With dairy exports plateaued, it’s time for a “Big, Hairy, Audacious Goal,” according to Tom Vilsack, president and chief executive officer of the U.S. Dairy Export Council (USDEC). That goal: boost the percent of U.S. milk production exported another 5 percent by 2021.

U.S. dairy exports have fluctuated around 15 percent of total production for several years. To take the next step, Vilsack called for more coordination between USDEC and its members, dairy co-ops, processors and marketers.

Vilsack outlined some of the plan in a recent USDEC blog post: “Why U.S. Dairy Exports Need “The Next 5%.”

To attain the 5 percent increase, he said it is important for U.S. suppliers to have a greater physical presence in high-growth-potential regions. That presence will help U.S. suppliers gain a better understanding of local tastes and product needs, and solidify business partnerships.

Back at home, the American public must also be educated about the importance of dairy exports to the U.S. economy. This fall, USDEC will launch a collaborative campaign with the National Milk Producers Federation (NMPF) and International Dairy Foods Association (IDFA) called "Dairy Exports Mean Jobs." The campaign will tell positive stories of people working jobs supported by U.S. dairy exports.

USDEC will focus on three areas to attain the 5 percent growth:

- facilitate sales by making it easier for U.S. suppliers to access overseas markets by collecting and disseminating the technical requirements of exporting – from labeling to testing to certification

- increase demand by supporting research into dairy nutrition and communicating positive health links to consumers, governments and aid organizations

- secure market access to everything from working to remove nontariff trade barriers to making sure U.S. dairy concerns are heard during trade negotiations

July exports lower

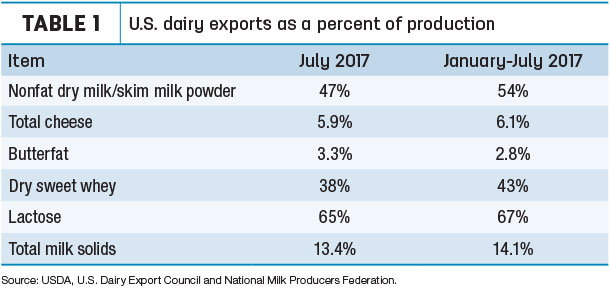

Reaching that goal suffered a setback in July. On a total milk solids basis, U.S. exports were equivalent to 13.4 percent of U.S. milk production in July (Table 1), the lowest figure since January. Imports were equivalent to 3.6 percent of production.

After 12 straight months of year-over-year growth, U.S. dairy export volumes declined in July, according to Alan Levitt, vice president of communications and market analysis at the U.S. Dairy Export Council (USDEC). Suppliers shipped 147,419 tons of milk powder, cheese, butterfat, whey and lactose during the month, down 1 percent from last year and the lowest volume since January.

However, with stronger world prices than a year ago, U.S. exports were valued at $422 million in July, up 11 percent from the same month a year earlier.

Monthly exports of nonfat dry milk/skim milk powder (NDM/SMP) declined for the first time since June 2016, while sales of whey products and lactose were flat. The only major category to post a gain was cheese.

Dairy replacement sales: summer slump

At 1,464 head, exports of dairy replacement heifers softened in July, turning in the second-lowest monthly total of the year. The heifers were valued at $2.4 million.

North American Free Trade Agreement (NAFTA) partners Canada and Mexico were the leading U.S. markets for the month, taking 803 and 661 head, respectively.

Year-to-date 2017 U.S. dairy replacement heifer exports stand at 17,921 head, surpassing the total of 12,216 for all of 2016 and 16,171 for all of 2015.

Tony Clayton, Clayton Agri-Marketing Inc., Jefferson City, Missouri, expects the summer slump to end as buyers from Mexico follow traditional seasonal patterns and increase purchases in the final quarter of the year.

“We are seeing lots of inquiries, not only from Mexico, but Pakistan, Qatar and other countries in the Arab world,” Clayton said.

“We have seen inquiries for dairy cattle are still coming from emerging markets, and some of them have translated into orders,” said Gerardo Quaassdorff, TKE Agri-Tech Services Inc., Boston, Virginia. “However, some buyers from these emerging markets have been postponing orders to later in the year, or reducing the number of cattle from the original requests. It seems that line of credits are more difficult to get for companies interested in investing in dairy operations or processing plants in those emerging markets.”

At 1,069, July exports of dairy embryos were the highest monthly total since December 2016. The embryos were valued at just over $1 million. China, Japan and Kazakhstan were leading buyers.

Alfalfa hay exports remain strong

Monthly exports of alfalfa hay dipped to a calendar-year low in July, but year-to-date sales remained at a record-high pace. U.S. alfalfa hay exports were estimated at 184,218 metric tons (MT) for the month, the lowest total since February 2016.

China was the leading foreign market for alfalfa hay in July, at 84,384 MT. However, it was the lowest monthly total since January.

July 2017 sales of other hay rebounded slightly from May-June. Monthly sales totaled 127,816 MT, with sales to South Korea complementing market leader Japan.

July exports of alfalfa cubes and meal were mixed.

U.S. ag trade surplus grows

Both July U.S. ag exports and imports were down from June, but the ag trade surplus grew.

Overall July 2017 U.S. ag exports were valued at $10.4 billion. Monthly U.S. ag imports were valued at $9.97 billion. As a result, July’s U.S. ag trade surplus was $718 million, the largest since April.

U.S. ag exports for the first 10 months of this fiscal year are at $119.7 billion, $12.5 billion more than the same time in 2016, and almost $20 billion higher than imports. ![]()

-

Dave Natzke

- Editor

- Progressive Dairyman

- Email Dave Natzke