyman

- Email Dave Natzke