- U.S. average replacement cow prices decline

- Cull cow prices dip in September

- Canada to boost 2022 producer milk prices 8.4%

- Butter, cheese, powder prices jump on GDT

- July 2021 mailbox, all-milk price spread steady

- Input cost concerns continue to rise

- USDA calls for cheese, yogurt and butter

U.S. average replacement cow prices decline

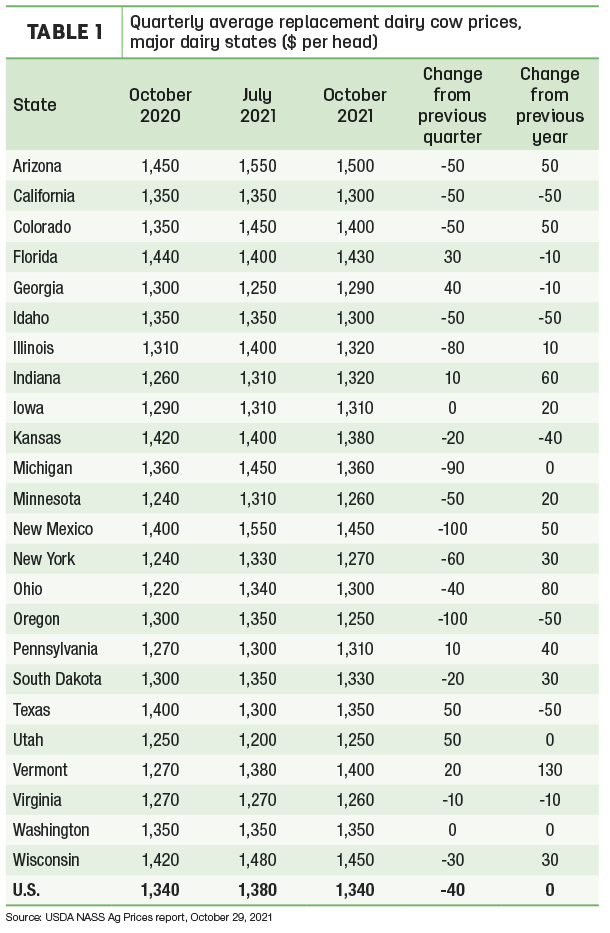

With stubbornly tight milk income margins and cow numbers in the nation’s dairy herd decreasing this fall, the U.S. average prices for dairy replacement cows also weakened slightly in October, according to latest estimates from the USDA.

U.S. replacement dairy cow prices averaged $1,340 per head in October 2021, down $40 from revised estimates for July 2021 and unchanged from October 2020. The U.S. average price was still 37% per head less than the latest high of $2,120 per head in October 2014.

The USDA estimates are based on quarterly surveys (January, April, July and October) of dairy farmers in 24 major dairy states, as well as an annual survey (February) in all states. The prices reflect those paid or received for cows that have had at least one calf and are sold for replacement purposes, not as cull cows. The report does not summarize auction market prices.

When overlayed on USDA Milk Production reports, changes in average replacement prices were weakly correlated with trends in cow numbers. The major states saw dairy cow numbers drop by about 22,000 between August and September (the latest estimates available), with largest declines in New Mexico and Washington. As of September, U.S. cow numbers were down 85,000 head since peaking in May 2021 and were the lowest since December 2020.

Compared to the previous quarter, average replacement cow prices were down in 15 of 24 major dairy states tracked by the USDA (Table 1). Decreases of about $100 per head were reported for New Mexico and Oregon. Countering that, average prices were modestly higher in seven states, led by Texas and Utah, up $50 per head.

Cull cow prices dip in September

After hitting a four-year high in August, cull cow prices softened a bit in September, according to USDA’s latest Ag Prices report.

U.S. prices received for cull cows (beef and dairy, combined) averaged $72.90 per hundredweight (cwt) during the month, down about $3.10 from August. Despite the decline, the 2021 average is still $6.30 more than a year earlier and the highest for the month of September since 2016.

Through Oct. 16, weekly dairy cull cow slaughter at federally inspected plants had surpassed comparable weeks a year earlier for 19 consecutive weeks, reaching nearly 2.52 million head. During that 19-week period, dairy cow slaughter surpassed year-earlier totals by about 53,600 head.

Canada to boost 2022 producer milk prices 8.4%

The Canadian Dairy Commission (CDC) will increase the milk price paid to dairy producers in 2022 by 8.4%. The $6.31 per hectoliter (6 cent per liter) increase, announced Oct. 29, equals about $2.64 ($ Canadian) or $2.14 ($ U.S.) per cwt.

From January through July 2021, the average blend price was $79.10 per hectoliter in the Western Milk Pool and $77.29 per hectoliter in the P5 provinces ($ Canadian), or $28.93 and $28.27 ($ U.S.) per cwt, respectively.

Once approved by provincial authorities in December, the new farm milk prices will become official on Feb. 1, 2022. The specific increase for milk used to make dairy products for the retail and restaurant sectors will depend on the butterfat and solids nonfat content of the manufactured product.

The action follows an annual review of milk prices and various other costs used in administering Canada’s supply management system. Each year, the CDC, in collaboration with the provinces, undertakes a national study of the cost of producing milk at the farm. The CDC also holds consultations on milk prices with dairy producers, processors, restaurateurs and consumers.

According to the CDC, the increase in producers’ prices will partially offset input costs driven higher in part by the COVID-19 pandemic, especially feed, energy and fertilizer costs.

Addressing increasing costs for processors, the CDC reduced butter storage fees by 33%, from $0.0206 to $0.0137 per kilogram, or about one-half cents per pound ($ Canadian). Reflecting higher packaging, labor and transportation costs, the support price for butter used by the CDC in its storage programs will increase from $8.7149 to $9.7923 per kilogram on Feb. 1, 2022, an increase of 12.4%.

Butter, cheese, powder prices jump on GDT

Most Global Dairy Trade (GDT) dairy product prices were higher in the latest auction held Nov. 2, pushing the overall price index up 4.3% and near a seven-year high. Among individual product categories:

- Skim milk powder was up 6.6% to $3,627 per metric ton (MT, or about 2,205 pounds).

- Whole milk powder was up 2.7% to $3,921 per MT.

- Butter was up 4.7% to $5,350 per MT.

- Cheddar cheese was up 14.1% to $5,508 per MT.

- Anhydrous milkfat was up 4.2% to $6,384 per MT.

The next GDT auction is Nov. 16.

July 2021 mailbox, all-milk price spread steady

With Federal Milk Marketing Order (FMMO) producer price differentials (PPDs) mostly positive in July, the differences in two regular milk prices announced by USDA held steady.

The spread between the July average “all-milk” and “mailbox” prices was about 87 cents per cwt during the month, just 2 cents more than June.

The all-milk price is the estimated gross milk price received by dairy producers and includes quality, quantity and other premiums but does not include marketing costs and other deductions.

The mailbox price is the estimated net price received by producers for milk, including all payments received for milk sold, and deducting costs associated with marketing.

The price announcements reflect similar – but not exactly the same – geographic areas. The USDA National Ag Statistics Service (NASS) reports monthly average all-milk prices for the 24 major dairy states. The mailbox prices are reported by the USDA’s Agricultural Marketing Service (AMS) and covers selected FMMO marketing areas. The AMS announcement of mailbox prices generally lag all-milk prices by a couple of months.

Through the first seven months of 2021, the USDA’s mailbox prices averaged $16.87 per cwt, about $1.12 per cwt less than average all-milk price of $17.99 per cwt for the same months.

The difference in the two announced prices can create challenges to dairy risk management, since indemnity payments under Dairy Margin Coverage (DMC), Dairy Revenue Protection (Dairy-RP) and Livestock Gross Margin for Dairy (LGM-Dairy) programs are all based on the all-milk price, before any marketing cost deductions.

Input cost concerns continue to rise

Agricultural producer sentiments regarding short- and long-term financial positions continue to be chilled by the prospect of higher input costs, based on results of the monthly Purdue University/CME Group Ag Economy Barometer survey.

“Recent weakness in farmer sentiment appears to be driven by a wide variety of issues, with concerns about input price rises topping the list,” said James Mintert, the barometer’s principal investigator and director of Purdue University’s Center for Commercial Agriculture. “Rapid run-ups in input prices, especially fertilizer for crop production, are giving rise to concerns among producers about their operating margins weakening. Livestock producers are also concerned about a cost-price squeeze, especially in the pork and dairy sectors.”

Among highlights in the most recent survey:

- Over half (51%) of producers in the survey said they expect input prices to rise 8% or more in the coming year, and one-third of producers said they expect those prices to rise by 12% or more. Leading the expected rise in input costs are fertilizer, seed, pesticides, machinery repairs and ownership costs.

- Rising input costs are starting to have a dampening effect on expectations for farmland cash rental rates, with a smaller percentage of surveyed producers expecting farmland cash rents to rise next year. Despite these concerns, producers remain bullish on farmland values.

- Nearly four of 10 respondents said their farm machinery purchase intentions were impacted by low inventories.

- Compared to a month earlier, the percentage of producers planning to increase building and grain bin construction declined.

- There’s been little change in producers’ awareness of on-farm carbon capture opportunities.

The Ag Economy Barometer provides a monthly snapshot of farmer sentiment regarding the state of the agricultural economy. The survey collects responses from 400 producers whose annual market value of production is equal to or exceeds $500,000. Minimum targets by enterprise are as follows: 53% corn/soybeans, 14% wheat, 3% cotton, 19% beef cattle, 5% dairy and 6% hogs. Latest survey results, released Oct. 5, reflect ag producer outlooks as of Oct. 18-22.

USDA calls for cheese, yogurt and butter

The USDA is accepting bids for dairy products for distribution through domestic feeding and nutrition programs. Latest bid invitations seek:

- 302,400 pounds of shredded cheddar cheese, 112,320 pounds of sliced cheddar cheese, 116,400 pounds of shredded pepper jack cheese and 769,400 pounds of flavored yogurt for delivery at various locations throughout the U.S. during the first quarter of 2022 – bids close Nov. 11.

- 123,120 pounds of butter (print, salted, in 1-pound packages) for distribution in Idaho during the first quarter of 2022 – bids are due by Nov. 17.

-

Dave Natzke

- Editor

- Progressive Dairy

- Email Dave Natzke