World dairy supplies expanded the last five years on the assumption that uninterrupted China growth was almost a sure thing, but that’s no longer the case.

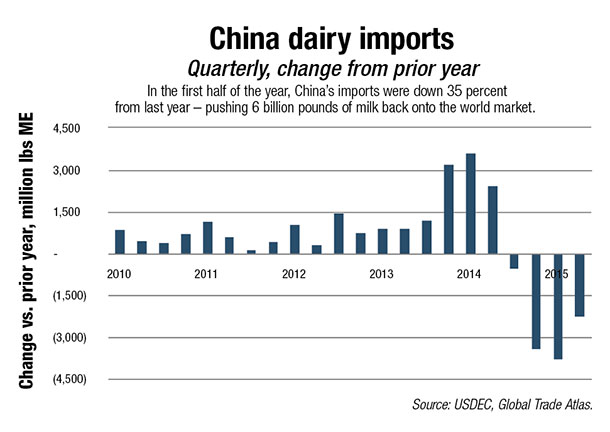

In the first half of the year, China dairy imports on a milk-equivalent basis were down 35 percent from last year, led by a 56 percent drop-off in whole milk powder imports. That pushed 6 billion pounds of milk back onto the world market.

From 2008-2014, China accounted for about 40 percent of the growth in global dairy trade. But with widening concerns about the health of China’s economy, dairy imports may have shifted into a lower gear.

In addition, domestic milk production is estimated to be up about 4 percent in the first half of his year (another 1.4 billion pounds more milk), and this excess milk is being diverted into powder, keeping inventories high. As a result, China has little need for substantial new imports.

In addition, domestic milk production is estimated to be up about 4 percent in the first half of his year (another 1.4 billion pounds more milk), and this excess milk is being diverted into powder, keeping inventories high. As a result, China has little need for substantial new imports.

This has a couple of implications.

First, if China’s ongoing level of imports goes back to, say, what it bought in 2012, the world will need about 8 billion pounds less milk than it did in 2014. At some point, suppliers need to respond to that.

Second, it affects product mix. New Zealand is pushing production toward skim milk powder and cheese to offset the slowdown in the China market for whole milk powder. That’s turned up the volume on competition for the U.S. in key products and markets.

Second, it affects product mix. New Zealand is pushing production toward skim milk powder and cheese to offset the slowdown in the China market for whole milk powder. That’s turned up the volume on competition for the U.S. in key products and markets.

In the long run, China will remain the world’s largest dairy importer – mostly because it’s still less expensive to import milk powder than produce milk in China. But the bubble of China imports in 2013-2014 is causing an adjustment in world milk production and dairy prices that will last well into 2016. PD

U.S. exports pull back in first half of 2015

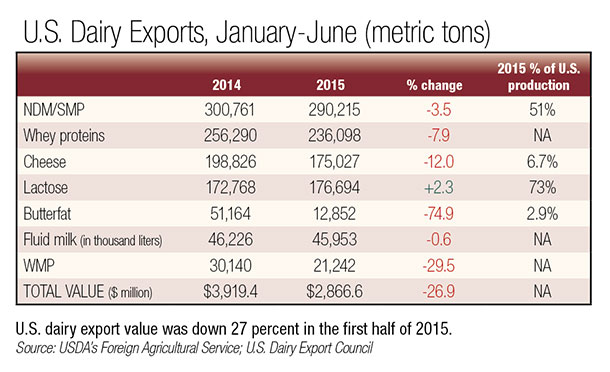

In the first half of 2015, U.S. suppliers shipped 960,984 tons of milk powders, cheese, butterfat, whey and lactose, down 11 percent from last year’s record pace. Total overseas sales were valued at $2.87 billion, down 27 percent.

U.S. suppliers moved milk powder aggressively despite soft world-market conditions. Exports of nonfat dry milk/skim milk powder were 290,515 tons, just 4 percent lower than last year. Sales to Mexico were 112,974 tons, up 8 percent, but lower shipments to Southeast Asia (-9 percent), China (-33 percent) and the Middle East/North Africa region (-65 percent) pulled the total down.

Cheese exports in the first half were 175,027 tons, down 12 percent from a year ago. Suppliers sold 47,059 tons to Mexico, up 20 percent, and 36,544 tons to South Korea, up 2 percent. However, shipments to Japan and the Middle East/North Africa region trailed year-ago levels.

Cheese exports in the first half were 175,027 tons, down 12 percent from a year ago. Suppliers sold 47,059 tons to Mexico, up 20 percent, and 36,544 tons to South Korea, up 2 percent. However, shipments to Japan and the Middle East/North Africa region trailed year-ago levels.

Dry whey exports were down 20 percent, and whey protein concentrate shipments were off 5 percent, offsetting an 83 percent gain in exports of whey protein isolates.

Butterfat exports were just 12,852 tons, down 75 percent from last year.

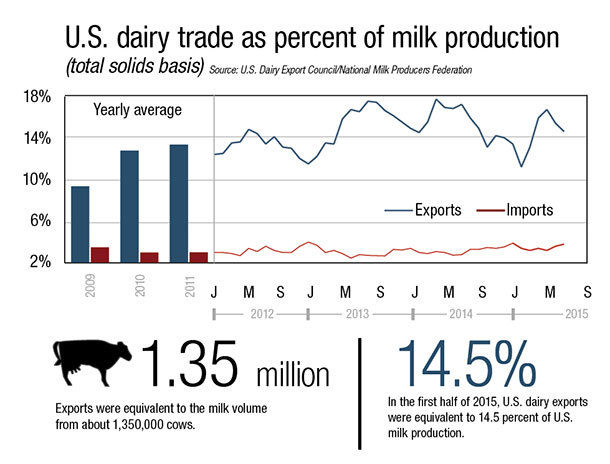

Export sales (on a total milk solids basis) were equivalent to 14.5 percent of U.S. milk solids production in the first half, down from 15.4 percent in 2013-2014. Imports were equivalent to 3.4 percent of production in the first six months.

Marketing events keep suppliers engaged

Even though sales are lower this year, U.S. exporters remain engaged with overseas customers, sowing the seeds for the inevitable market turnaround.

For instance, in April, more than two dozen USDEC members participated in the U.S. Dairy Business Conference in Singapore, a two-day event that attracted prominent food and beverage decision-makers from throughout Southeast Asia. For many buyers, one of the highlights was the talk from five U.S. dairy farmers that put a face on where U.S. milk comes from.

“The conference positioned the U.S. as a high-quality, reliable and preferred source of dairy products to meet the region’s expanding cheese and dairy ingredient needs,” said Vikki Nicholson, USDEC’s senior vice president of global marketing.

“The conference positioned the U.S. as a high-quality, reliable and preferred source of dairy products to meet the region’s expanding cheese and dairy ingredient needs,” said Vikki Nicholson, USDEC’s senior vice president of global marketing.

On a post-conference survey, more than three-quarters of the attendees said they intend to increase or initiate purchases of U.S. dairy products in the next 12 months.

This update is provided by the U.S. Dairy Export Council (USDEC), a non-profit, independent membership organization that represents the global trade interests of U.S. dairy producers, proprietary processors and cooperatives, ingredient suppliers and export traders. Its mission is to enhance U.S. global competitiveness and assist the U.S. industry to increase its global dairy ingredient sales and exports of U.S. dairy products. USDEC programs and activities are supported by the dairy checkoff program, with additional funding from the U.S. Department of Agriculture, Foreign Agricultural Service and from membership dues. For more information, go to the website.