Profit margins for dairy producers have remained relatively steady over the past few months since our last update in July. While the forward margins themselves have not changed much, movement in the individual markets has been significant. From a historical standpoint, margins remain below average within the context of the past five years, although they are positive through Q3 of 2012. Given this outlook, it will be important for producers to carefully manage their forward profitability such that they preserve a positive margin without giving up the opportunity to participate in stronger returns should that materialize over time.

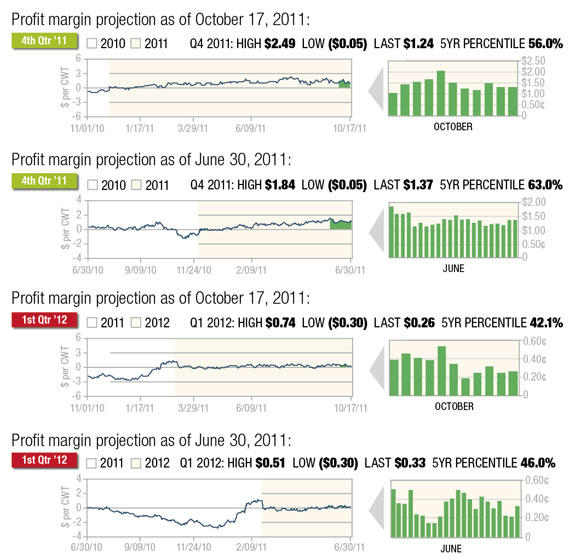

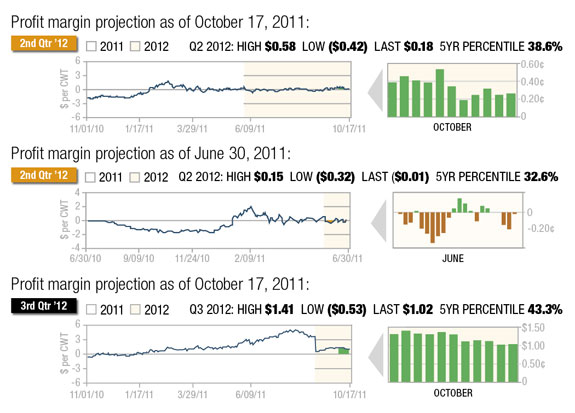

Figure 1 and 2 reflect both the current outlook for dairy margins through the third quarter of 2012 as well as comparison graphs to these same forward profit margin projections back in July.

Milk prices rallied significantly during the month of July, supported by strength in the cheese market and scorching summer temperatures that affected milk intake among dairymen.

A string of 45 consecutive days with block cheese trading above $2.00, matching a record dating back to 2004, supported the Class III Milk futures rally during July and August, and a blistering La Niña-inspired drought gripped the Central and Southern Plains with Texas maintaining triple-digit temperatures throughout the month of July.

The hot weather also gripped the Midwest and Northeast, with Lancaster, Pennsylvania – the largest dairy county in the nation – recording temperatures over 100 degrees in late July for the first time since 1966. At that time, USDA Cold Storage data indicated June 30 American Cheese stocks of 619.0 million pounds, down 1.3 percent from last year and equivalent to about 53 days of use – the lowest for that date since 2007.

Strong demand was particularly evident in the export market, with weakness in the U.S. dollar making U.S. dairy products attractive to international buyers. The USDA reported that cheese exports in the three-month period from March to May was up 36.4 percent from 2010.

In addition, dairy exports during June were valued at a record $423 million, up 24.3 percent from last year and 10.4 percent higher than May.

Unfortunately though, milk production has increased along with the stronger demand and stiffer competition is noted in the global market due to a strong New Zealand spring flush.

August milk production in the U.S. at 16.43 billion pounds was up 2.1 percent from last year and, due to record-high prices, cow numbers were up 2,000 head in August to 9.217 million head – the most in over two years. On top of that, productivity is on the rise as production per cow was 57.5 pounds per day, an improvement of 1.1 percent over August of last year.

Meanwhile, a record spring flush out of New Zealand is pressuring global dairy prices, with Fonterra reporting that milk intake is running 13 percent above last year, creating logistical challenges managing pick-up, handling and processing. Fonterra’s monthly auctions had already been indicating weakness, with the weighted average price for skim milk powder in the latest auction at $3,193 per ton.

This was the ninth straight auction of lower prices and the lowest since last December. As a result of these developments in addition to renewed concerns of the global economy’s health and the Euro zone in particular, milk prices were sharply lower during the month of September.

The feed markets experienced similar volatility over the past few months, with summer weather and some key reports adding to the uncertainty of supply availability in the new-crop year. Corn futures rallied $2 per bushel from early July to late August before retracing that entire gain during the month of September.

Soybean meal prices declined even further after rising $60 per ton during July and August as the market dropped $90 per ton or 23 percent during September. Hay availability has been compromised by the drought in the Plains, with prices up sharply as a result. The USDA reports that alfalfa premium hay in California’s Central Valley now averages more than $300 per ton.

The hot weather this summer that affected milk production similarly affected the corn and soybean growing season. Yields are being reported well below trend with harvest progress now more than half finished across the Midwest.

Steadily declining crop conditions through July and August reflected the weather’s impact on corn and soybean development, with high nighttime temperatures allowing for little relief as corn pollinated and soybeans filled out their pods.

The USDA’s latest October WASDE report projected a national corn yield of 148.1 bushels per acre, unchanged from September but down substantially from an initial trendline assumption of 158.7 bushels per acre back in May. National soybean yield was pegged at 41.5 bushels per acre, down 0.3 bushels from September and down from 43.4 bushels per acre estimated initially in May.

The lower production for both crops suggests another tight balance between supply and demand as we begin the new-crop year. The corn stocks/use ratio is currently estimated at 6.8 percent, which would again represent the lowest level since the 1995-1996 crop year.

The corn balance sheet got some reprieve recently as the USDA raised carryover stocks significantly in the marketing year that just ended. The September 30 quarterly grain stocks report pegged September 1 corn stocks of 1.128 billion bushels versus the average industry estimate of 962 million and the range of estimates between 820 million and 1.05 billion.

The report helped to culminate what had been sharply lower trade during the month of September, as usage during the final quarter of the marketing year was obviously much lower than previously thought. It also provided somewhat of a buffer for the smaller production now being realized on new-crop.

The soybean stocks/use ratio comparatively is tighter at 5.1 percent based on the October WASDE, which also ranks as one of the lowest levels in modern history. Soybean stocks as of September 1 were within expectations at 215 million bushels relative to the average guess of 225 million and the range of estimates between 202 and 240 million.

For both the corn and soybean new-crop balance sheets, the USDA lowered its export forecast in the October report; however, it appears that this may be premature as lower prices through the month of September have reignited demand with China active recently for significantly quantities of both crops.

In summary, dairy producers specifically and the livestock industry generally will have to endure another trying year of tight supply and competition from both the ethanol and export industries.

The good news is that the price discovery mechanism of the futures market is identifying positive margins looking forward over the next year. While as previously mentioned, these forward margins are only average at best, they nonetheless represent profit opportunities, which is a good starting point.

Most dairies do not like volatility in their pricing, either on the cost or revenue side of the ledger. Although volatility is unsettling and presents a management challenge, it also represents an opportunity if approached correctly. The key is to have an open mind and be flexible with your strategy selection.

Sometimes it is better to protect a price level without making a hard commitment to it. In other words, instead of contracting to a fixed feed purchase price, it may be more opportune to protect against higher prices without the corresponding commitment to ownership.

Similarly, instead of contracting to a fixed sale price on milk, it may be optimal to protect against lower prices without the sale commitment.

Fortunately, the futures market allows for this flexibility in your contracting. You can use options to help protect a minimum margin while you wait for the opportunity of improved margins to commit to more firm pricing either using futures or physical contracts.

In addition, the futures market allows further flexibility in that the contracts are liquid to adjust your protection to both higher and lower prices as market conditions change. This can significantly improve your profit margins over time if you employ a margin management approach in your tactical strategies.

Because volatility remains an ongoing feature of the market, it is best to learn how to manage it effectively to the benefit of your dairy. Margin management helps you remove the fear and anxiety associated with price volatility in your costs and revenues.

It will put you in greater control of your operation and allow you to focus on the things that have made you successful in the first place as an industry-leading dairyman. PD

Whalen is a senior risk manager and director of education for Commodity & Ingredient Hedging based in Chicago, Illinois. E-mail him at cwhalen@cihedging.com

References omitted due to space but are available upon request to editor@progressivedairy.com .