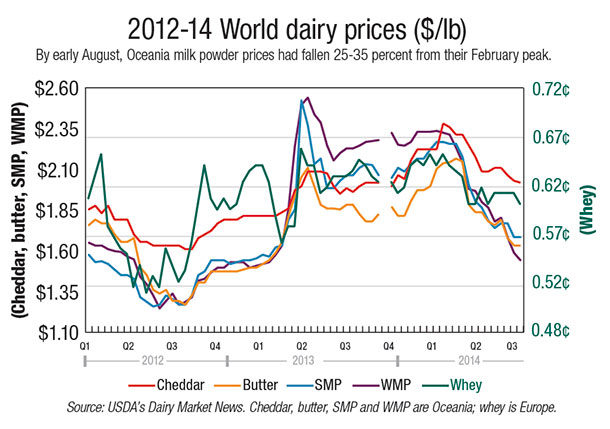

The global dairy markets, suffering from excess production and a halt in orders from China, fell to a two-year low in early August. Over the last six months, milk powder prices have fallen 25 to 35 percent while butter prices are off nearly 25 percent and cheese prices are down about 15 percent.

In the first five months of 2014, milk deliveries in the EU-28 were up 5 percent from a year ago, and production in New Zealand was up 16 percent. In addition, Australia production was 5 percent higher and even U.S. milk supply rebounded in the second quarter with a 1.6 percent gain, the best quarter in two years. All told, this increase in supply has far exceeded the world’s appetite.

Meanwhile, China overcommitted on their purchases in the second half of 2013 and the first few months of 2014. Though volumes continue to move due to prior commitments, new orders slowed to a crawl. In the first half of the year, China imports of milk powder were up 75 percent.

Of course, Chinese consumers aren’t drinking that much more milk, so processors there now have to work through record-high stocks of milk powder, and they’re not interesting in buying more. Inventories aren’t likely to move back into balance until 2015.

Unfortunately, other buyers aren’t picking up the slack, even as prices have come down. Mexico, Japan, Indonesia, Philippines and Singapore all bought less in the early months of 2014.

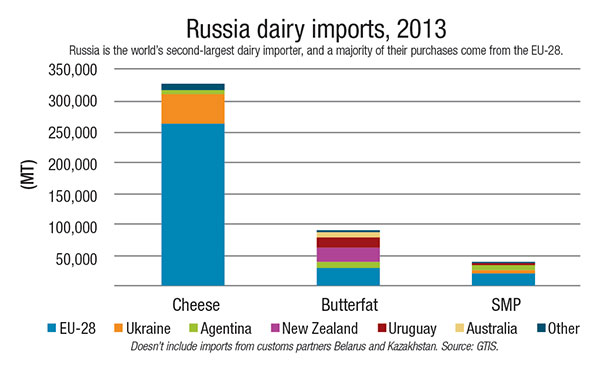

And now that Russia, the world’s second-largest importer (after China), has banned dairy imports from the EU-28, Australia and Ukraine, even more supply could be looking for a home elsewhere throughout the world.

Meanwhile, milk production continues to come on strong. That could keep world prices depressed until well into next year.

U.S. exports continue record pace in first half

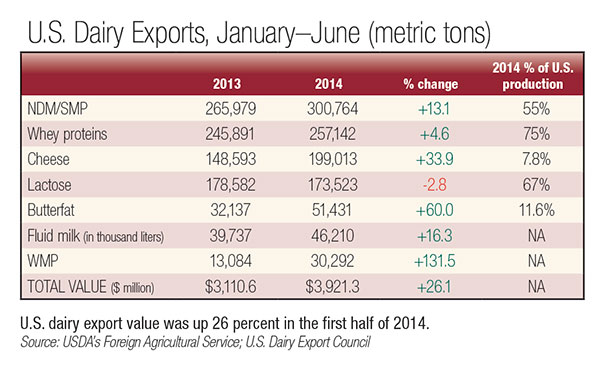

Halfway through 2014, U.S. dairy exports were on pace to reach record volumes for the fifth straight year. U.S. suppliers shipped 1,078,272 tons of milk powders, cheese, butterfat, whey and lactose in the January-June period, up 14 percent from last year. Total value of all exports was $3.92 billion, up 26 percent.

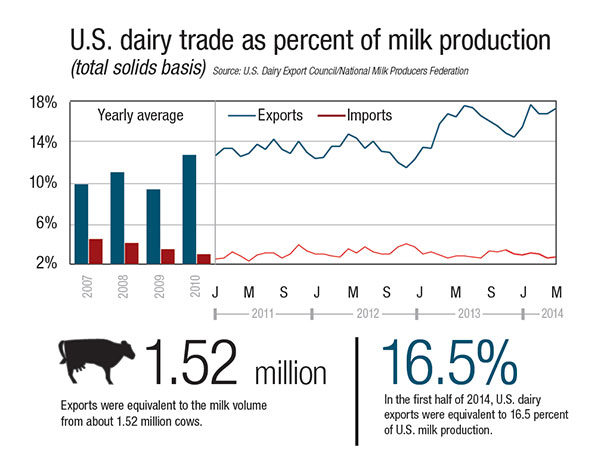

U.S. exports (on a total milk solids basis) were equivalent to 16.5 percent of U.S. milk solids production in January-June. Imports were equivalent to 2.9 percent of production. Nearly two-thirds of U.S. sales went to the top four customers: Mexico (+28 percent versus a year ago), Southeast Asia (+25 percent), Middle East/North Africa (+31 percent) and China (+44 percent).

This year’s gains have been led by milk powders, cheese and butterfat.

Exports of nonfat dry milk/skim milk powder (NDM/SMP) topped 300,000 tons in the first half of the year (+13 percent). In addition, exports of whole milk powder were up 132 percent in the first half, while shipments of milk protein concentrate were 57 percent higher.

Cheese exports in January-June were 199,013 tons, up 34 percent. Shipments to South Korea (+52 percent) and Japan (+92 percent) were up significantly.

Butterfat exports in the first half of 2014 topped 51,000 tons, up 60 percent and the most since the mid-1990s. More than two-thirds of this year’s sales went to the Middle East/North Africa region.

Russia import ban will disrupt

In early August, Russia banned imports of dairy products from the EU-28, U.S., Australia, Canada and Norway. The ban doesn’t affect U.S. dairy trade with Russia, since the Russian market has been closed to U.S. dairy exports since 2010 over a long-standing certification issue. However, the block on EU products is expected to disrupt world dairy markets.

Russia is the world’s second-largest dairy importer – #1 in butter and #2 in cheese. And the largest supplier to that market is the EU. Major supplying countries are the Netherlands, Finland, Germany, Poland and Lithuania.

For the EU, about one-third of its cheese exports and one-fourth of its butter exports go to Russia. These volumes now must go into inventory or be cleared in other overseas markets, an unwelcome development at a time when world dairy markets are already weak.

Other countries, such as Argentina, Uruguay and Belarus, will fill some of Russia’s needs while the ban is in place. But their available supply is just a fraction of what Russia buys. PD

This update is provided by the U.S. Dairy Export Council (USDEC), a non-profit, independent membership organization that represents the global trade interests of U.S. dairy producers, proprietary processors and cooperatives, ingredient suppliers and export traders. Its mission is to enhance U.S. global competitiveness and assist the U.S. industry to increase its global dairy ingredient sales and exports of U.S. dairy products. USDEC programs and activities are supported by the dairy checkoff program, with additional funding from the U.S. Department of Agriculture, Foreign Agricultural Service and from membership dues. For more information, go to the website .