January DMC margin: $10.72 per cwt

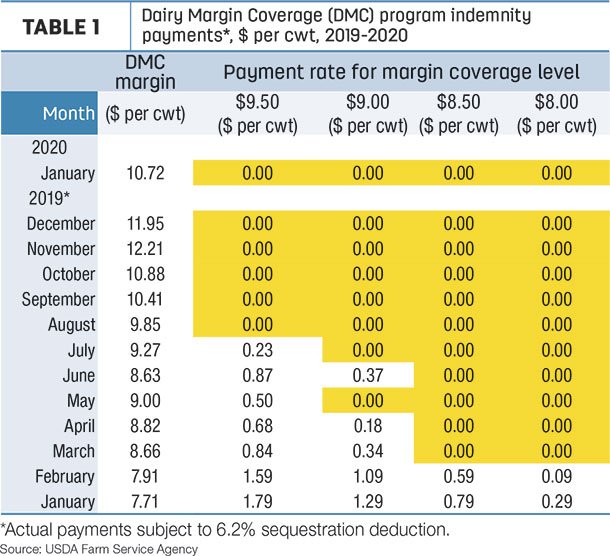

The USDA released its latest Ag Prices report on Feb. 28, including factors used to calculate DMC margins and payments. Using those prices, the January DMC margin is estimated at $10.72 per hundredweight (cwt), down $1.23 per cwt from December but above the highest insurable margin of $9.50 per cwt (Table 1). There were no DMC program indemnity payments at any level of coverage for a sixth consecutive month.

January milk price falls

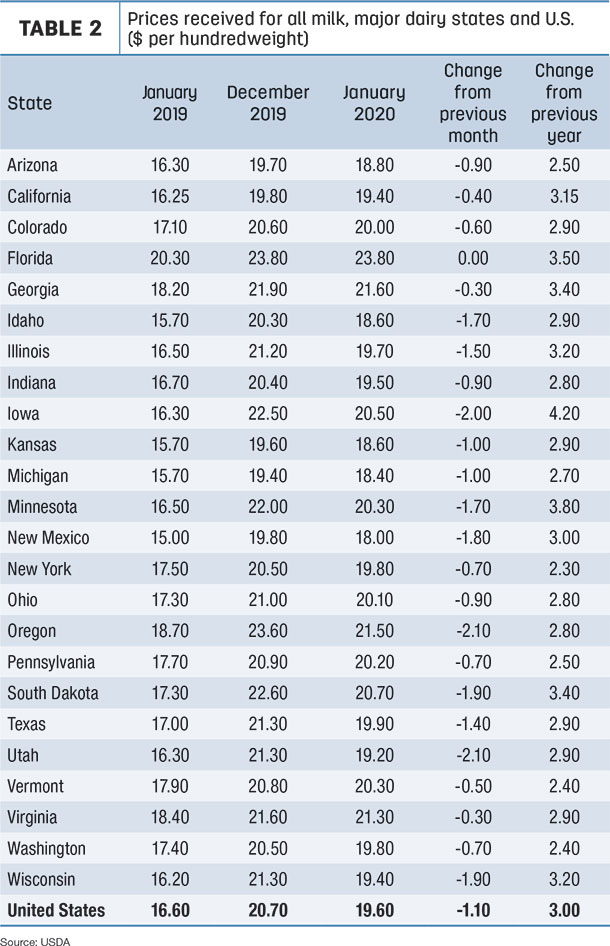

The January 2020 U.S. average milk price fell $1.10 per cwt from December to $19.60 per cwt. The average was $3 higher than January 2019 (Table 2).

Compared to a month earlier, prices fell in all major dairy states except Florida, which held steady. Largest declines ($1.70-$2.10 per cwt) were in Idaho, Iowa, Minnesota, New Mexico, Oregon, South Dakota, Utah and Wisconsin.

Prices remained well above year-earlier levels in all major dairy states, led by Iowa, up $4.20 per cwt from January 2019. Producers in eight other states saw year-over-year prices up at least $3 per cwt.

The highest milk prices for January 2020 were in Florida ($23.80), Georgia ($21.60) and Oregon ($21.50). Monthly lows, all under $19 per cwt, were in Arizona, Idaho, Kansas, Michigan and New Mexico.

Feed costs slightly higher

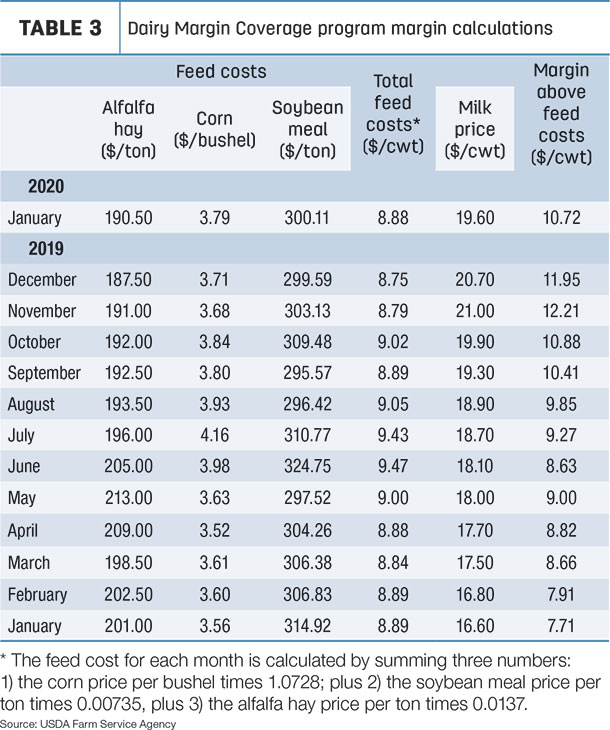

U.S. average corn, soybean meal and alfalfa hay prices were all somewhat higher in January, causing income margins to shrink.

The January average alfalfa hay price used in the DMC calculations was $190.50 per ton, up $3 from December. Soybean meal averaged $300.11 per ton in January, up 52 cents per ton from December; corn prices averaged $3.79 per bushel, up 9 cents.

That yielded an average DMC total feed cost of $8.88 per cwt of milk sold, up 13 cents from December (Table 3).

Outlook cloudy

The DMC Decision Tool estimates margin ranges and payment probabilities based on current milk and feed futures prices. While still forecast to top $10 per cwt in February (the February margin is announced on March 31), the outlook gets cloudier after that, potentially dipping closer to $9 in May and June.

As of the close of trading on March 2, DMC margins had about a 65% probability of falling below the top insurable level of $9.50 per cwt between April-June 2020, a 45% chance of falling below $9 per cwt and a 30% chance of falling to $8.50 per cwt.

One positive in the event there are DMC payments later this year: It appears budget sequestration deductions will not factor into payments. ![]()

-

Dave Natzke

- Editor

- Progressive Dairy

- Email Dave Natzke