First, a summary of December and year-end dairy product numbers from the U.S. Dairy Export Council (USDEC):

- Volume basis: In December 2019, U.S. suppliers shipped 179,382 tons of milk powders, cheese, whey products, lactose and butterfat during the month, 14% more than December 2018. Southeast Asia provided an especially strong market.

Looking at annual totals, U.S. cheese exports reached 357,910 tons in 2019, up 3% from the year before and the most in five years. Nonfat dry milk shipments were down 2% from the record level of 2018. However, sales improved markedly starting in September and were up 29% in the last four months of the year, once European Union intervention stocks were cleared. On the downside, total whey exports were down 18% from 2018, with China accounting for all of the overall decline.

-

Value basis: Overall dairy product export value was up 8% in 2019, and over the last three years, the value of dairy exports has increased 25%. In December, exports to South America were a record-high $49.1 million, led by record shipments of nonfat dry milk/skim milk powder to Colombia.

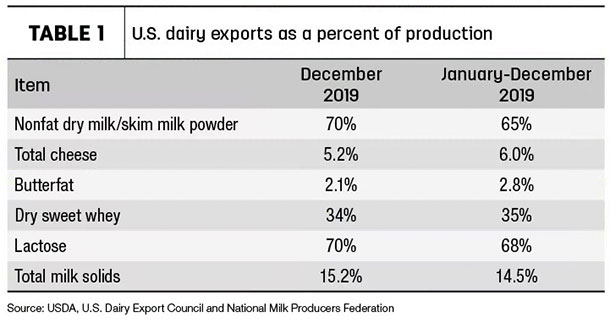

- Total milk solids basis: U.S. exports were equivalent to 15.2% of U.S. milk solids production in December (Table 1). Exports accounted for 14.5% of production in 2019, down from 15.7% in 2018.

In a separate report, the U.S. Department of Commerce estimated that while 2019 U.S. dairy exports were up 8% to $6 billion, the value of foreign dairy products imported into the U.S. was $3.1 billion, up 6% from 2018. Cheese imports were valued at $1.3 billion, up 2%.

The growth in 2019 dairy exports came despite significant disruptions in trade, noted Michael Dykes, president and CEO of the International Dairy Foods Association (IDFA). “This growth is a testament to America’s dairy industry, which continues to innovate, build new customer bases around the world, and deliver a high-quality product known for consistency, safety and deliciousness,” he said.

Dairy heifer exports softer

Editor's note: This article has been updated from the original to include exporter comments.

U.S. dairy heifer exports closed out 2019 softer after hitting a 12-month high in October, according to latest estimates from USDA’s Foreign Agricultural Service. December exports totaled 989 head, below the monthly average for the year of 1,462.

More than half (500 head) of December’s exports took up residence in Egypt, with 320 moving to Mexico and 161 to Canada.

Tony Clayton, Clayton Agri-Marketing Inc., Jefferson City, Missouri, said the USDA numbers undercounted actual dairy heifer exports in December. He said his company alone exported 2,975 head to Egypt and knows of another company that sent 1,503 head to Egypt during the month.

A shipment of 3,000 more heifers was sent to Egypt in January, although new cattle health protocols related to leukosis will likely close that market to more U.S. cattle, Clayton said.

Clayton, who had just finished loading 1,384 heifers bound for Vietnam from the Port of Olympia, Washington, expects January shipments to that country to top 3,000 head. He said that higher costs related to clean-burning fuels are adding about 10% to shipping budgets.

December’s sales pushed total 2019 dairy heifer exports to about 17,538 head, the lowest total since 2016. Top markets for the year were:

- Mexico – 8,569

- Canada – 2,974

- Egypt – 2,003

- Pakistan – 1,752

- Vietnam –1,625

- Others (Kuwait, Kazakhastan, Columbia, Honduras, Thailand and Chile) – 615

December dairy heifer exports were valued at about $1.7 million, raising the 2019 total to about $31.4 million.

Gerardo Quaassdorff, T.K. Exports Inc., Boston, Virginia, said foreign demand for beef replacement heifers is high and should remain strong through 2020. The USDA reported 6,853 beef heifers were exported in 2019, the highest annual total since 2014. Beef cattle are being sought to help fill an animal protein deficit resulting from the African swine fever outbreak in China, he noted.

Despite the demand for protein, foreign sales of U.S. fat cattle remain a small market. One reason is that some emerging markets – mainly Muslim countries – want young bulls instead of steers.

Alfalfa hay exports set new record high

U.S. December 2019 alfalfa hay exports were the smallest since February, but the total was still enough to push total 2019 sales to a new record high. December shipments raised the 2019 total to 2.685 million metric tons, (MT), edging out the previous high of 2.661 million MT in 2017.

Like alfalfa, December exports of other hay declined slightly in December to 115,199 MT. The 2019 total was about 1.393 million MT, up slightly from 2018 but still the second-lowest annual total in at least 15 years.

Concerns over human health and the coronavirus in China are impacting hay shipping logistics, according to Christy Mastin, international sales manager with Eckenberg Farms Inc., Mattawa, Washington. In addition, conversion of ships to burn low-sulfur fuels results in several days in dry docks, impacting vessel schedules and port movement.

For more on hay exports and market conditions, check out Progressive Forage’s Forage Market Insights update.

Ag trade balance

Overall, December 2019 U.S. ag exports were valued at $11.85 billion, while ag imports were estimated at $10.75 billion, resulting in a $1.1 billion ag trade surplus.

Calendar year 2019 exports hit $136.66 billion, and imports were estimated at $131.04 billion, leaving an ag trade surplus of about $5.64 billion for the year.

Other dairy trade news

- To offset the negative impact of trade and tariff wars, the third and final 2019 Market Facilitation Program (MFP) payment – this one equal to 5 cents per hundredweight (cwt) on a dairy farmer’s annual milk production history – was distributed during the first week of February. In August 2019, eligible dairy farmers received an MFP payment of 10 cents per cwt on their annual production history. A second payment, equal to 5 cents per cwt, was distributed last November.

- Meeting with European agriculture and trade officials, U.S. Ag Secretary Sonny Perdue warned the European Union must stop its aggressive use of geographical indications (GIs) as trade barriers in order to successfully negotiate a trade deal with the U.S. Officials with USDEC, the National Milk Producers Federation (NMPF) and the Consortium for Common Food Names (CCFN) said dismantling EU trade barriers must remain a top priority in negotiations with the EU.

-

Dave Natzke

- Editor

- Progressive Dairy

- Email Dave Natzke