While Dairy Margin Coverage program sign-up for 2021 doesn’t begin until October, other options are available. Dairy Revenue Protection (Dairy-RP) and Livestock Gross Margin for Dairy (LGM-Dairy) are both crop insurance products supported and underwritten by the USDA’s Risk Management Agency (RMA). Their coverage is different, however.

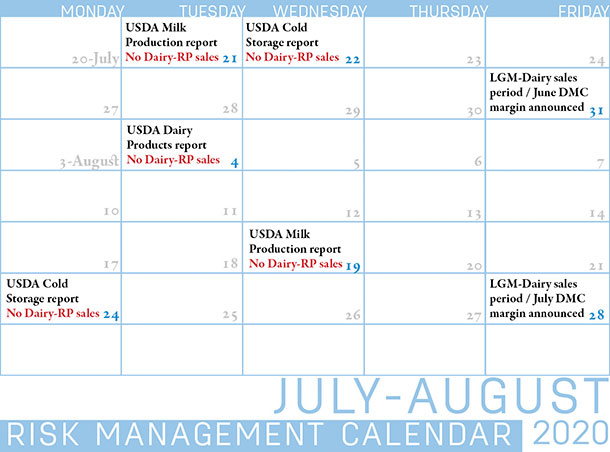

Click here or on the calendar above to view it at full size in a new window.

Dairy-RP

Dairy-RP is a revenue protection product, so it involves price and yield. Price times yield equals revenue. If you have crop insurance on corn, for example, you will be familiar with this concept.

If the milk prices fall below the deductible and the milk per cow number does not change, you will get a payout. It is similar to a milk “put.”

In Dairy-RP, the yield is milk per cow, not quarterly production. The beginning amount of milk per cow (used to purchase coverage) is estimated for each state or region and is based on historical data, including the way production in that state or region has responded to past events.

The ending value for milk per cow is published by the USDA’s National Ag Statistics Service (NASS) in the monthly Milk Production report (usually released around the 20th of each month). The July report, estimating June milk production, was released July 21.

Read: June Milk Production report: Cow numbers down a third straight month.

The NASS production data is compared to the beginning milk per cow that was declared when the Dairy-RP coverage was purchased. That comparison, either positive or negative, is then used to generate potential indemnities. If milk per cow goes up more than anticipated, it will reduce the indemnity payout. If it goes down, it will increase the payout.

Example: Let’s look at a producer who purchases 1 million pounds of Dairy-RP coverage at the 95% level and a 1.0 protection factor when milk was at $18 per hundredweight (cwt). If the milk price went lower to $16 per cwt, the payout would be $11,000 if the milk-per-cow number did not change. If the milk per cow number goes up 1%, the payout would be $9,400 (a decline of $1,600). If milk per cow goes up 2%, the payout would be $7,800 (a drop of $3,200). If the milk per cow number is lower by 1% and 2%, these payouts would increase by $1,600 and $3,200, respectively.

Dairy-RP coverage is generally available for milk produced four or five quarters out in the future. The next available quarter is the fourth quarter (October, November and December) of 2020. The last day to purchase coverage for that quarter is Sept. 15, 2020. Currently, coverage for the first three quarters of 2021 is also available.

Dairy-RP is available every day except holidays and days when the USDA releases reports that could impact markets (see calendar) and on days when applicable futures market moves limit-up or limit-down.

In July, the RMA made improvements to Dairy-RP policies, increasing the declared protein and butterfat ranges and making Grade B milk insurable. However, a plan to make component pricing for Class IV milk was delayed.

LGM-Dairy

LGM-Dairy also functions like a milk put. However, LGM-Dairy adds feed price protection, creating a margin product: Milk price minus feed price equals margin.

If milk prices go down and feed prices go up, you will get an indemnity if it exceeds your deductible. You can use a small amount of feed or a large amount of feed, depending on what risk you see in the future. If feed prices go up, your indemnity payout will increase. If feed prices go down, your indemnity will decline.

Example: Let’s analyze a producer who purchased LGM-Dairy when milk prices were $18 per cwt, with a deductible of 90 cents per cwt (similar to Dairy-RP’s 95% coverage), using the smallest amount of feed possible. For 1 million pounds of milk, that would be 36.6 tons, or 1,307 bushels of corn and 8.1 tons of soybean meal. If corn and meal prices do not change, there would be an indemnity payment of $11,000. If corn prices dropped by 50 cents per bushel, the indemnity would be reduced by $654. A $50 per ton drop in the soybean meal price would reduce the payout by $405 per ton. If corn and meal prices moved higher by 50 cents per bushel and $50 per ton, respectively, the payout would increase by $654 and $405, respectively.

The next scheduled sales period for LGM-Dairy is July 31. Coverage is available for up to 10 months, so you will be able to buy coverage for September 2020 through June 2021. You need to select coverage in two-month increments to get the premium subsidy.

USDA’s RMA continues to improve the LGM insurance products. Starting in July, premiums for LGM-Cattle and LGM-Swine policies are subsidized at similar rates as LGM-Dairy. We expect additional changes for LGM-Dairy, LGM-Swine and LGM-Cattle yet this year.

You cannot use LGM-Dairy and Dairy-RP in the same quarter. In some states, premium costs for LGM-Dairy are cheaper than Dairy-RP.

Dairy-RP and LGM-Dairy coverage is available through a licensed and trained crop insurance agent. ![]()

Ron Mortensen with Dairy Gross Margin LLC provides monthly updates on Dairy-RP and LGM-Dairy coverage for the readers of Progressive Dairy.

-

Ron Mortensen

- Co-Owner

- Dairy Gross Margin LLC