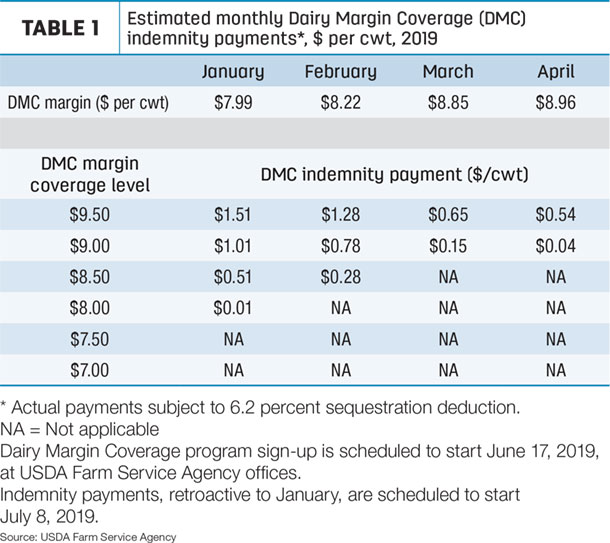

The USDA released its latest Ag Prices report on May 31, including factors used to calculate April DMC estimated payments. The April DMC margin was estimated at $8.96 per hundredweight (cwt) (Table 1), resulting in an indemnity payment of 54 cents per cwt on milk covered at the $9.50 per cwt level. Producers selecting the $9 coverage level would see an indemnity payment of 4 cents per cwt.

The USDA previously estimated the milk income over feed cost margin of $7.99 per cwt in January, $8.22 per cwt for February and $8.85 per cwt for March.

Based on conditions at the close of trading on the Chicago Mercantile Exchange (CME), May 31, the latest forecast from the Program on Dairy Markets and Policy website projects DMC program margins to climb to above $9 per cwt in May. However, recent increases in corn and soybean futures prices have pushed expected margins lower in June, July and August before rising to near $9.50 per cwt in September-December 2019.

The USDA’s DMC Decision Tool currently estimates a producer insuring 5 million pounds of milk production history (maximum under Tier I coverage) at the 95 percent level would pay $7,125 in premiums for the year and receive $22,087 in DMC indemnity payments. All DMC indemnity payments are subject to a 6.2% sequestration deduction.

Enrollment in the DMC program will be held June 17-Sept. 20 at the USDA Farm Service Agency (FSA) offices. For those who sign up early, distribution of indemnity payments, retroactive to January 2019, is scheduled to begin July 8.

Next scheduled DMC margin announcements are set for June 27 (May), July 31 (June) and Aug. 30 (July), so dairy producers could know expected payments for January-July 2019 before DMC program sign-up closes.

April milk prices higher

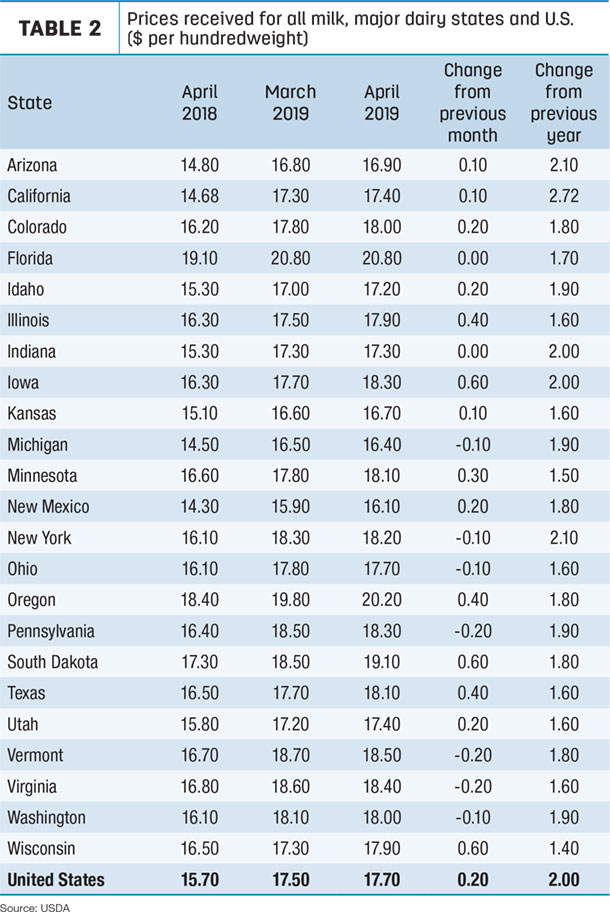

The April 2019 U.S. average milk price rose 20 cents per cwt from March to $17.70 per cwt. The average was $1.90 higher than April 2018 (Table 2) and the highest average since November 2017.

Florida’s average of $20.80 per cwt remained the nation’s high; the low was in $16.10 per cwt in New Mexico. Compared to a year earlier, April 2019 milk prices were up at least $2 per cwt or more in five states (Arizona, California, Indiana, Iowa and New York).

While milk prices rose slightly, lower monthly average corn and soybean meal prices offset most of the impact of a higher average alfalfa hay prices, which jumped $15 from March to $199 per ton. Corn prices averaged $3.52 per bushel, down 9 cents from March, and soybean meal averaged $304.26 per ton, down $2.12. That yielded an average total feed cost of $8.74 per cwt of milk sold, up 9 cents from March (Table 3).

Markets, government programs impacting DMC projections

This spring’s slow planting progress and multiple government programs are creating uncertainty in corn and soybean markets. For dairy producers, those dynamics are also influencing projected milk income margins using the DMC program formula.

In addition to delayed planting and the impact on both reduced acreage and yield potential – which alone could boost prices – many corn acres will soon be eligible for prevented planting payments on corn crop insurance policies. Or, producers could take 35 percent of the corn prevented planting payment and plant soybeans after the late planting period for corn.

Enter the recently announced 2019 Market Facilitation Program (MFP). The USDA has initially stated that MFP payments will not be received on prevented planting acres, but the final details have yet to be released. MFP payments could provide incentives to plant crops and not take prevented planting payments.

Adding confusion to this situation is a disaster assistance program working its way through Congress, which may or may not adjust prevent planting payment levels. Other factors – probably not the last – relate to remaining supplies from last year’s corn crop, which has seen weakening demand from ethanol and export markets.

And finally, there’s the wildcard of another set of tariffs to be imposed on Mexico, which could trigger retaliatory tariffs, negatively impacting U.S. dairy exports and prices. (Read: New threat of tariffs on Mexican goods puts dairy exports in crosshairs again.)

DMC calculator available

A reminder as you head to your FSA office after June 17: The USDA has made a new web-based tool to help dairy producers evaluate coverage levels through DMC program by combining operation data and other key variables to calculate coverage needs based on price projections.

The decision tool assists producers with calculating total premiums costs and administrative fees associated with participation in DMC. It also forecasts payments that will be made during the coverage year.

What if? New ‘dairy hay’ information

Mandated by the 2018 Farm Bill, the USDA has begun reporting average “dairy quality” Premium and Supreme alfalfa hay prices in an effort to more accurately calculate dairy farmer feed costs under federal dairy safety net programs. The report lists hay prices in eight states and averages prices from the top five milk-producing states: California, Idaho, New York, Texas and Wisconsin.

April 2019 dairy-quality hay prices in those states averaged $219 per ton, up $6 from March and $20 per ton more than April’s all alfalfa hay average of $199.

It’s only a “what if?” scenario, but if that average was incorporated into the DMC formula, the income margin would have been 27 cents lower, or about $8.69 per cwt. That would have yielded an April 2019 DMC indemnity payment of $0.81 per cwt at the top margin coverage level of $9.50 per cwt. However, the new dairy-quality hay prices are not part of the DMC calculations. ![]()

-

Dave Natzke

- Editor

- Progressive Dairyman

- Email Dave Natzke