September U.S. dairy product export volumes were above year-ago levels for a fourth straight month; however, export values are on pace to be the lowest level since 2010, according to Alan Levitt, with the U.S. Dairy Export Council (USDEC).

The bad news: Through the first nine months of the year, U.S. export values were down 16 percent from the same period a year ago, putting values on pace to be the lowest since 2010.

The good news: September dairy export volumes topped year-ago levels for a fourth consecutive month. September exports were valued at $392.2 million, down 2 percent from a year ago, but the highest total of the year (on a daily-average basis).

Adjusted total nonfat dry milk and skim milk powder (SMP) exports were estimated at 51,847 tons in September 2016, up 6 percent from last year. Strength in sales to Southeast Asia offset declines to Mexico.

Whey exports were estimated at 41,938 tons, less than recent months, but still 22 percent more than a year ago. Sales volume to China was the lowest in five months, but still topped year-ago levels. Shipments of whey protein concentrate (WPC) remained on a record pace.

Cheese exports remain slow, although they’ve held in a range of 21,000-25,000 tons per month for about 15 months. September sales to the Middle East/North Africa region were the lowest since January 2010. Sales to Japan continued to lag, but cheese exports to South Korea were up 19 percent compared to a year earlier.

U.S. butterfat exports were estimated at 1,642 tons, a six-month high and more than double year-ago levels, but still just a fraction of 2013 volume.

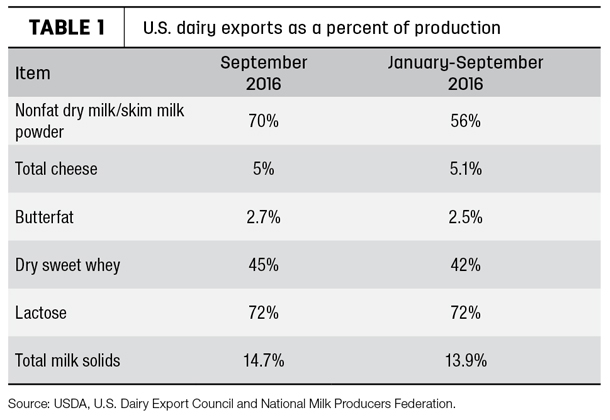

On a total milk solids basis, U.S. exports were equivalent to 14.7 percent of U.S. milk production in September, bringing the year-to-date proportion to 13.9 percent (Table 1). Imports were equivalent to 3.7 percent of production, the lowest since April.

Read the full USDEC report.

Cooperatives Working Together

The calendar year-to-date milk equivalent of dairy product sales contracted through the Cooperatives Working Together (CWT) reached nearly 800 million pounds at the end of October. Through the first 10 months of 2016, cheese exports topped 44 million pounds; butter exports totaled almost 11 million pounds; and whole milk powder (WMP) topped 19 million pounds.

Reporting to National Milk Producers Federation (NMPF) members at the organization’s annual meeting, Nov. 1, Jim Tillison, CWT chief operating officer, and Peter Vitaliano, NMPF vice president of economic policy and market development, said CWT was suspending WMP export assistance, enabling more investment in cheese exports, which have a bigger impact on U.S. dairy farmer milk prices.

Dairy cattle exports set to break loose?

There wasn’t anything exceptional about September dairy replacement cattle exports, but interest seems to be growing with phone calls and U.S. farm visits.

USDA said 904 female dairy cattle replacements found homes outside the U.S. in September, the third-highest monthly total of the year. While Mexico (375 head) and Canada (229 head) were again primary destinations, a 300-head shipment was reported to Honduras. Total September sales were valued at $2.13 million, $1 million more than August 2016 sales.

Exporters said the strength of the U.S. dollar remains a hinge point for sales.

“The interest from farms in Mexico is still pegged to the exchange rate between the U.S. dollar and the Mexican peso (MP),” said Tony Clayton, Clayton Agri-Marketing Inc., Jefferson City, Missouri. “When the exchange rate is MP $19 or ticks above MP $20, no one answers the phone in Mexico. When the peso is under MP $19, the buyers find your telephone number and call.”

Clayton said Mexican buyers have “come down off the fence” to make significant purchases in recent weeks, with confirmed sales of Holstein and Jersey heifers. Buyers from Russia, Sudan and Vietnam are also making purchase plans for 2017.

“I look for 2017 to be a rebound year for cattle exports from the U.S.,” Clayton said.

Many buying decisions were also being delayed until after the U.S. presidential election, Clayton said. “It is not only the talk of the town, but the talk of the world, and everyone is watching.”

Gerardo Quaassdorff, DVM, sales and management consultant with TK Exports Inc., TKE Agri-Tech Services Inc., Culpeper, Virginia, also expects dairy cattle exports will be picking up soon. U.S. exporters are receiving more serious inquiries seeking dairy cattle, with more specific requests about delivery times. However, the market is still affected by unfavorable exchange rates and the larger geographical distance from target destinations compared to competitors from the European Union (EU), Australia and New Zealand.

“An encouraging note is that potential new and repeat buyers seem to recognize the higher genetic quality and potential of U.S. dairy cattle compared to the EU, Australia and/or New Zealand cattle, and are willing to pay the higher difference today compared to previous months,” Quaassdorff said.

U.S. exporters also receive periodic inquiries from Muslim countries for feeder cattle, Quaassdorff said. However, for cultural reasons, the requests are mainly for non-castrated animals. Since most male feeder cattle in the U.S. are steers, those requests are difficult to fill.

Somewhat quietly, foreign sales of U.S. dairy embryos are growing, with monthly sales averaging about 175 more than a year ago. September 2016 shipments totaled 869 embryos, the fourth-highest monthly total of the year. The embryos were valued at $1.07 million, the second-highest total of the year. Japan was the leading market for the month, purchasing 352 dairy embryos, followed by China, at 308.

September alfalfa hay exports weaker

U.S. alfalfa hay exports weakened in September, but still posted a 34 percent volume gain compared to a year earlier. Shipments totaled 201,734 metric tons (MT), the lowest volume since June, but the fifth consecutive month above 200,000 MT.

Alfalfa hay exports to China, Saudi Arabia and South Korea were well above a year ago, with sales to Japan and the United Arab Emirates marginally higher.

With lower volumes, September alfalfa export values were also down to $59.9 million, also the lowest total since June.

At 131,080 MT, September exports of other hay were the highest since November 2015. Those sales were valued at $37.6 million, the highest since March.

Shipments of dehydrated alfalfa cubes and meal were up compared to August, but sales of other alfalfa products were lower.

U.S. ag trade balance summarized

The September U.S. agricultural trade balance posted its largest monthly surplus of the year, but the fiscal year surplus was the smallest in several years.

Monthly ag exports were valued at $11.11 billion. Imports were valued at $8.88 billion, resulting in a U.S. ag trade surplus of about $2.23 billion.

Fiscal year 2016 (October 2015-September 2016) exports were estimated at $129.73 billion, compared to $113.11 billion in imports, for a trade surplus of $16.62 billion. That compares to a trade surplus of $25.51 billion in 2015; $43.06 billion in 2014; $37.27 billion in 2013; and $32.54 billion in 2012. ![]()

-

Dave Natzke

- Editor

- Progressive Dairyman

- Email Dave Natzke