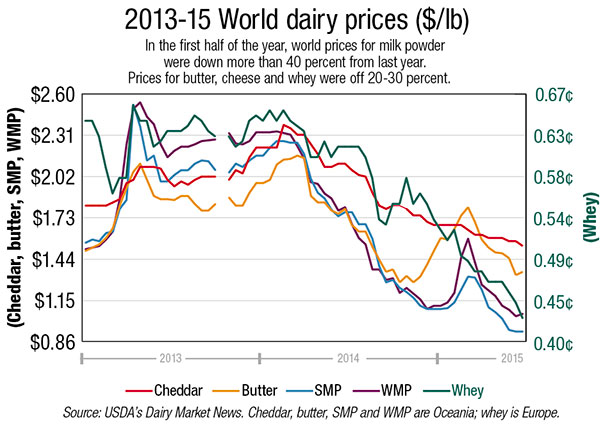

The world dairy markets hit the halfway point of the year in the weakest state in six years. In the first half, Oceania prices for skim milk powder averaged $1.11 per pound, down 48 percent from the first half of 2014. Butter averaged $1.56 per pound (-21 percent) and cheddar averaged $1.62 per pound (-27 percent). Dry whey from Europe averaged just $0.48 per pound (-24 percent).

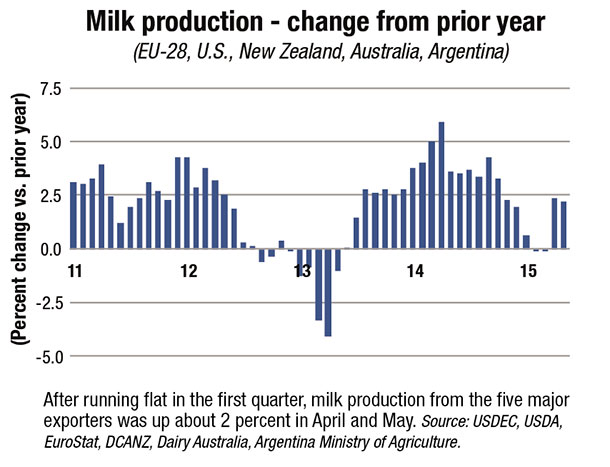

The biggest issue is that milk supply continues to expand, even in the face of lower prices. In the first quarter, output from the five major suppliers (EU-28, U.S., New Zealand, Australia and Argentina) was about flat. But in April and May, production was up about 2 percent with gains from every corner.

Right now, the world doesn’t need that kind of milk production growth. In the first five months of the year, China imports (on a milk-equivalent basis) were down 38 percent from last year. That’s the equivalent of pushing back about 507,000 tons (1.1 billion pounds) of milk per month. Put another way, that’s the same as if milk production from the five major exporters increased by an extra 2.1 percent this year.

Russia is no help either; besides what it’s getting from Belarus, Russia is importing just a fraction of what it bought last year. In late June, Russia extended its ban on EU dairy products for another year.

Other importers, such as Mexico, Southeast Asia and Japan, have bought aggressively, but they can’t make up for what China and Russia are leaving on the table. And with these early purchases, buyers are stocked up pretty well for months to come.

Most observers are coming to the realization that the chance of the markets still rebounding this year is getting slimmer and slimmer. Analysts are pushing out their timetable for any kind of sustained improvement in prices to somewhere in 2016. PD

April exports rise for the third straight month

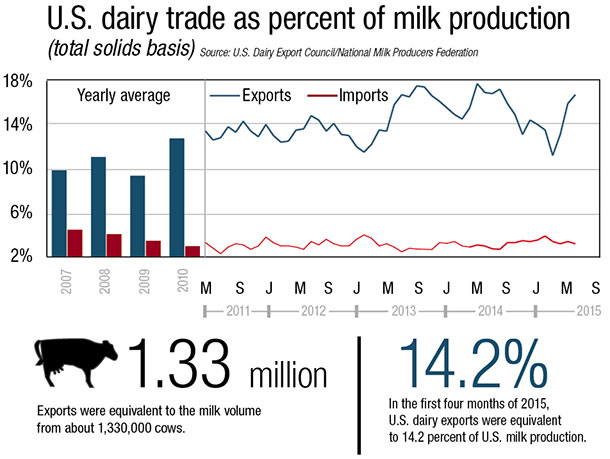

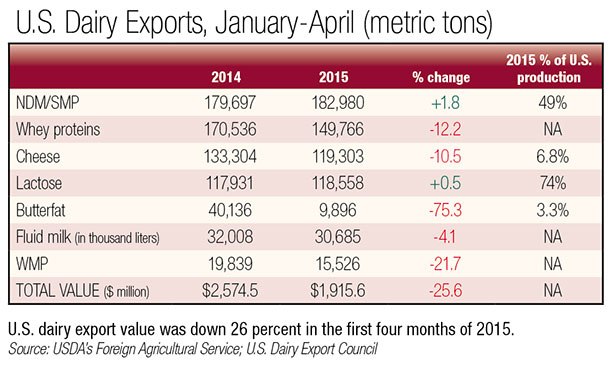

U.S. dairy export volumes in April reached their second-highest level ever (on a daily average basis). U.S. suppliers shipped 185,342 tons of milk powders, cheese, butterfat, whey and lactose in April, and total overseas sales were valued at $535 million. On a daily average basis, compared with March, exports were up 5 percent by volume and 1 percent by value.

U.S. suppliers moved milk powder aggressively despite soft world-market conditions. Shipments of NDM/SMP were 57,400 tons, the third-highest total ever. This volume was up 8 percent from March (daily average) and up 8 percent from last year. Sales to Southeast Asia – led by Vietnam and Indonesia – were 23,713 tons, the most ever and 10 percent more than a year ago.

Cheese exports in April were 31,656 tons, down 6 percent from a year ago. Suppliers sold 8,556 tons to Mexico, up 48 percent from last year. However, shipments to South Korea, Japan and the Middle East/North Africa region trailed year-ago levels.

U.S. exports reached record highs in April in a number of categories: lactose (+39 percent versus last year), whey protein isolate (+150 percent) and fluid milk (+7 percent).

Export sales (on a total milk solids basis) were equivalent to 16.7 percent of U.S. milk solids production in April, the most since June 2014. Imports were equivalent to 3.2 percent of production in April. PD

In a tough year, a number of bright spots

U.S. dairy suppliers realized several bright spots in export sales in the first four months of the year:

- U.S. shipments of NDM/SMP to Mexico were up 41 percent from a year ago. March volume was a record high, and more than 42 percent of all NDM/SMP exports year-to-date went to Mexico.

- U.S. shipments of cheese to South Korea were up 25 percent. Suppliers shipped almost as much to South Korea as they did to Mexico, the number one market.

- Exports of whey protein isolate (WPI) were nearly double year-ago levels. The big buyer was China, which boosted purchases more than fivefold.

- Lactose exports were running at a record pace in the first four months of the year, led by increases in sales to Southeast Asia, China, New Zealand and Mexico.

- Overall sales to South America were up 27 percent by value, led by gains in shipments of NDM/SMP to Peru, Chile and Colombia.

- Exports to the Caribbean were up 5 percent by value, with a sixfold increase in volume of fluid milk.

This update is provided by the U.S. Dairy Export Council (USDEC), a non-profit, independent membership organization that represents the global trade interests of U.S. dairy producers, proprietary processors and cooperatives, ingredient suppliers and export traders. Its mission is to enhance U.S. global competitiveness and assist the U.S. industry to increase its global dairy ingredient sales and exports of U.S. dairy products. USDEC programs and activities are supported by the dairy checkoff program, with additional funding from the U.S. Department of Agriculture, Foreign Agricultural Service and from membership dues. For more information, go to the website.