A decline in cow numbers and a modest gain in milk output per cow helped limit July 2018 U.S. milk production growth to just 0.4 percent compared to a year earlier. Reviewing the USDA estimates for July 2018 compared to July 2017: U.S. milk production: 18.35 billion pounds, up 0.4 percent U.S. cow numbers: 9.396 million, down 8,000 head U.S. average milk per cow per month: 1,953 pounds, up 10 pounds 23-state milk production: 17.3 billion pounds, up 0.4 percent 23-state cow numbers: 8.735 million, up 1,000 head 23-state average milk per cow per month: 1,980 pounds, up 8 pounds Source: USDA Milk Production report, Aug. 20, 2018

Looking deeper

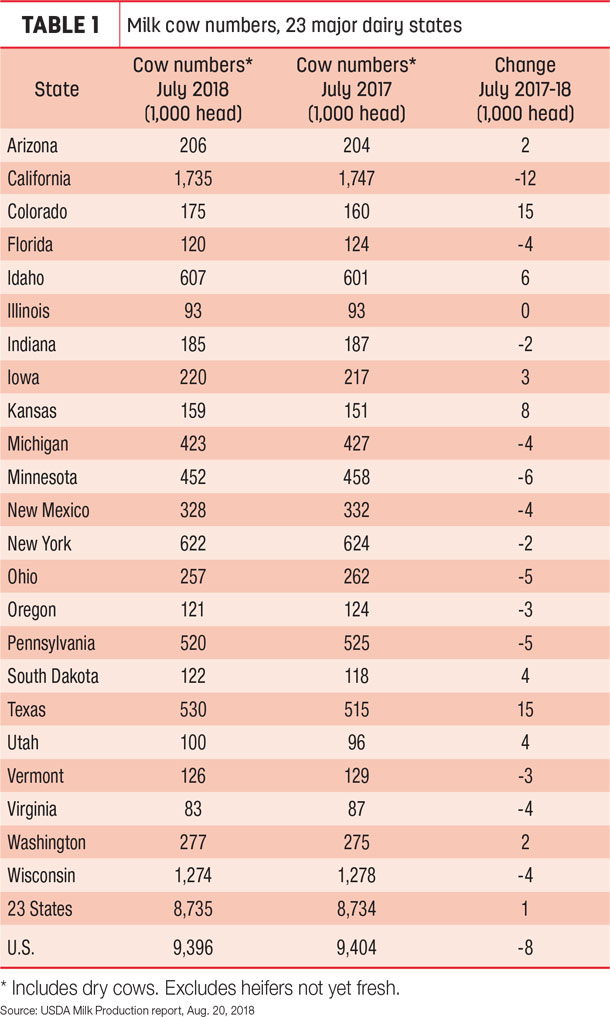

• Cow numbers: At 9.396 million head, U.S. cow numbers dipped below 9.4 million for the first time since last November. U.S. cow numbers were down 8,000 head from both June 2018 and July 2017. Cow numbers in the 23 major dairy states were up about 1,000 head from a year ago, but 8,000 less than June 2018 (Table 1). As of late July, dairy cull cow slaughter was running about 75,000 head more than the same period a year ago.

Dairy producers in nine of the major states had more cows than a year ago, led by Colorado and Texas (both +15,000), Kansas (+8,000) and Idaho (+6,000). Producers in 13 states had fewer cows than a year earlier, led by California (-12,000 head), Minnesota (-6,000) and Pennsylvania and Ohio (each -4,000 head).

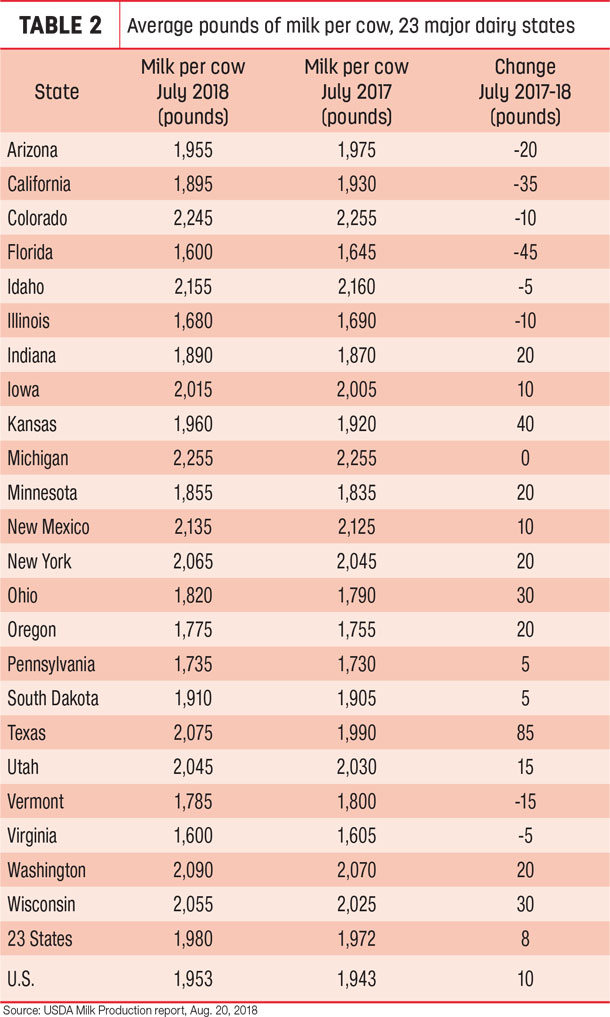

• Milk per cow: July’s monthly milk production increase per cow moderated, up just 8 pounds (0.3 percent) nationally compared to a year earlier (Table 2). July 2018 per-cow production was up 85 pounds in Texas and 40 pounds in Kansas, offsetting 35- and 45-pound declines in California and Florida, respectively.

• Milk production: On a percentage basis, greatest year-over-year milk production growth was again centered in three states: Colorado output was up almost 9 percent, with Kansas and Texas up more than 7 percent. In contrast, 11 major dairy states saw year-over-year declines, led by Florida and Virginia.

Texas led all states for milk production growth on a volume basis in July, increasing production by 75 million pounds compared to a year earlier. Colorado and Wisconsin each increased milk production by about 30 million pounds. On the other hand, California production declined 84 million pounds from a year earlier.

July-August margin outlooks reviewed

After weakening in July, estimated quarterly dairy income margins held mostly steady in the first half of August, according to Commodity & Ingredient Hedging LLC.

Dairy margins generally deteriorated over the second half of July, as rising feed costs more than offset higher milk prices. However, in August, the third-quarter 2018 margin outlook strengthened to above breakeven due to higher milk prices. Much of the strength in the nearby milk market appears to be seasonal, with back-to-school buying for lunch programs boosting fluid milk consumption. The USDA also announced it will spend $50 million to purchase fluid milk and distribute it through food assistance programs.

Adding support, there is concern that recent heat stress, particularly out West, is reducing milk yields and lowering the butterfat component of milk production. Also, spot Chicago Mercantile Exchange cheddar barrel prices have been rising.

Cutter cow price outlook weaker

The USDA’s latest Livestock, Dairy and Poultry Outlook forecasts further weakening in national average cutter cow prices into the first quarter of 2019.

Through the first half of 2018, national cutter cow prices averaged about $61.50 per hundredweight (cwt). Third-quarter prices are projected in a range of $57 to $61 per cwt, with fourth-quarter prices in a range of $56 to $62 per cwt. If realized, the 2018 cutter cow price would average about $60 per cwt (midpoint), down from $65.16 per cwt in 2017, $70.07 in 2016 and $99.56 per cwt in 2015.

First-quarter 2019 prices are forecast in a range of $56 to $65 per cwt.

Global Dairy Trade index falls

Global Dairy Trade (GDT) dairy product prices were lower during the auction held Aug. 21. The overall index was down 3.6 percent.

Among major products, the cheddar cheese price was down 4.7 percent, to $3,484 per metric ton (MT); butter was down 8.5 percent, to $4,392 per MT; whole milk powder was down 2.1 percent, to $2,883 per MT; and skim milk powder was down 1.3 percent, to $1,953 per MT.

The next GDT auction is Sept. 4.

Cottonseed news is mixed

The USDA’s August World Ag Supply and Demand Estimates report estimated fewer acres of cotton will be harvested this year in the U.S. However, more acreage and higher anticipated yields in the Southeast could be good news for dairies in Florida, the Northeast, Mid-Central and Midwest market areas, according to Nigel Adcock with Cottonseed LLC.

The USDA estimated cottonseed production for the coming harvest at 6.021 million tons, down from 6.422 million tons last year. Anticipated cotton acres (minus what the USDA felt would be abandoned) was 10.1394 million acres, a decline of almost 1 million acres from last year’s 11.1004 million acres.

Ginners in central and south Alabama markets have been actively looking for bids as they seek homes for what is anticipated to be a very good harvest. Gins in these areas have been reliant on buyers utilizing vans and containers to ship product to markets in eastern Wisconsin and the Pacific Northwest. However, recent changes to drivers’ hours and the increase in freight rates no longer make these shipment methods to those areas competitive, so buyers are becoming reluctant to pay the premiums.

Cotton crop conditions have declined in recent weeks and should be followed closely to determine if yields will ultimately be impacted, Adcock said. The other major factor that needs watching is the hurricane season.

The USDA indicated that 40 percent (about 3 million acres) of the Texas crop would be abandoned this year. Under the terms of the crop insurance/disaster payment programs, crops must be plowed under. None of this crop will come to market, creating additional hardships and higher prices for many Texas cattlemen. Despite all the bad news, prices on old-crop seed have continued to slide. ![]()

-

Dave Natzke

- Editor

- Progressive Dairyman

- Email Dave Natzke