My oldest daughter is only 10. However, much like her father, she has a very inquisitive spirit. She likes to know how things work. She asks a lot of questions. This includes questions about her future and what she will be doing and what life might be like when she is older.

Included in these discussions have been conversations regarding driving. She has estimated that in just four-and-a-half years she will have her permit and that it would be wise if we began searching for a vehicle.

As a father, this is a scary mind trip to take but has opened up some teachable moments to begin talking through driving habits, the rules of the road and how cars work. As a bit of a “gear-head,” I have found myself enjoying these conversations (despite being faced with the reality that my little girl isn’t little any more).

I recall one particular conversation when she was asking about the rear-view mirror. She was confused as to why we must always look forward, left and right when driving forward but could rely solely on a mirror when moving backward … sound logic for a 10-year-old.

I, of course, assured her that she could also look backward when moving in reverse, but the mirror provided the driver with a bit more comfort in the process.

She then asked whether it would be possible to bring all of the forward angles of view together in a mirror that would give us greater comfort when driving forward … rather than having to pay so much attention to all of the things going on around us. It was a bizarre question at the time, but later it got me to thinking about the parallels in our conversation to how many choose to manage risk and market commodities.

For all of 2014, producers were able to enjoy milk prices never before seen … month after month after month. The opportunity was greater than ever before realized and more than anyone thought possible. It afforded an opportunity for economic healing on many a dairy farm. It returned equity that had been washed out in 2009. It brought replacement, expansion and new investment back to the farm. It was a great year.

From a marketing perspective, many producers enjoyed the higher prices on open milk and saw marketing losses on sold volumes. This was acceptable to many – but frustrating to others. Enter 2015. As many went about planning the 2015 year, they decided a change was necessary. For a few, marketing and risk management was abandoned altogether. In the case of some, a change in strategy to something more fitting of what worked in 2014 was the answer.

However, the underlying theme for each group was that they were committed to do in this year what they thought they should have done last year. It is very much like trying to drive forward with only a rear-view mirror, comfortably observing what happened in the past without giving notice to what is happening out front or to the left or right.

It is a pitfall repeated by many year after year after year. It is an easy trap to fall into because, let’s face it, we remember our most recent victories and failures with much more clarity than those that took place years ago. It is a trap that can catch us when times are good and when times are not so good.

Similarly, some will avoid taking action all together. They avoid taking action to defend themselves from lower prices after experiencing higher prices because they are comfortable, question the risk or fear missing higher prices that may still come (seen often with milk sales).

It is also common to see people avoid taking action to defend themselves from higher prices after experiencing lower prices. This happens for the same relative reasons. We get comfortable. We enjoy the trend and become lackadaisical about the fact that markets are constantly changing and completely unpredictable.

Managing risk or making marketing decisions requires us to move in a direction counter to what is defined as today’s norm. It requires us to accept change and prepare our business to embrace it. It is often uncomfortable. However, it remains the right thing to do.

Because, as we have witnessed, falling into the trap of doing what worked last year or, out of our comfort or fear, deciding to do nothing at all leaves us with a result very different from our initial intention. And it is even more frustrating than not “picking the market right.” It is a vicious circle of chasing “what might happen” with a mindset of “what did happen” only to get “what I didn’t think could happen.”

Marketing and price risk management is about looking forward, left and right, planning for what could happen and accepting what does happen. Regardless of what happens in 2015, it is important to recognize that it is not 2014. Further, 2014 was not 2013, which was not 2012, which was not 2011, etc.

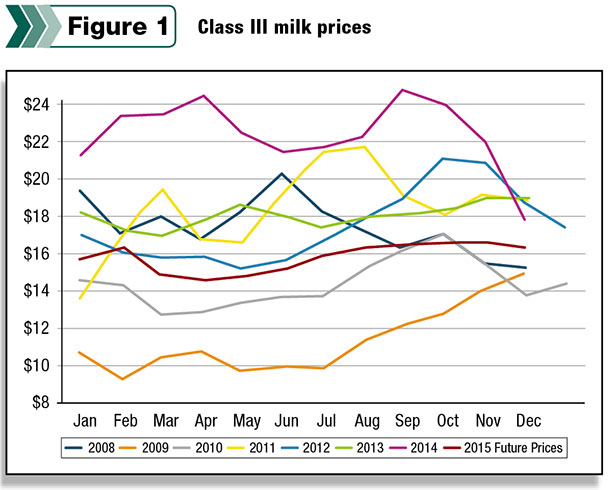

A quick look at a chart mapping out recent years’ prices allows us to quickly see that there are no two years alike, especially two years back to back (Figure 1). We can make some general observations. It is easy to deduce that annual highs are often made in the fall. It is easy to observe that the lows are often made between March and June.

However, we cannot judge the absolute opportunity in a price by comparing it to the year prior. As witnessed in the figure, there can be extreme changes in price from one year to the next. Further, we cannot address that price with the same strategy from one year to the next. Each year must be judged separately. Each year must be evaluated relative to its own set of circumstances.

This may seem like a simple concept. However, it is a stumbling block many have a hard time getting past. So here is a simple reality we must face. Markets change. Markets go up … and markets go down … and vice versa.Markets can move higher than most think they should and lower than many think they could.

They can follow patterns, but those patterns do not create absolutes. No two years are alike; however, history helps us gauge the reaction of buyers and sellers in different environments and helps us understand opportunity relative to its related risk.

In order to embrace this reality and properly address it, we cannot be rigid. We must be flexible. One of the best ways I have discovered to do this is with options. In coming articles, we will walk through how these work and why they work in your marketing/risk management efforts.

We will explore how they complement your buying and selling activities and what they add to your business. For now, we must keep looking forward, left and right to recognize the opportunities and risks present in our business.

If you find that you have tried to address 2015 with the plan you wish you had employed in 2014, please contact your risk management adviser to start mapping out a change of course. In the meantime, eyes to the windshield.PD

For nearly 20 years, Mike North has educated and guided dairymen and farmers in their efforts to manage commodity price risk.

Mike North

President

Commodity Risk Management Group