The preliminary report, released Dec. 17, indicated more cows and more milk per cow pushed total U.S. November 2020 milk production up about 3% from November 2019. The milk production growth rate in the 24 major dairy states was slightly higher, up 3.1%.

November 2019-20 recap at a glance

Reviewing the USDA preliminary estimates for November 2020 compared to November 2019:

- U.S. milk production: 18.03 billion pounds, up 3%

- U.S. cow numbers: 9.41 million, up 62,000 head

- U.S. average milk per cow per month: 1,916 pounds, up 43 pounds

- 24-state milk production: 17.22 billion pounds, up 3.1%

- 24-state cow numbers: 8.899 million, up 82,000 head

- 24-state average milk per cow per month: 1,935 pounds, up 41 pounds

Source: USDA Milk Production report, Dec. 17, 2020

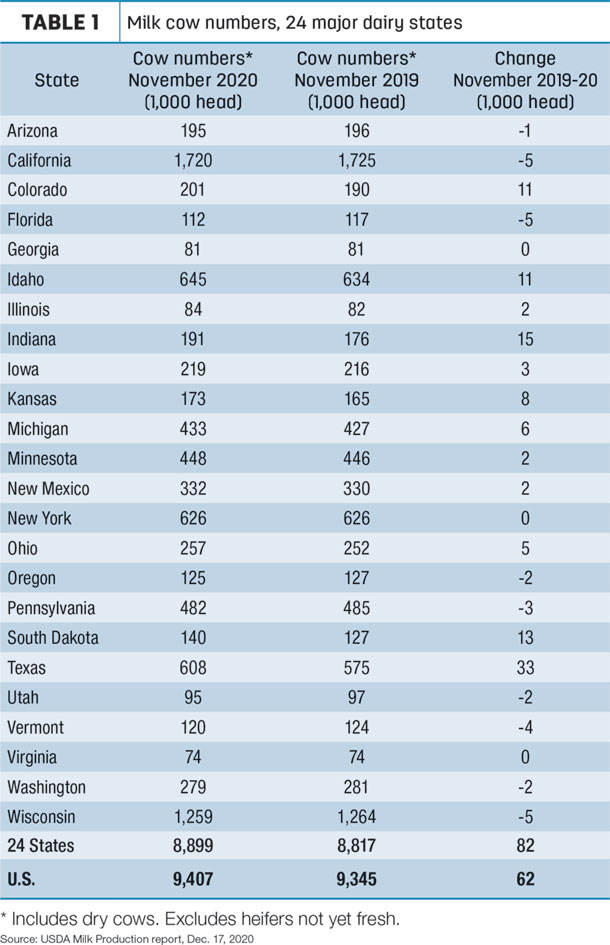

Based on USDA estimates, U.S. cow numbers hit 9.407 million in November, the highest total since June 2018. The herd increased by 12,000 head from October, and USDA also revised its preliminary October estimate higher by 5,000 head. Since bottoming out in June, U.S. cow numbers have now grown by 57,000 head.

In the 24 major dairy states, November 2020 cow numbers were estimated at 8.899 million head, up 13,000 from October and 82,000 more than a year earlier. Major state cow numbers are now up 72,000 head since June.

The slowdown in cow culling continues to account for some of the growth in the milking herd. The week ending Nov. 28 marked the 29th consecutive week in which U.S. dairy cow slaughter under federal inspection was lower than the comparable week a year earlier, according to the USDA data. During that period, weekly slaughter averaged 4,800 head less than the year before, for a total of almost 141,000 cows. Year to date, dairy cow slaughter was down about 106,500 head from 2019.

Compared to a year earlier (Table 1), November cow numbers were reported higher in 11 states and lower in 21 states, with Georgia, New York and Virginia unchanged. Cow numbers were up a combined 83,000 head in Texas, Indiana, South Dakota, Colorado and Idaho, far offsetting the 29,000-head decline in nine other states. California, Florida and Wisconsin showed the biggest drop, down 5,000 head from the year before.

Milk per cow stronger

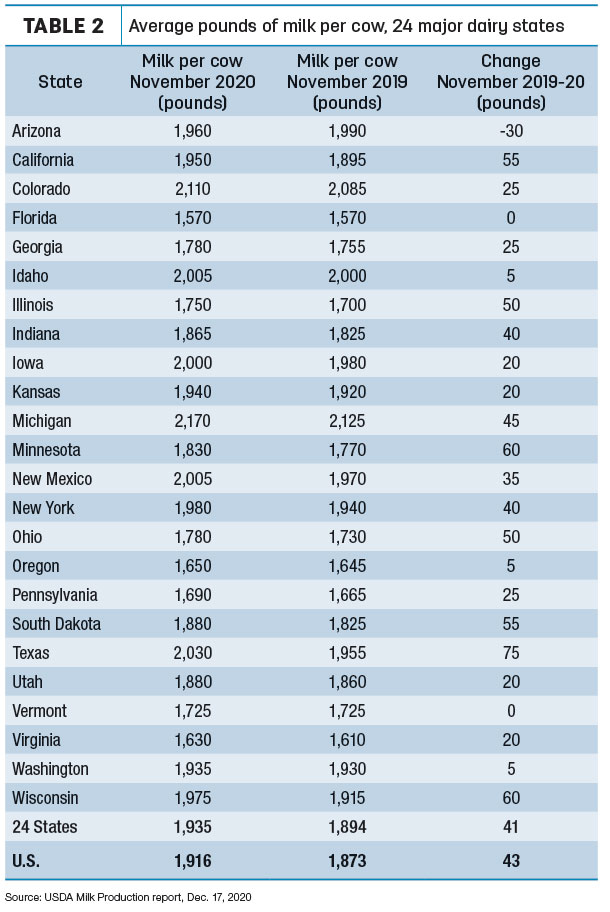

With reports of generally good feed quality from 2020 crops, November 2020 growth in U.S. and major dairy state average milk output per cow rose about 1.25 pounds per day compared to a year ago (Table 2). Producers in three states – Texas, Minnesota and Wisconsin – boosted daily output by at least 2 pounds per day. Only Arizona reported lower year-over-year output per cow.

Michigan remained the nation’s leader in milk per cow, averaging 2,170 pounds in November 2020.

Volume, percentage growth

Texas led the 18 states with year-over-year milk volume growth in November, up 110 million pounds (9.8%), while California and Wisconsin were up 85 million pounds and 66 million pounds, respectfully.

On a percentage basis, growth in South Dakota continued at a double-digit pace in November, up more than 13% compared with a year earlier. Indiana output was up about 11%. Florida (-4.3%) and Vermont (-3.3%) led decliners.

Are brakes ahead?

The growing herd and above-trend production increases are testing the ability of processors and cooperatives to handle the additional milk, according to Rabobank’s latest Global Dairy Quarterly report. That could result in a return of tiered pricing and base-excess programs – widely implemented last spring due to COVID-19 market disruptions – to disincentivize further expansion. As the balance between supply and demand becomes more perilous over winter, Rabobank expects the brakes to be tapped on expansion in the first quarter of 2021. ![]()

-

Dave Natzke

- Editor

- Progressive Dairy

- Email Dave Natzke