New Zealand is a fascinating country. It has about 4.6 million dairy cows, which is more cows than people. New Zealand annual milk production of about 42 billion lbs is only 20 percent of the U.S. milk production, but the 42 billion lbs is produced in a country that is about the same size as the state of Colorado.

Milk production in New Zealand increased almost 40 percent in the past 10 years.

About 95 percent of the country’s milk production is sold outside of its borders, and New Zealand is considered by many as the global leader in dairy marketing.

But what about farm milk prices in New Zealand? What price do New Zealand dairy farmers receive for their milk production? Is it higher or lower than U.S. milk prices? Do New Zealand dairy farmers see the same ups and downs in milk prices as U.S. dairy farmers?

Answering those questions is not as simple as it may seem due to differences between U.S. and New Zealand in regards to how milk prices are expressed, different currencies and fluctuating exchange rates and the milk components priced.

Using data from the 2011-2012 New Zealand Dairy Statistics published by DairyNZ and the Livestock Improvement Corporation, information provided by some of my New Zealand friends, and drawing from my own experience in visiting the country, we will address these questions.

To begin, we need a basic understanding of the New Zealand milk pricing system. The New Zealand system is described as:

A + B – C.

A equals the price per kilogram of butterfat. B equals the price per kilogram of protein, and C equals a volume charge per liter of milk.

My New Zealand dairy farmer friends tell me the volume charge is an economic incentive to encourage dairy farmers to produce the maximum kilograms of butterfat and protein in the least amount of volume.

Almost all of New Zealand’s milk production is utilized in manufactured dairy products, such as milk powders, cheese and butter. Manufacturing these types of products basically separates milk solids from water.

The more milk solids and less water in a given amount of milk, the greater the manufacturing efficiency. Such a milk pricing system makes good economic sense when almost all of the milk is manufactured.

Based on increasing milk component averages, New Zealand dairy farmers have responded to this milk pricing system. In the 2000-2001 season, New Zealand farm milk averaged 4.84 percent milk fat and 3.64 percent crude protein.

For the 2011-2012 season, the averages were 4.99 percent milk fat and 3.82 percent crude protein. For comparison purposes, U.S. farm milk averages about 3.66 percent milk fat and 3.07 percent true protein. Note the U.S. uses true protein, while New Zealand uses total or crude protein.

True protein is about 0.19 percent lower than crude protein due to crude protein measuring the non-protein nitrogen in milk.

New Zealand statistics are listed by season. A New Zealand season is from July 1 to June 30. Most New Zealand dairy farmers start calving their cows in July (beginning of winter in New Zealand) and then turn their cows dry in April to May. Average days in milk during the 2011-2012 season were 275.

New Zealand Dairy Statistics , as well as most published milk price information from New Zealand, lists farm milk prices per kilogram of milk solids. Generally, we think of milk solids as being all of the solids in milk: butterfat, protein, fat and ash.

However, the New Zealand price per milk solids refers to only butterfat and protein. In other words, the published New Zealand farm milk price per kilogram of milk solids is the combined price of a kilogram of butterfat and protein less the volume charge.

As pointed out in New Zealand Dairy Statistics , the published price excludes any levy or retentions. In the U.S., this is comparable to cooperative dues, equity retains or mandatory assessments.

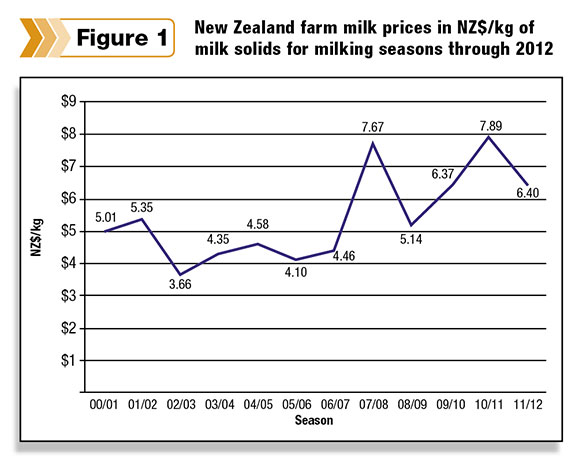

Figure 1 shows annual New Zealand farm milk prices published by New Zealand Dairy Statistics from the 2000-2001 through 2011-2012 seasons.

As the figure shows, New Zealand dairy farmers do experience ups and downs in milk prices, especially in recent years.

However, the trend line shows milk prices increasing. Remember the price per kilogram milk solids equals the price per kilogram butterfat plus price per kilogram protein minus a volume charge per liter.

The next obvious question is: How do these prices compare to U.S. prices? To answer that question, we must make some adjustments.

These adjustments include converting the New Zealand price to a price per cwt in US$ at average U.S. milk component levels, converting true protein to crude protein using the 0.19 factor and changing the average U.S. all-milk price from a calendar year to a New Zealand season.

The New Zealand-U.S. exchange rate in January of each year was used to convert New Zealand dollars to U.S. dollars.

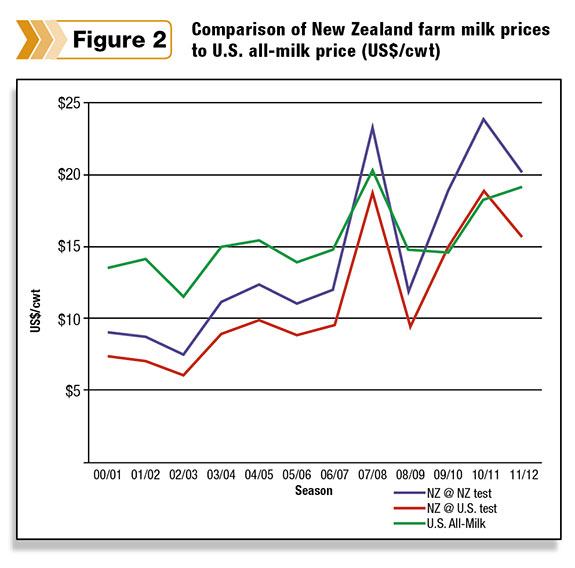

Making these adjustments results in Figure 2 comparing the New Zealand farm milk price in US$ per cwt to the U.S. all-milk price.

The New Zealand price is calculated at both New Zealand average milk solids and U.S. average milk solids levels.

Figure 2 shows the U.S. all-milk price was higher than the New Zealand price through the 2006-2007 season.

In the 2007-2008 season, prices were close. Due to a large drop in the exchange rate, the New Zealand price experienced a steep decline in 2008-2009.

For the last three seasons, the New Zealand price – at New Zealand component levels – exceeded the U.S. all-milk price.

For the last season, the U.S. all-milk price was higher than the New Zealand price at U.S. component levels.

We need to interject that currency exchange rates improved the New Zealand milk price in relation to the U.S. price. In 2000-2001 it took $0.47 to buy a New Zealand dollar. In 2011-2012 it took $0.78.

What is the take-home message? When comparing New Zealand farm milk prices to U.S. milk prices, several adjustments that we discussed must be made. The New Zealand farm milk price, expressed at U.S. milk component averages, has been close to the U.S. all-milk price for the past three seasons.

Higher New Zealand milk component levels (butterfat and protein) add to the New Zealand farm price being higher in comparison to the U.S. price. Currency exchange rates make a difference in comparing New Zealand versus U.S. farm milk prices. PD

Covington is a retired dairy co-op CEO and currently a management consultant.

Photo illustration by Mercedes Opheim.

Calvin Covington

Farm Consultant