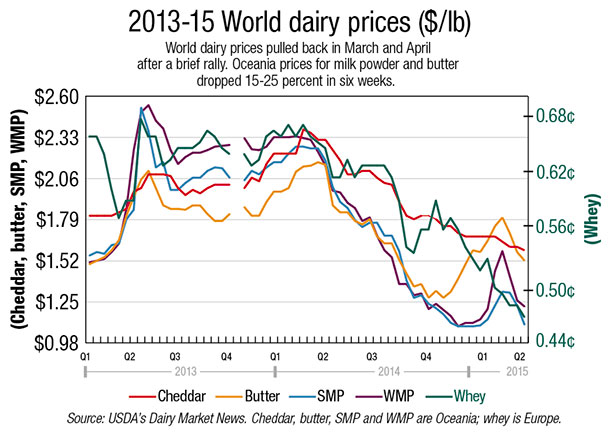

The market tone is weak as the U.S. and Europe head into the spring flush. Milk powder and butter prices dropped 15 to 25 percent from mid-March to late April. Whey prices are down nearly 30 percent in the last 14 months. Whey protein concentrate prices are down close to 40 percent in the last year.

Analysts expect the market to remain soft for the next four to six months at least. A rebalancing is occurring, but it’s a slow process.

The first step is a halt to milk production growth. Output from the top five milk exporters (EU-28, U.S., New Zealand, Australia and Argentina) in the first quarter was unchanged from a year ago after growing 3.7 percent in calendar 2014. So that’s a start.

Opinions are mixed as to whether European supplies will start to expand again now that production quotas are lifted. We think production will decline through the balance of 2015 as farmers grapple with lower profitability.

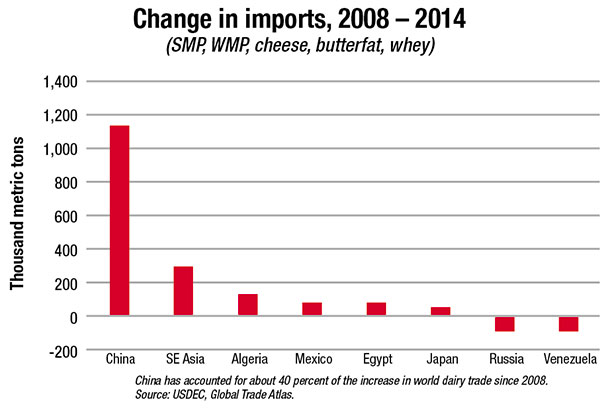

The decline in imports is the other half of the equation. From 2008-2014, China accounted for about 40 percent of the increase in global dairy trade. However, Rabobank forecasts China’s imports could be down 50 to 60 percent in the first half of 2015. The decline in China and Russia’s imports in the first half of the year compared with a year ago will be equivalent to about 5.6 million tons of milk, Rabobank estimates.

Therefore, it will take quite a few more months of flat to declining milk production to bring global supply back into balance.

In the meantime, global buyers are mostly covered for the near term and see no urgency in buying too far ahead in a soft market. European suppliers are pricing aggressively to prevent inventories from building. Oceania suppliers are eager to move current production before the season comes to a close. PD

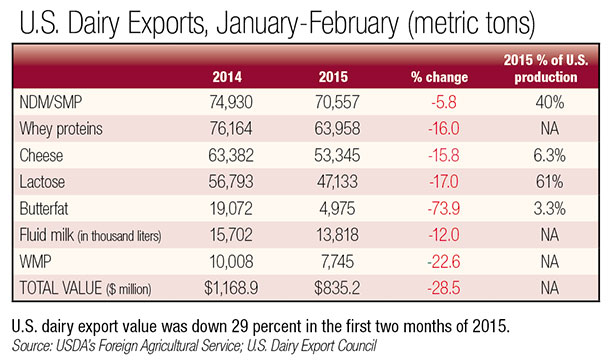

Export numbers lower in early 2015

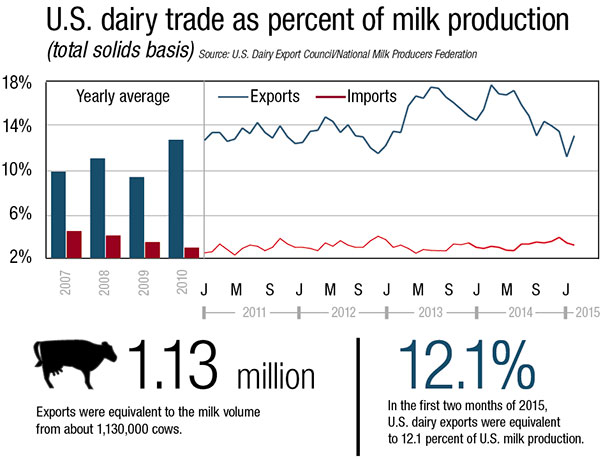

Continuing the trend that began in the middle of 2014, U.S. dairy exports continued to slump in early 2015. In the first two months of the year, exporters shipped 263,452 tons of milk powders, cheese, butterfat, whey and lactose, down 19 percent from the prior year.

Total overseas sales were valued at $835 million, down 29 percent. U.S. exports were equivalent to just 12.1 percent of U.S. milk solids production, down from the 15.4 percent average moved overseas in 2013-2014.

Declines occurred across the board, in almost all products and to almost all major markets. The biggest drop-offs came in sales to the Middle East/North Africa (MENA) region (-68 percent), Southeast Asia (-44 percent) and China (-43 percent). Of the top seven U.S. markets, South Korea (+18 percent) was the only one to post an increase.

Shipments of nonfat dry milk/skim milk powder (NDM/SMP) were 70,557, down 6 percent from a year ago. Exports to Mexico were up 34 percent, but shipments to Southeast Asia, China and MENA were lower.

Cheese exports were down 16 percent in the first two months of the year, with large reductions in sales to MENA.

Butterfat exports have slowed to a crawl. In the first two months, just 4,975 tons were exported, down 74 percent.

Whey exports were off 16 percent in January-February. Whole milk powder and milk protein concentrate also were lower.

EU ready to grow production

European Union (EU-28) milk production quotas came off April 1, leaving dairy farmers to produce as much milk as the market can bear. According to U.S. Dairy Export Council (USDEC) research, EU-28 milk production was forecast to increase by 34 billion pounds from 2013-2020.

However, a good chunk of that increase occurred in 2014. As a result, production is projected to increase about 1 percent per year for the balance of the decade, an additional 3.3 billion pounds of milk per year.

A portion of this increase will be consumed internally, USDEC says, but not all. Therefore, Europe will have more product to sell on the international market.

Export volumes are expected to increase across all product categories, according to USDEC research. European companies are expected to target China for milk powder, infant formula and whey; the Middle East/North Africa region for butterfat, cheese and milk powder; and Japan for cheese. Most of these market sectors are important to U.S. suppliers and add competitive pressure, USDEC says.

The following update is provided by the U.S. Dairy Export Council (USDEC), a non-profit, independent membership organization that represents the global trade interests of U.S. dairy producers, proprietary processors and cooperatives, ingredient suppliers and export traders. Its mission is to enhance U.S. global competitiveness and assist the U.S. industry to increase its global dairy ingredient sales and exports of U.S. dairy products. USDEC programs and activities are supported by the dairy checkoff program, with additional funding from the U.S. Department of Agriculture, Foreign Agricultural Service and from membership dues. For more information, go to the website.