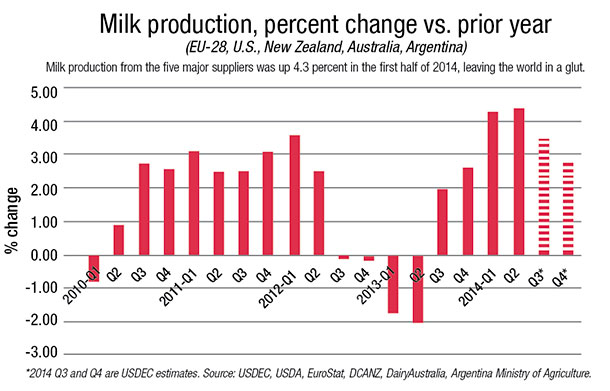

After a year of strong international markets that contributed to record-high prices for U.S. dairy farmers in 2014, trading conditions now appear set for an extended slump. High milk prices and favorable weather led to a strong rebound in global milk production starting mid-2013. Output from the five major suppliers, which was down 1.3 percent in the year ending June 2013, was up 3.2 percent in the year ending June 2014.

Even though processors have cut payout forecasts, farmers continue to push for more milk. In the third quarter, production from these five suppliers was still up about 3.5 percent. Fourth-quarter output is forecast to rise close to 3 percent as well.

Meanwhile, China, which accounts for around 20 percent of world dairy imports, has retreated from its aggressive buying while it tries to clear accumulated inventory. That’s left New Zealand to scramble to move its growing production elsewhere. The Russian ban on imports from the European Union also forces significant volumes of EU product back on the market. Previously, sales to Russia represented about 2 percent of EU milk production.

With all this surplus, world prices have fallen to their lowest levels since 2009. Both SMP and butter from Oceania are trading below $1.30.

Those looking for a bright spot in the market point to three things: With prices at five-year lows, buying activity should improve; we’re entering China’s seasonal buying period; and by the first quarter of 2015, milk production growth in Europe and New Zealand will slow significantly due to stronger comparables and lower milk prices. All these factors will help move supply and demand back toward balance.

However, there’s still so much excess hanging over the market that a turnaround will not be swift. Lower prices are expected to languish well into 2015. PD

U.S. exports slow in second half

U.S. exports were below year-earlier levels in the third quarter, reflecting pricing disadvantages for U.S. suppliers and more competition from Oceania and the EU.

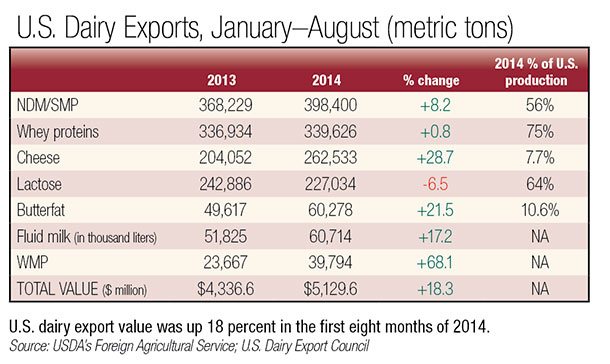

In July and August, U.S. exports of milk powders, cheese, butterfat, whey and lactose were down 8 percent from a year ago. Total value of all exports during the two months was down 1 percent. This is a big change from the first half of the year, when U.S. exports were up 14 percent by volume and 26 percent by value.

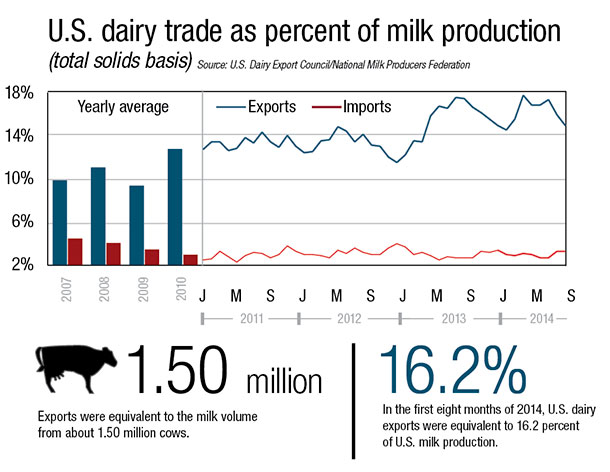

U.S. exports (on a total milk solids basis) were equivalent to 15.4 percent of U.S. milk solids production in July-August, more than a point less than the first-half average. Imports were equivalent to 3.3 percent of production in July-August, up from 2.9 percent in the first half.

On a value basis, sales to Mexico (+14 percent), South Korea (+32 percent) and Japan (+37 percent) registered significant gains in July-August compared with a year ago. But Southeast Asia (-3 percent), China (-19 percent) and the Middle East/North Africa region (-37 percent) saw declines.

Year-to-date, exports of milk powders, cheese and butterfat are tracking above last year.

Exports of NDFM/SMP were up 8 percent in the first eight months of the year, while cheese exports were up 29 percent and butterfat shipments were up 21 percent.

DFA honored for export growth

Dairy Foods magazine selected Dairy Farmers of America, based in Kansas City, Missouri, as its eighth annual “Tom Camerlo Exporter of the Year.” The honor is given to a company that demonstrates leadership in driving global dairy demand and advancing U.S. dairy exports, commits resources to export market development and makes exports a key part of its overall growth strategy.

Dairy Foods recognized DFA for a number of achievements in the last year, including an $85 million investment in a plant in Fallon, Nevada, to supply global whole milk powder markets, an energetic initiative to expand overseas sales of UHT milk in various formats, an updated strategic plan to boost investment in the global marketplace, and active engagement and leadership in the industry.

“The Fallon plant sends the message that we are committed to global markets and customers overseas,” said Jay Waldvogel, DFA’s senior vice president, strategy and international development. “We’re not hopping in when the market is high and hopping out when the market is low. We’re building relationships for the long term.”

This update is provided by the U.S. Dairy Export Council (USDEC), a non-profit, independent membership organization that represents the global trade interests of U.S. dairy producers, proprietary processors and cooperatives, ingredient suppliers and export traders. Its mission is to enhance U.S. global competitiveness and assist the U.S. industry to increase its global dairy ingredient sales and exports of U.S. dairy products. USDEC programs and activities are supported by the dairy checkoff program, with additional funding from the U.S. Department of Agriculture, Foreign Agricultural Service and from membership dues. For more information, go to the website.