Dairy farmers consistently face decisions that will materially impact their operation’s financial performance. In a period of low milk margins, these decisions are much more critical to the dairy’s ability to endure.

The two most prominent factors relating to a dairy farm’s profitability, and those receiving the greatest focus, are the price of milk and the cost of feed. While these budgetary items are of the utmost importance to the dairy’s survival, another revenue stream seldom garnering the attention it deserves is income derived from cull cow sales.

The business plans compiled by dairy managers must account for each and every cost associated with milk production, from the impact of switching to cheaper ration components to adding labor and making monthly interest payments to the bank.

Every dollar earned and put back into the operation is done with the goal of increasing profitability. Each kernel of corn purchased or wage paid to employees is weighed against the projected future returns. Cash generated from cull cow sales must be too.

Near-constant volatility within the value of milk and ration components is no different than the variations in a dairy’s herd value. Contracting or hedging milk and feed price risk by dairy producers is growing in popularity, as these initiatives can bolster the financial performance of their operations.

However, how much consideration or time has been spent to protect the income generated from cull cow sales?

The decision to cull a dairy cow could be based on a variety of factors: whether the cow is sick or lame, a slow/low milker or one with reproduction issues. Electing to cull animals can go well beyond securing the most productive animals and is critical to fulfilling longer-term goals.

Cow culling could address short-term cash constraints, aid in the management of feed resources and costs or increase the herd’s genetic quality for years to come. With monthly cull cow receipts accounting for up to 15 percent of a dairy’s revenue, producers should consider addressing the price volatility associated with these cows.

Meeting contract specifications

Dairy producers who cull a minimum of 30 animals per month have the ability to hedge this financial risk through the Chicago Mercantile Exchange live cattle futures market. The reason a minimum of 30 animals per month is important is because the combined weight of the cull cows would meet the specifications of a Chicago Mercantile Exchange live cattle futures contract.

Each futures contract represents 40,000 pounds of live steers or heifers, a level too large for smaller dairies. Any number below 30 cows would exclude a producer from transacting within this market due to the size of these contract specs (30 cows x 1,500 pounds = 45,000 pounds).

For those who can meet or exceed this threshold, using the futures market provides an avenue to alleviate some of the swings in the dairy’s variable costs.

Tracking live cattle, cull cow prices

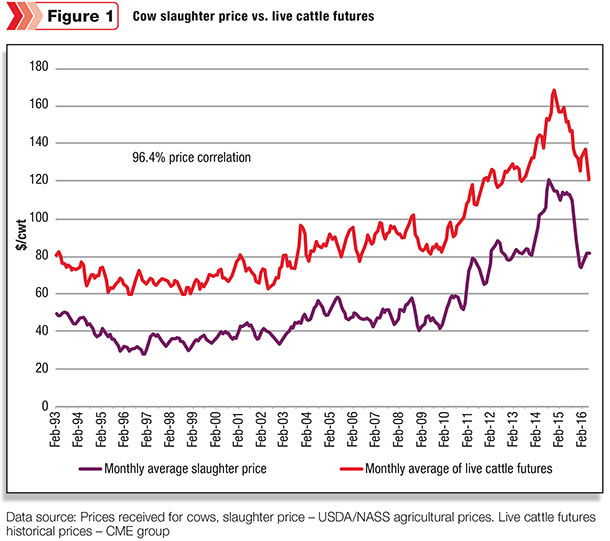

As depicted in Figure 1, the average monthly U.S. cow slaughter price has tracked close to the average value of the live cattle futures contract.

On a historical basis, the two price points have a correlation factor of 96.4 percent, which means that for every $1 per hundredweight move in the cow slaughter price, the live cattle futures contract value responds with a similar directional move of $0.964 per hundredweight.

This tight correlation (100 percent would be perfect) is an indication of the viability of the live cattle futures market as an acceptable tool for hedging.

As with hedging with any financial instrument, one must take into account the basis factor. The basis associated with hedging the dairy’s cull cows would originate from the differential between the local cash price received versus the futures contract price.

Take the time to thoroughly research hedging components, reaching out to your broker to determine if this strategy is right for you. For those culling a minimum of 30 animals a month on a consistent basis, now is the time to expand your hedging initiatives to include your cull cows.

This article is not meant as a step-by-step guide to hedging cull cows but rather a conversation starter, providing some basic insight into an as-yet not widely implemented tool to manage the risk related to dairy cull cow sales.

With feed prices increasing and milk prices currently residing near their historical lows, dairy producers should be actively searching for viable outlets to protect what margin remains for their operations. PD

-

Derek Nelson

- Risk Management Consultant

- FCStone, LLC

- Email Derek Nelson