Terms like “record crop” and “bin buster” in the headlines have dairy producers’ attention turned away from feed costs. It is easy to let fundamental news and reports from the USDA shape your attitude toward feed costs. It happens slowly and with subtlety. We take in the headlines about a plentiful corn crop and gradually develop a bias that feed prices will be relatively low not only now but also indefinitely.

Feed buyers beware. While it is true that the prospect of a good crop drives good buying opportunities, a good crop doesn’t guarantee the preservation of good buying opportunities for the next year or two.

When in doubt, look at the math. If you chart statistics and look at what actually happened to prices after record crop years, you see a picture of what could happen to feed prices next year – a picture that is very different from today’s fundamental picture.

What prices have done

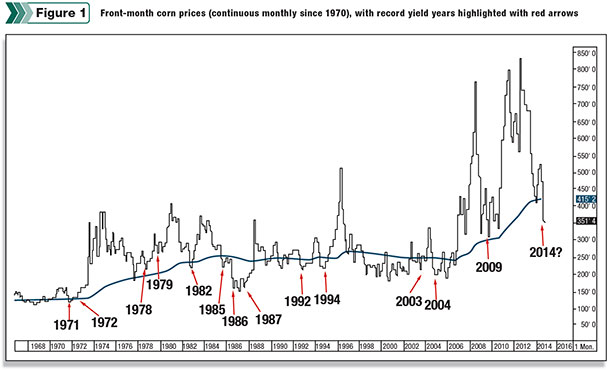

Let’s look at the past four decades of record crops and what prices have done the following year. Figure 1 depicts how corn prices behaved after each of the record crop years since 1970. It is generally true that a record crop has almost always come at the very bottom of the price cycle.

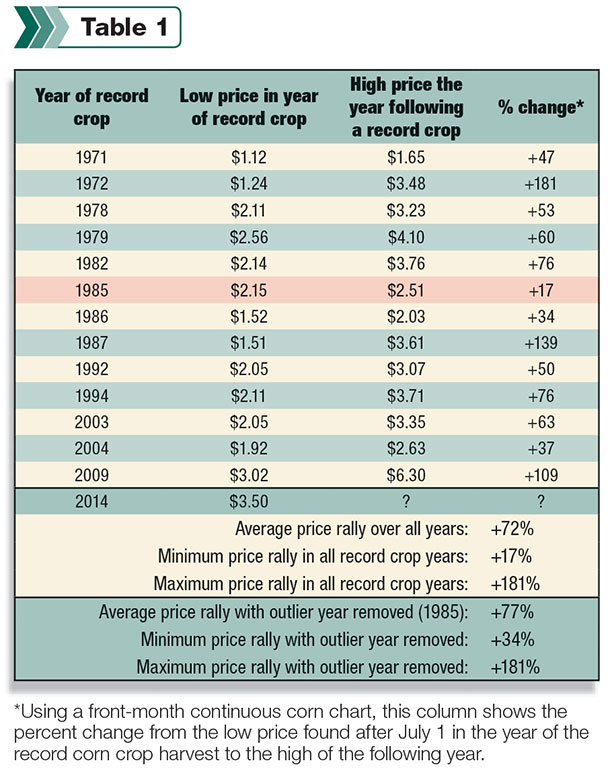

Now let’s dig into the data a little bit more. In Table 1, the baseline year is 1970, where the final corn yield was 72.4 bushels per acre. From 1970 onward, any year where the yield hit a new high can be classified as a record year. There have been 13 such record years since 1970, and the 2014 crop is shaping up to be the 14th.

The next two columns in Table 1 are the lowest price from July 1 through Dec. 31 in the year that record crop was harvested, followed by the highest price for corn that occurred in the year after the crop was harvested. The final column shows the percentage of change from the low to the high price. From this data, we see that:

- The average price rally from the low price to the high price the following year was 72 percent.

- The minimum rally in the year following a record crop was 17 percent.

Even more interesting is what happens when we pull out the outlier year: 1985. It can be considered an outlier because in that year the record crop occurred when the market was at a different point in its price cycle than it was when all the other 12 record yields occurred.

The corn market is very cyclical, moving from bull markets to bear markets and back again in cycles. Historically, the time span between a cyclical record-high and the next cyclical low has been one to four years, with the average span being two-and-a-half years.

The same is true between the cyclical lows and highs: one to four years. In 1985, we were still in the midpoint of a downtrend in prices when the record crop occurred; therefore, the rally was only 17 percent.

Removing the outlier, we are left with 12 years in which we saw a new record-high corn yield. For this set of 12 years, the corn price rallied anywhere from 34 percent to 181 percent in the year following the record yield, with the average rally in those years being 77 percent.

If history carries any weight, you can see that there is significant feed price risk for the next year. A 72 percent (average) price rally would mean that today’s corn price hovering around $3.50 would climb to about $6.02. Even the very minimal 17 percent price increase would put corn back over the $4 mark to $4.10.

The maximum price rally of 181 percent would take prices from $3.50 to $9.84. (Sounds crazy – but it’s not unheard of when you look at historical data.) So, as you can see, it is worth taking some action to protect good prices while they are here with us.

For the big-picture financial health of a dairy business heading into 2015, it is important that dairy producers not get caught up in record crop news, thinking corn is going to stay relatively cheap forever. Counter to the headlines and intuition, the data says that we see big upward swings following record yields. PD

DISCLAIMER: Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. Reproduction of this information without prior written permission is prohibited.

Patrick Patton

Director of Client Services

Stewart-Peterson Inc.