January prices will rise

The advanced January Class I base price is up 54 cents from December to $19.71 per hundredweight (cwt). Adding Class I differentials, the January Class I price will average $22.53 per cwt. January Class II, III and IV milk prices will be announced on Feb. 2.

At the close of Chicago Mercantile Exchange (CME) trading on Jan. 20, the January Class III futures price slipped from earlier peaks to $20.25 per cwt, up $1.89 from December. The January Class IV futures prices settled at $22.80 per cwt, up $2.92 per cwt from December. If those prices hold, the Class III-IV price spread would be $2.32 per cwt, again adding incentives for Federal Milk Marketing Order (FMMO) Class IV depooling.

Longer term, as of Jan. 20, Class III futures prices averaged $20.76 per cwt for all of 2022, with Class IV futures averaging $22.08 per cwt. The spread between the Class III-IV futures prices averages about $1.30 for the year.

December milk estimate released on Jan. 24

The USDA’s monthly Milk Production report, estimating December 2021 production, was released later than usual this month on Jan. 24. Check back with Progressive Dairy for numbers and analysis.

December FMMO review

It took a roller coaster ride to get there, but December 2021 uniform milk prices in FMMOs reached the highest level in more than seven years. December uniform prices increased in a range of 40 cents-$1.06 per cwt across all 11 FMMOs compared to November. The high uniform price for December was $23.97 per cwt in Florida FMMO #6; only one FMMO, the Upper Midwest #30, had a uniform price under $19 per cwt.

December baseline producer price differentials (PPDs) were positive, up 7-62 cents per cwt compared to November and in many cases the largest positive PPDs in two years or more.

Riding the recent wave in milk class prices, more Class III milk was pooled but more Class IV milk wasn’t. December’s class milk prices created a wide, $1.52-per-cwt gap between Class III-Class IV prices, providing incentives for Class IV depooling from FMMO pools.

Read: (December FMMO uniform prices are highest since 2014.)

Also, the Feb. 7 issue of Progressive Dairy takes a look back at 2021 FMMO uniform prices, PPDs and pooling. Watch for Infocus: 2021 was another wild ride.

Dairy margins start year stronger

Dairy margins strengthened sharply to start the year as a continued surge in milk prices combined with a mild correction in the feed markets, boosted projected profitability, according to Commodity & Ingredient Hedging LLC. The milk market caught fire from a perfect storm of declining global production at the same time as demand for dairy products soared.

Feed prices meanwhile have corrected as much-needed rain is forecast for parched areas of Argentina and Southern Brazil, while the USDA’s January World Ag Supply and Demand Estimates (WASDE) report was considered neutral for corn and soybeans.

WASDE projections

The USDA’s WASDE report left milk production forecasts unchanged from last month but raised projected milk prices for 2022. Meanwhile, multiple crop reports point to smaller forage supplies.

The report estimated 2021 milk production at 226.2 billion pounds, up about 1.1% from 2020. Looking into 2022, milk production was forecast at 227.7 billion pounds, which would be up less than 0.7% from the 2021 forecast. For 2022, projected milk prices were: Class III – $19.65 per cwt, Class IV – $20.90 per cwt and all milk – $22.60 per cwt.

Read Weekly Digest: Higher milk prices ahead.

November 2021 butter, powder output lower

While the preliminary November 2021 milk production estimate was down from a year earlier, dairy product production was mixed, according to the USDA’s monthly Dairy Products report.

November 2021 total cheese production was estimated at 1.12 billion pounds, 1.6% more than the same month a year earlier, but 2.9% less than October 2021. November butter production fell sharply, down 9.6% from November 2020 and 3% less than October 2021. Nonfat dry milk and skim milk powder followed suit, declining 15% and 24.5%, respectively, from a year ago.

November U.S. dairy exports strong

After a slower October, November strength in foreign sales of milk powders and cheese pushed the U.S. dairy export market toward a strong finish to 2021, according to the U.S. Dairy Export Council (USDEC). Compared to year-earlier levels, November 2021 export volumes were up 19%, led by gains in shipments of nonfat dry milk/skim milk powder to Southeast Asia and cheese to Mexico, Latin America, South Korea and Australia.

November 2021 exports on a total solids basis were estimated at 192,278 metric tons (MT), about 30,000 MT more than the November 2020.

Through November, the value of calendar year 2021 exports was estimated at $6.05 billion, up 18% from January-November 2020.

Read: U.S. dairy exports ending 2021 strong.

Dairy Margin Coverage

In December, the USDA released details regarding changes to the Dairy Margin Coverage (DMC) program, including hay price adjustments used to calculate monthly feed costs and margins, creation of a Supplemental DMC provision for small- and midsized dairy producers to update milk production history and establishment of a 2022 sign-up period.

Through Jan. 18, 2021, total 2021 indemnity payments (covering January-November 2021 milk marketings, hay price adjustments and some Supplemental DMC payments) had reached $1.9 billion (down slightly from the previous week’s report), averaging more than $63,000 per dairy operation.

December 2021 DMC program margin and potential indemnity payments are scheduled to be released on Jan. 31. Check the Progressive Dairy website for an update late that day. The January 2022 DMC program margin and potential indemnity payments will be released on Feb. 28, 2022.

As of Jan. 19, the USDA’s online DMC Decision Tool had not been updated to include the new dairy-quality hay prices used in monthly feed cost calculations, and therefore was inaccurate in its margin forecasts for December 2021 through all of 2022.

The enrollment period for the 2022 DMC and Supplemental DMC programs year is open through Feb. 18, 2022.

Other tools

Dairy Revenue Protection (Dairy-RP) and Livestock Gross Margin for Dairy (LGM-Dairy) are two federally subsidized risk management programs administered by USDA’s Risk Management Agency. Both Dairy-RP and LGM-Dairy are sold and delivered solely through private crop insurance agents.

-

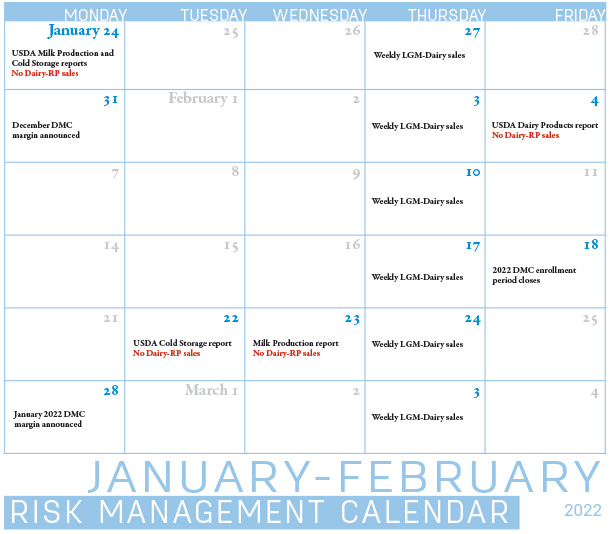

Dairy-RP: Dairy-RP coverage cannot be purchased on on days when major USDA dairy reports that could impact markets, including Milk Production, Cold Storage and Dairy Product reports (see Calendar). Dairy-RP is also not available on days when applicable futures contracts move limit-up or limit-down. Dairy-RP policies are available for the second quarter of 2022 through the second quarter of 2023 until March 15, 2022.

- LGM-Dairy: Sales periods for the LGM-Dairy program are open on a weekly basis. Unlike Dairy-RP, LGM-Dairy is available even if a sales period falls on the day of a USDA report.

Click here or on the calendar above to view it at full size in a new window.

Other resources

- Zach Myers, risk education manager with Pennsylvania Center for Dairy Excellence (CDE), will host a special edition of the “Protecting Your Profits” webinar on Jan. 26, 12-1 p.m. (Eastern time). Christopher Wolf, Cornell University dairy economist, will provide a 2022 dairy market outlook to help guide producer risk management and decision-making. Advance registration is not necessary. To participate in the webinar, click here or phone: (646) 558-8656. When prompted, enter meeting ID 848 3416 1708 and passcode 474057.

- The USDA’s Farm Service Agency (FSA) in New York will present a webinar on the DMC and Supplemental DMC programs on Jan. 27, 10-11 a.m. (Eastern time). The webinar is free but pre-registration is required. The webinar will be recorded, and a link will be sent to all who register.

- Travis Glaser, agent and co-owner at ARM Services LLC, a dairy and crop risk management company, will discuss risk management strategies during the Farm First Dairy Cooperative annual meeting, Feb. 11-12, in Onalaska, Wisconsin. His presentation will be held during Farm First’s Producer Discovery Workshops, set for Friday afternoon, Feb. 11, beginning at 2:15 p.m. (Central time).

Preceding Glaser, Dana Coale, deputy administrator of the USDA’s Agricultural Marketing Services Dairy Program, will speak at 1:15 p.m., discussing Federal Milk Marketing Orders.

The workshops are open to all dairy farmers regardless of cooperative membership. There is no cost to attend the workshops; however, to ensure sufficient seating space, call (608) 286-1909. ![]()

-

Dave Natzke

- Editor

- Progressive Dairy

- Email Dave Natzke