This past year has certainly been one many dairy producers would just as easily like to forget. After a brutal year in 2009, profit margins remained negative through most of last year with depressed milk prices and high feed costs crippling operations. Increased debt loads and lost equity have been the themes as many dairymen are simply trying to weather the storm and survive this current cycle. After the past couple of years, one has to wonder if things can get much worse than they have been, as well as when or if the cycle may finally be turning for the better.

While the outlook continues to appear challenging in the year ahead, there does appear to be a ray of hope. After suffering through negative profit margins over the past two years, it is beginning to look like there may be light at the end of the tunnel.

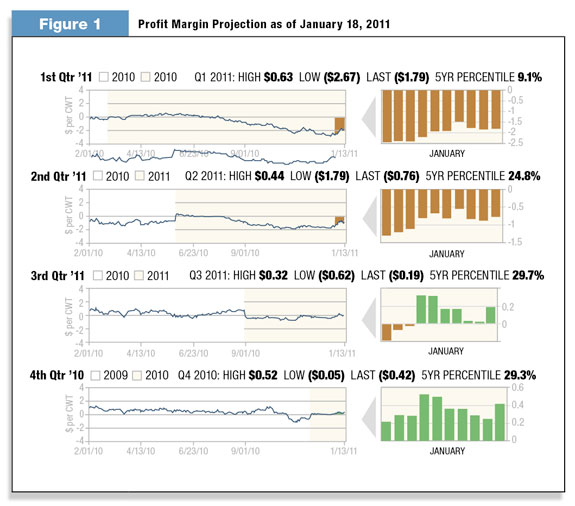

As you can see from Figure 1 , while production returns are forecast to be negative through the first half of 2011, the second half is currently reflecting a breakeven-to- slightly-positive margin in the third and fourth quarters.

While this is only a model and subject to change, it nonetheless represents a brighter outlook than we have seen recently.

While the outlook for profitability in 2011 is certainly promising, the landscape will be challenging for dairy producers as many of the issues that pressured margins remain present and have intensified.

At the top of this list is feed costs, which look to remain high for most of this year. USDA released their January crop report, which has had a major impact on the market for corn and soybeans recently.

This year was no exception, as the report details the final size of last year’s harvested crop as well as stocks, as of December 1, that help gauge demand and disappearance through the first quarter of the marketing year. The report was quite bullish for both corn and soybeans in each regard.

For corn, USDA increased harvested area by 100,000 acres to 81.4 million, but cut the yield forecast by 1.5 bushels per acre to 152.8 from 154.3 previously. The reported yield was below both the average of pre-report trade estimates at 153.9 bushels per acre, as well as the range of expectations between 153.0 and 154.8 bushels per acre.

As a result, production was reduced 93 million bushels from December to 12.447 billion bushels, down 663 million bushels or 5 percent from last year. Most of this lost production carried through to the bottom line of the balance sheet, as ending stocks were reported at 745 million bushels – down 87 million from December and down 963 million bushels or 53 percent from last year.

When measured relative to total usage, the stocks/use ratio is now forecast at 5.5 percent, the second-lowest on record to only that of the 1995-1996 crop year at 5.0 percent.

In terms of stocks, USDA reported December 1 corn stocks at 10.04 billion bushels, the lowest in three years. The figure implies usage during the September-November period of 4.117 billion bushels, a record pace for the first quarter.

Ethanol demand use was adjusted higher by 100 million bushels in the report to 4.9 billion bushels, and this now represents 36.5 percent of total corn usage.

Feed and residual usage was similarly cut by 100 million bushels to 5.2 billion, the highest demand category at 38.7 percent of total usage. This implies that stronger domestic demand for ethanol is occurring at the expense of livestock producers, who are being rationed out of the demand equation.

Meanwhile, South American weather continues to be a concern – particularly in Argentina – as only light rains have occurred and total precipitation for the season to date is well below normal.

USDA cut Argentina’s production forecast by 1.5 million tons to 23.5 million tons, which will similarly reduce exports to 16 million tons from 17.5 million previously.

This loss of production also impacted the global stocks/use ratio, now estimated at only 15.2 percent, also the second-lowest in history. This means that a significant increase in corn acreage will be required in the U.S. during 2011, with no margin for error during the growing season as a result of poor weather.

The soybean meal market also was supported by the USDA’s January WASDE report as the government noted a similar drop in soybean production. Both planted and harvested acreage were reduced by 300,000 and 200,000 acres, respectively, and yield was cut by 0.4 bushels per acre from December to 43.5 bushels per acre.

As a result, production dropped 46 million bushels from the December forecast to 3.329 billion bushels. NASS also reported December 1 soybean stocks at 2.277 billion bushels. The figure implies record Q1 usage during the September-November period of 1.082 billion bushels.

The government did note some demand rationing by cutting the crush forecast 10 million bushels to 1.655 billion, as well as lowering residual usage by 7 million bushels.

Interestingly though, the export forecast was left unchanged at 1.59 billion bushels despite widespread expectations for an increase. The current pace of sales and shipments is well ahead of where it should be by standard econometric models given the existing forecast, so an increase at some point in time seems warranted.

The problem is that ending stocks are now projected at only 140 million bushels, down 15 million from December and at a threshold that many traders feel represents a mere “pipeline” supply – the minimum necessary to maintain logistics through the domestic supply chain.

Also concerning is the fact that when these stocks are measured relative to total usage, the resulting stocks/use ratio is now projected record low at only 4.2 percent.

Like corn, USDA forecast a similar decline in Argentina’s soybean production of 1.5 million tons to 50.5 million, which is projected to lower their exports by 500,000 tons from previous estimates.

This will make it extremely difficult for the U.S. to ration export demand without higher prices, and also necessitates the need for additional soybean acreage in the U.S. to help rebuild stocks in 2011.

Unfortunately, the battle for acreage this spring will be quite intense given that other crops are likewise trading at very high historical prices, including wheat and cotton that compete directly for corn and soybean acres.

The government did note a 4 percent increase in winter wheat acreage in the January report, indicating that high prices have already bought additional wheat acreage in the U.S. this season.

On a positive note, milk prices have risen sharply over the past month, led by a significant increase in butter prices to over $2.00 per lb, unprecedented during the month of January.

Historic flooding in Australia has likewise supported the powder market, with milk production negatively impacted in Oceania.

These developments have caused the Class IV price to rise sharply, which in turn has supported the Class III price as well.

Both have increased about $2.00 per hundredweight over the past month, helping to offset the 60-cent per bushel increase in corn prices as well as the $20 per ton increase in soybean meal prices since the USDA January report was released.

While it seems as though still higher milk prices will be needed to overcome the impact of higher feed costs, the recent rally in milk futures is certainly a welcome development that has helped to prevent any further deterioration in forward profit margins.

How much higher butter can trade and whether or not this will continue to support the Class III futures market is anyone’s guess. One concern is the fact that high prices may begin to put pressure on demand, although recent dollar weakness has been welcome for exporters.

Another concern is that cheese production is still quite high. According to USDA’s “Dairy Products” report, cheese production in November was 889.6 million pounds, up 6 percent from last year with record daily production of 29.65 million pounds per day noted in the report.

There is no problem with high prices and big production as long as demand is willing to absorb the larger quantities at higher price levels.

It is when this demand weakens that prices become vulnerable and the market reacts accordingly.

In the meantime, opportunities exist for dairies to protect breakeven or profitable levels in 2011, and many flexible strategy alternatives exist that will protect these margins while allowing the potential for them to improve through time.

Taking advantage of these opportunities when they present themselves is often the difference between dairying profitably or unprofitably, and this remains the choice of the individual operator to make.

Now that we have embarked on a new year though, a good resolution to keep would be a commitment to managing margins and taking control of your profitability with a comprehensive, strategic plan. PD

-

Chip Whalen

- Senior Risk Manager and Director of Education

- Commodities & Ingredient Hedging, LLC

- Email Chip Whalen