With President-elect Donald Trump set to take office on Jan. 20, U.S. dairy and other agricultural organizations remain unclear regarding future trade policy direction. One thing that is certain is the steady resurgence of U.S. dairy exports as the leadership transition nears.

In the weeks leading up Jan. 20, dairy and agricultural leaders reminded the incoming administration of the importance of agriculture in future trade policies.

Jim Mulhern, president and chief executive officer of the National Milk Producers Federation (NMPF) joined 15 other farm organizations in sending a letter to President-elect Donald Trump and Vice President-elect Michael Pence highlighting the importance of trade to America’s farmers. The letter called for enforcement of existing trade agreements, as well as expanding market access for U.S. producers through new agreements.

“The growth of America’s dairy sector is directly tied to our ability to export,” Mulhern said. “We have a positive trade balance in agriculture, and don’t want to see those hard-earned export markets eroded.”

Mulhern said the U.S. dairy sector exports 14 percent of its milk production, “which last year was worth over $5 billion, in the process generating more than 120,000 jobs in dairy farming, manufacturing and related sectors. Any disruption in exports of dairy and other food products would have devastating consequences for our farmers, and the many American processing and transportation industries and workers supported by these exports.”

USDEC, USTR get new leaders

In addition to Trump, changes in two other roles mean dairy-exporting efforts will see additional new faces in leadership.

Tom Suber, who served as the president of U.S. Dairy Export Council (USDEC) since its inception in 1995, retired at the end of the year. What the organization loses in Suber’s experience it may be gaining in a new high-profile successor – reported to be outgoing U.S. Secretary of Agriculture Tom Vilsack. No official announcement had been made as of Progressive Dairyman's enewsletter deadline.

The U.S. Trade Representative’s (USTR) office will also see a new chief negotiator. Robert Lighthizer, a deputy U.S. trade representative in the Reagan administration, was nominated by Trump to serve as USTR. That appointment, along with Trump’s campaign pledges, lead many to believe the U.S. will move away from multi-lateral trade deals previously endorsed by NMPF and USDEC, and toward country-to-country negotiations.

In an earlier statement released by Mulhern and Matt McKnight, USDEC senior vice president of market access, regulatory and industry affairs, they expressed hope the Trump administration would build on the success of current agreements.

“The U.S. dairy industry, like most other agricultural sectors across America, has significantly benefited from the agricultural provisions of prior U.S. free trade agreements,” Mulhern and McNight said. ”At the same time, however, we face a growing wave of nontariff barriers that threaten to impede overseas sales. Our North American Free Trade Agreement (NAFTA) partners epitomize both sides of that story: Our dairy agreement with Mexico has created an export market worth well over $1 billion a year, while on the other side of the border Canada has at every opportunity decided to flout its dairy trade commitments to the U.S.

“A focus on preserving and growing what is working well, while cracking down further on what is not, will help to expand global markets for U.S. dairy farmers and the companies that turn their milk into nutritious dairy products shipped all over the world,” they continued. “Given that every $1 billion in U.S. dairy exports translates into over 23,000 jobs in the dairy sector and related industries, expanding dairy sales abroad is a strong job-creation strategy.”

Dairy exports continue resurgence

The latest USDA and USDEC data shows a steady resurgence in U.S. dairy exports, according to USDEC’s Alan Levitt. November 2016 dairy exports posted an 18-month high in volume and a 17-month high in value. Compared to a year earlier, November export volumes were up across most major product categories, with milk powder and whey products standing out.

Cheese exports were up 10 percent from November 2015, turning in the best month since March 2016. Strongest growth was to Mexico and South Korea.

U.S. butterfat exports were more than double year-ago volume, with more than half of shipments going to Canada.

Overall, November 2016 dairy product export value was estimated at $429 million.

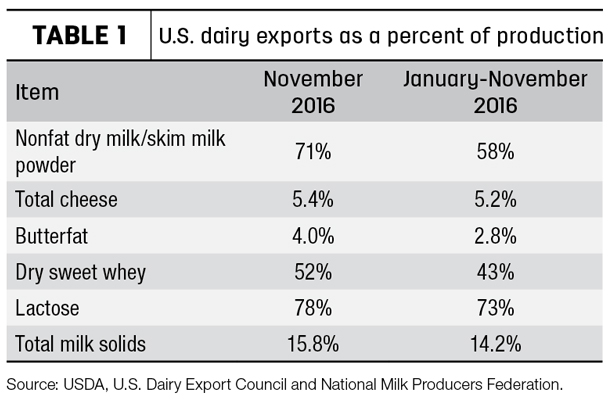

On a total milk solids basis, U.S. exports were equivalent to 15.8 percent of U.S. milk production in November (Table 1), bringing the year-to-date average to 14.2 percent. Imports were equivalent to 4 percent of production.

U.S. ag trade surplus hits 24-month high

The Trump administration may do well to consider agriculture when addressing trade policy changes. The November 2016 U.S. agricultural trade balance posted its second-largest monthly surplus since November 2014.

Monthly ag exports were valued at $14.3 billion, also the highest since November 2014. Imports were valued at $9.7 billion, resulting in a U.S. ag trade surplus of more than $4.56 billion.

That compares with an overall U.S. November 2016 trade deficit of $45.2 billion for all goods and services.

Dairy replacement cattle sales also jump

On the dairy replacement export side of the market, the news continues to brighten. November female dairy cattle exports totaled 2,157 head, valued at nearly $4.1 million. Both volume and value were the highest monthly totals since July 2015. With concerns over potential border tightening under the Trump administration, Mexico imported 1,803 head in November, 84 percent of the total.

Tony Clayton, Clayton Agri-Marketing Inc., Jefferson City, Missouri, said his company has confirmed shipments of more than 4,000 dairy replacement cattle during the first quarter of 2017, and anticipates additional shipments to be announced soon.

Gerardo Quaassdorff, DVM, sales and management consultant with TK Exports Inc., TKE Agri-Tech Services Inc., Boston, Virginia, said demand seems to be growing worldwide, although other countries (Uruguay and Chile) are also competing to fill dairy cattle orders. Smaller orders create economical shipping challenges, with not enough numbers to move by ship, but movement by plane too cost prohibitive. Negotiations over health requirements are ongoing with Algeria and China, which could create additional markets.

November exports of dairy embryos, at 1,112, nearly doubled the October total, posting the second-highest total of the year. The embryos were valued at $1.1 million. China purchased nearly half the monthly total.

Alfalfa exports increase

At 228,226 metric tons (MT), November alfalfa hay exports were the second-highest monthly total of the year, marking the seventh consecutive month above 200,000 MT. Those exports were valued at $68.3 million. ![]()

-

Dave Natzke

- Editor

- Progressive Dairyman

- Email Dave Natzke