The American Farm Bureau Federation and American Farm Bureau Insurance Services have been working collaboratively with other partners to develop a new insurance product for dairy farmers. The proposal is for a Dairy Revenue Protection (Dairy-RP) policy.

Similar to crop revenue protection policies, Dairy-RP would protect against unexpected declines in milk prices, unexpected declines in milk production or both. This policy would be in addition to margin-based insurance offerings currently available to dairy farmers.

The concept is simple: The insurance policy would protect dairy farmers against quarterly revenue losses caused by declines in the Class III or Class IV milk price, or unexpected declines in milk production. The flexibility provided by Dairy-RP, i.e., the ability for farmers to use both Class III and Class IV milk prices, allows as much as 98 percent of the milk price risk to be removed.

For each quarterly policy, the expected revenue would be the product of the weighted average Chicago Mercantile Exchange (CME) futures prices multiplied by the amount of milk the farmer elects to cover during the insurance period. The dairy farmer would then select the amount of revenue coverage he or she wishes to insure for the quarter, in a range of 60 to 90 percent.

The actual revenue would be based on USDA-announced milk prices and USDA-National Agricultural Statistics Service state-level milk production data. If the actual revenue during the quarter is less than the amount of insurance protection, the dairy farmer is paid an indemnity based on the difference.

Under Dairy-RP, a farmer has only four decisions to make:

1. The milk price “mix” between Class III and Class IV

2. The amount of milk production to cover

3. The level of coverage (from 60 to 90 percent of the revenue guarantee)

4. Which quarterly contracts he or she wishes to purchase

Dairy-RP insurance policies would be sold quarterly by USDA-approved insurance providers and could be purchased voluntarily for an individual quarter, or a strip of quarters, up to 15 months out.

Importantly, like Livestock Gross Margin for Dairy (LGM-D), Dairy-RP is designed to be actuarially appropriate with coverage levels and premiums based on CME futures and options. The USDA would provide a premium subsidy to purchase Dairy-RP, and subsidies would increase for more catastrophic levels of protection. Preliminary analysis indicates that a Dairy-RP policy, covering 90 percent of the milk revenue, would range from 5 cents per hundredweight to 20 cents per hundredweight, depending on the quarter of the year covered. With a 90 percent coverage level, the farmer is electing a 10 percent policy deductible.

Why Dairy-RP?

For a variety of reasons, one size does not fit all for dairy risk management. First, milk is not simply milk. Milk is composed of fat, protein and other milk solids used to produce a variety of dairy products. The value of the milk produced on the farm depends on a variety of factors, including the utilization of the farmer’s milk, the location of the dairy farm, whether the milk is marketed in a state or federal marketing order and if the milk value is based on components, skim fat or cheese yield formulas.

For these reasons, milk prices and milk price volatility is unique for every dairy farmer. The existing dairy risk management tools use a standardized milk price as the basis for the margin protection, i.e., 3.5 percent fat Class III milk or the U.S. average all-milk price, and do not capture farm-level milk price risk.

Dairy-RP, by allowing a farmer to choose his or her own “mix” of Class III and Class IV milk price, would more fully capture the milk price risk. A recent study, “Chewing the Cud on Using Multi-Commodity Hedge Ratios To Manage Dairy Farm Risk” and University of Wisconsin’s Mailbox Milk Price Tool found that a combination of Class III and Class IV milk can remove 98 percent of the variability in milk prices, no matter where the farm is located, how the milk is used, etc.

Extending this methodology to cover milk price and quantity risk provides an additional risk management option for dairy farmers. An additional policy modification to Dairy-RP would allow the revenue guarantee to be based on the value and quantity of milk components produced. For high-component herds, this option would more fully capture the dairy farm risk.

Another big reason why one size does not fit all in dairy risk management is: Feed price risk is different. The USDA’s Economic Research Service estimates the percent of purchased feed costs exceeds 80 percent in Western states and in the Southeast but is below 50 percent in parts of the Upper Midwest.

When the supply of livestock feed is reduced due to poor growing conditions, producers purchasing most of their feed may see higher prices or find it difficult to secure the needed feed.

For these farms, a margin-based safety net provides protection against higher feed prices. However, for farmers who rely on homegrown feed, the value of the milk produced may be a bigger source of risk on the farm. Dairy-RP would fill this gap in risk coverage by providing farmers an option to purchase margin protection, revenue protection or a combination of both.

Finally, Congress continues to move in the direction where farmers have skin in the game. Direct payment programs were repealed in the 2014 Farm Bill and are unlikely to return in the future.

The Milk Income Loss Contract is unlikely to return, and the coverage available under the Margin Protection Program does not reflect market prices or risk. Moving the dairy safety net in the direction of being actuarially sound helps to accomplish the congressional goal of having farmers proactively manage risk with insurance.

Would it work?

Yes. The success of federal insurance programs is well documented. Insurance policies cover most the field crop acreage planted each year. In 2016, nearly 90 percent of all corn, wheat, soybean, cotton and rice acres were protected by an insurance policy. For many of these crops, revenue-based policies represent 80 to 90 percent of all policies sold. In addition to field crops, insurance policies covering price or margin risk are available for cattle, swine, lamb and dairy cattle.

Combined, farmers pay billions of dollars in premiums each year for insurance, and in the event that market prices or revenues decline, farmers receive an indemnity payment. In 2016, due to declining crop prices, $2.2 billion in insurance indemnities were made on behalf of corn, cotton, rice, soybean and wheat farmers. Dairy-RP would have provided similar protection in 2015 and 2016 when milk prices fell by nearly 50 percent and the farm value of milk fell by $10 billion.

Why now?

Dairy farmers need a robust safety net. It’s no secret that in the two-and-a-half years since the USDA’s Margin Protection Program for Dairy (MPP-Dairy) was introduced, dairy farmers have paid $100 million in premiums and received $12 million in program payments.

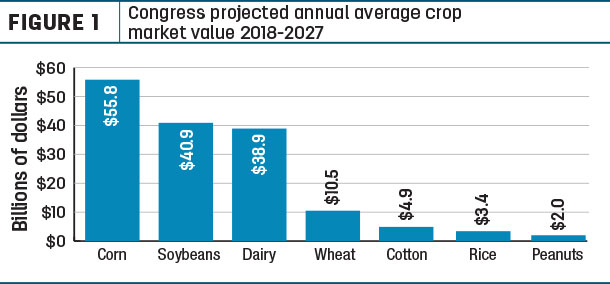

The Congressional Budget Office’s most recent baseline projected annual farm-level cash receipts in the dairy sector to average $39 billion per year for the next decade – behind only the value of corn and soybeans (Figure 1).

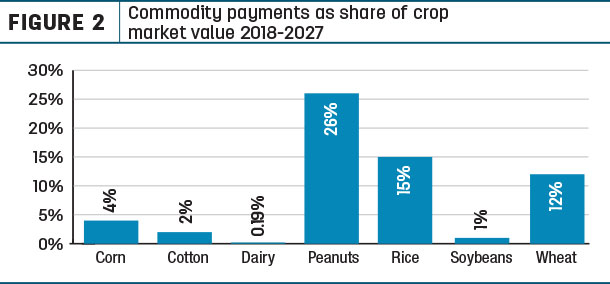

Yet, a workable safety net for dairy is absent. Projected outlays for MPP-Dairy from 2018 to 2027 totals $749 million and is less than a quarter of 1 percent of farm value of milk (Figure 2).

While the Farm Bureau continues to work to improve the dairy safety net available from the USDA’s Farm Service Agency, we believe our efforts to develop a new revenue-based insurance product will greatly improve the dairy safety net. ![]()

-

John Newton

- Director, Market Intelligence

- American Farm Bureau Federation

- Email John Newton

Farm Bureau wants farmer input on dairy revenue insurance proposal

The American Farm Bureau Federation (AFBF) and its insurance affiliate, the American Farm Bureau Insurance Services (AFBIS), are preparing a final proposal to create a new dairy income insurance policy. To get producer input, AFBF/AFBIS is conducting an online survey, seeking dairy farmer opinions on the proposed revenue protection insurance products.

In October, AFBF/AFBIS plan to submit a final proposal for the Dairy-Revenue Protection (Dairy-RP) policy to the Federal Crop Insurance Corporation (FCIC).

Dairy-RP would protect against unexpected declines in milk prices or state-level milk production that reduces the revenue on the farm during a quarter. This policy would be in addition to margin insurance and protection programs, including the Margin Protection Program for Dairy (MPP-Dairy) and the Livestock Gross Margin for Dairy (LGM-Dairy), currently available to dairy farmers through the USDA.

Under the program, farmers purchasing Dairy-RP would have the option to determine how the value of milk is determined in their policy:

- The class price option would allow a farmer to choose a milk value based on a mix of Class III and Class IV milk futures prices. Dairy-RP under this option provides revenue protection based on an index of state-level revenue constructed with Class III and Class IV milk prices and the state USDA National Ag Statistics all-milk yield.

The producer can choose the percent of Class III and Class IV used to establish their price guarantee per hundredweight to tailor to their operation based on utilization. For details on the class price option, visit:

- The component option is revenue protection based on milk component production, including butterfat, protein and other milk solids. The producer can select the desired butterfat and protein percentages. The other milk solids percentage is fixed at 5.7 percent.

Under either option, the dairy farmer would also choose the time period (only quarterly policies are available), how many pounds of milk to cover during a quarter and how much income protection to buy (from 70 to 95 percent). For details on the component option, visit:

The nine-question survey asks questions related to herd size, percentage of feed grown on the farm as well as questions related to producer interest in milk markets, risk management and participation in MPP-Dairy or LGM-Dairy.

Find the survey online at Farmer Survey on Dairy Risk Management