As a dairy producer, many different issues and risks are pulling you in a thousand different directions. As you began this new year, you probably assembled a list of priorities, such as a list of things to change or a list of things you’d like to get a better handle on.

You may be trying to evaluate whether price risk management is worth the time to do or to stay doing.

You may view marketing from one perspective, your accountant from another, your lender from another and partners or family members from yet another. With such a mix of input, market-related activities may seem difficult to evaluate.

In this article, we’ll take a look at reasons why price risk management should be on your 2014 list of priorities and where the greatest risks are in the year ahead.

Big risks in 2014

Heading into 2014, we see a great deal of risk for dairy producers. There are several reasons for this:

• The milk market continues to hold strong, fueled by exports. Much of the fundamental news, especially where exports are concerned, is bullish. Despite the headlines, there are risks that milk could reverse course. If feed costs stay low and production increases, any slowing in export demand could put significant downward pressure on prices.

• The risk that the corn price could go higher outweighs the opportunity of the corn price going much lower from here. At the time of this writing, corn is down approximately 50 percent from its high of $8.44 last summer.

From a technical standpoint, that is quite a sell-off, making the market very susceptible to a severe upward correction. In addition, there are several fundamental reasons to believe that corn is at risk of going higher from here, including demand renewal, export commitments and ramped up ethanol production.

• The above bullets really point to multiple price possibilities for feed and milk. It has been nearly four years since the last prolonged bear market for milk, so producers tend to believe low prices will not happen again.

Uncertainty about whether to protect milk or feed prices at these levels leads producers to want to focus on other areas of their business, where decisions seem more productive and concrete.

This last point is probably the greatest cause for concern when it comes to the financial health of dairy producers in 2014. We could provide many charts to explain the risks and opportunities in milk and feed markets for 2014; however, the most instructive chart is one that charts actual producer behavior over several price cycles.

Complacency charted

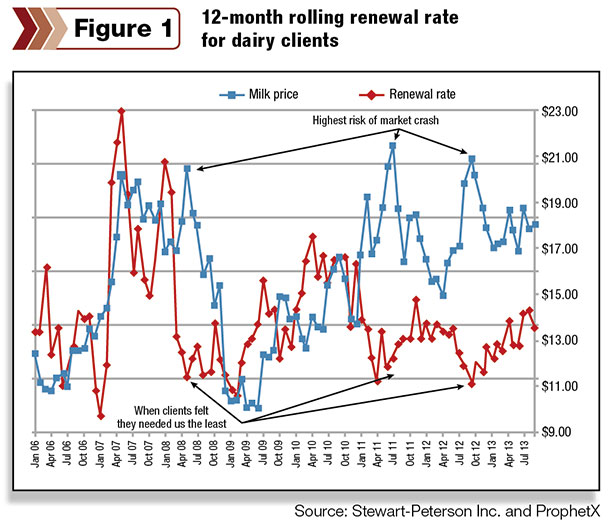

Figure 1 depicts our milk marketing service renewal rates overlaid with the Class III milk price over time. When we chart our renewal data, we find that renewals for our service typically decline during bull markets – just months before a market decline.

This figure clearly shows us that even our clients, many of whom are among the most consistent and disciplined marketers, struggle to stay consistent with their marketing when milk prices are high and news is bullish.

We’re publishing this figure in order to reveal the greatest risk we see facing producers this year – one that is within their control. The biggest risk producers face is quitting a consistent approach to the markets at the pinnacle of risk.

Marketing can only serve you well if you stick with your approach, even when all the fundamental news is good, profits are attractive in the cash market and you’re tempted to quit.

Another lesson we can learn from this figure is that it takes about 12 to 18 months for dairy producers to forget what a bear market feels like. When client behavior in the form of renewals is charted, the pattern is evident from cycle to cycle: While milk prices are trending up, producers gradually begin to doubt the need for marketing.

The more bullish the news and the more prolonged the bull market, the more a producer begins to doubt until he or she reaches the point of abandoning the consistent, strategic approach that was put in place together with their adviser.

There is a term for this in the investing world: “recency bias.” It’s the tendency to weigh recent data or experience more heavily than earlier data or experience. When we onboard new clients after a price downturn, they tell us, “We don’t want to go through that again.”

Fast-forward 18 months into a bull market, and those same producers are saying things like, “This market has gone up and up and is only going to go higher.” Forget the decades of history we have showing a cycle of bull and bear markets: The temptation is very great to weigh recent experiences and news more heavily.

Recency bias exists in any market, not just dairy. Housing comes to mind. Land prices. The tech bubble. The fact that there is a term like “recency bias” in the investing world tells us how real these emotions are for anyone who is involved with markets.

So if you are doubting your marketing approach right now, you are not alone. In fact, you are quite typical. Human emotions drive wedges into the best of plans. Our clients are among the most consistent and disciplined marketers out there, and even they struggle with consistency and discipline when the fundamental news is good.

To be successful in the markets, you are forced to make decisions that go against the herd. This is true for all markets, everywhere. When you hear commercials on the radio saying, “It’s time to buy gold,” it’s likely the worst time to buy it.

When everyone says housing prices will keep going up and up, they are due for a crash. What is in the headlines is already factored into market prices.

Robert Prechter, the noted stock market analyst and author, says, “There is always a great fundamental story to convince you to do exactly the wrong thing.”

And so, it is your challenge to create separation between what you hear and feel, and what you actually do in your price risk management. Open your mind to multiple price possibilities. Prepare your marketing approach. And then act without hesitation. That way you can avoid being fully exposed at the pinnacle of risk. PD

Futures trading is not for everyone. The risk of loss in trading is substantial. Therefore carefully consider whether such trading is suitable for you in light of your financial condition. There are no guarantees that using strategies, consistency or discipline will translate into successful marketing.

Patrick Patton

Director of Client Services

Stewart-Peterson Inc.