U.S. dairy product exports were virtually flat on both a volume and value basis in October, undermined by a continued loss of sales to China, according to Al Levitt, vice president of communications and market analysis at the U.S. Dairy Export Council (USDEC).

• Volume basis: Shipments of milk powder, whey, lactose, cheese and butterfat to China were down 47 percent in October; the whey volume was the lowest monthly total since November 2015. Exports elsewhere were up 14 percent, with large sales gains to Southeast Asia and Mexico. Cheese shipments to Mexico improved despite retaliatory tariffs, up 31 percent.

In the four months since China put additional tariffs in place, U.S. whey exports to China were down 36 percent (-6,909 tons per month) compared with a year ago; skim milk powder sales were down 54 percent (-1,333 tons per month); whole milk powder sales were down 97 percent (-1,288 tons per month); and cheese exports were down 56 percent (-752 tons per month).

• Value basis: October U.S. exports were worth about $460 million, down slightly from monthly totals in October 2016 and 2017.

On a value basis, October exports to Mexico and Southeast Asia were up 25 percent and 29 percent, respectively, mostly on the strength of improved sales of nonfat dry milk/skim milk powder. Those increases offset value declines in sales to China, Japan, the Middle East/North Africa, South America and the Caribbean.

Year-to-date, U.S. dairy exports are valued at $4.74 billion, up about 4 percent from January-October 2017.

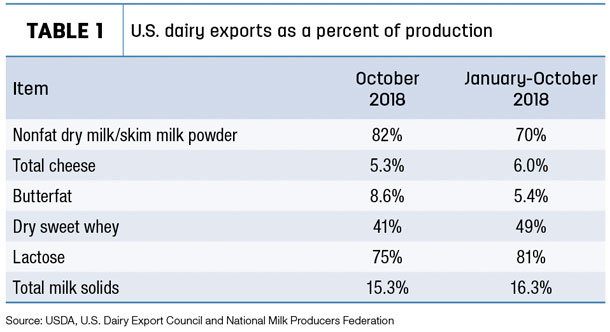

• Total solids basis: U.S. exports were equivalent to 15.3 percent of U.S. milk production in October, bringing the year-to-date percentage to 16.3 percent (Table 1).

Dairy replacement cattle exports

Paced by the sale of 2,184 head to Qatar, October U.S. dairy replacement heifer exports hit 4,851 head, valued at nearly $10.4 million. In terms of volume and value, both were the highest monthly totals since December 2017. At 23,631 head, the 2018 year-to-date sales are on pace to be the second strongest in the past four years.

But, October’s numbers again come with an asterisk. The USDA report said 1,850 head of dairy replacements were identified as landing in Russia, which may call both the destination and type of cattle into question, according to cattle exporters.

As we’ve discussed previously in Progressive Dairyman, at issue are shipments to the Commonwealth of Independent States (CIS), countries that were formerly Soviet republics. Some of the countries involved, such as Kazakhstan, have no seaports. Under an agreement with Russia, beef and dairy heifers and other commodities arrive at a Russian port on the Black Sea and are then trucked to their final destinations.

U.S. dairy cattle exporters see a stronger export environment mixed with uncertainty ahead.

Tony Clayton, Clayton Agri-Marketing Inc., Jefferson City, Missouri, said the end of 2018 is shaping up to be stronger for U.S. dairy cattle exports, and the outlook for early 2019 has improved. Another large shipment of heifers was scheduled to depart for Qatar in mid-December. Kuwait, long absent from the market, has newly approved health protocols and will be taking a shipment of Holstein and Jersey heifers in January. In February, another shipment of pregnant and open Holstein heifers will head to Vietnam.

Closer to home, Mexico’s new president is making funds available to import U.S. dairy cattle to Mexico’s southern states in Mexico, and purchases could be sizable, Clayton said.

For cattle exporters, the uncertainty centers on the availability and affordability of transportation (both ships and planes) and the ability to control contract risks, as higher U.S. interest rates impact foreign buyers’ abilities to obtain loans, according to Gerardo Quaassdorff, T.K. Exports Inc., Boston, Virginia.

U.S. heifer prices remain low and supplies are plentiful, as low milk prices force dairy producers to get rid of inventory.

“We expect potential buyers to become more familiar with technologies such as in vitro fertilization, sexing embryos and sexed semen, along with demanding genomically tested animals,” Quaassdorff said. That, in turn, expands the market for larger pools of U.S. commercial heifers – those not enrolled in breed associations.

Besides the traditional U.S. dairy cattle markets, Quaassdorff expects some new markets to develop and other former markets to return. He said India and Lybia have expressed interest in U.S. cattle recently. Negotiations on the health protocols are slow but moving forward in Northern Africa (Morocco, Algeria and Tunisia).

Despite plentiful supplies and lower prices, another challenge facing U.S. exporters is competition with alternative suppliers, Quaassdorff said. Due to the distance to markets, U.S. transportation costs are higher.

“The best way to compete here is through advanced planning to control expenses to reduce the risk during the export process of export,” Quaassdorff said. “However, it is difficult to convince buyers from emerging markets to stick to a medium- or long-range plan or commit to a contract when their domestic economies are volatile and/or they are culturally not inclined to do that.”

On the beef side, demand includes both replacement cattle to build herds as well as cattle for slaughter. The challenge of exporting feeder cattle is that most Muslim countries demand young bulls, which are of limited supply in the U.S.

Alfalfa hay exports slump

U.S. alfalfa hay exports slumped in October, pressured lower by tariff-impacted sales to China. Alfalfa exports there were the lowest monthly total since January 2014. Sales to Saudi Arabia and the United Arab Emirates were also down from September. As a result, total shipments of alfalfa hay fell to 197,718 metric tons (MT), the lowest monthly volume since January and February 2018. Year-to-date alfalfa hay exports now total about 2.1 million MT, behind last year’s record-high pace.

October exports of other hay showed some improvement, with volumes the highest since March 2018. Sales to Japan and South Korea were the highest since June, with Taiwan’s purchases the highest total of the year.

October through February is normally the high season for U.S. exports, said Christy Mastin with Eckenberg Farms Inc., Mattawa, Washington. But in addition to tariffs, strong typhoons that hit China, South Korea and Japan in early September and then again in early October caused shipping delays, reducing export totals.

Read: Hay Market Insights: The three ‘spirits’ of a hay year

U.S. ag trade surplus rebounds

Monthly U.S. agricultural exports were estimated at $12.2 billion, the highest monthly total since May. Imports were valued at $10.9 billion, yielding an October 2018 trade surplus of $1.3 billion, the largest surplus since June.

USDA cuts dairy export outlook

USDA trade forecasters factored trade tensions into their latest outlook report. The agency’s quarterly Outlook for U.S. Agricultural Trade report, released Nov. 29, reduced projected fiscal year 2019 (FY19) ag exports to $141.5 billion, a $3 billion decrease from the August forecast. Imports were raised by $0.5 billion, to $127 billion, dropping the projected U.S. agricultural trade surplus to $14.5 billion.

Projected FY19 (Oct. 1, 2018, through Sept. 30, 2019) dairy exports were lowered $300 million from August, to $5.3 billion, due to lower volumes of cheese and whey and weaker global dairy prices. If realized, the total would be about the same as FY17, but down $300 million from FY18.

Meanwhile, the FY19 U.S. dairy import forecast was estimated at $3.4 billion, about equal with FY18. Cheese imports were projected at $1.3 billion, compared to $1.2 billion in FY18.

The dollar’s value has strengthened since May, which is expected to continue into 2019 as U.S. interest rates increase relative to those in other major economies. Expectations for higher U.S. interest rates are driven by a strong U.S. economy, tightening monetary policy, and an expansionary domestic tax and spending policy.

Read also: USMCA signed, not sealed or delivered; U.S.-China trade war hits pause button ![]()

-

Dave Natzke

- Editor

- Progressive Dairyman

- Email Dave Natzke