2021 estimates

The DMC program was a vital risk management tool for participating dairy producers in 2021, with indemnity payments issued every month through at least November. (As of Progressive Dairy’s deadline, a small indemnity payment was anticipated for December milk marketings and will be announced on Jan. 31, 2022.)

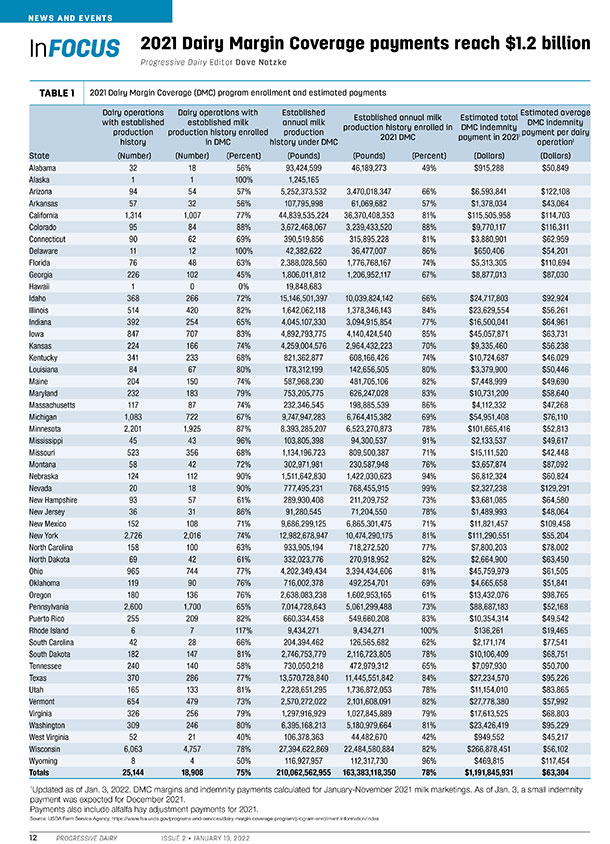

Of the nearly 25,200 dairy operations with established milk production history, 75% enrolled in DMC in 2021, covering more than 163.1 billion pounds of milk (Table 1).

Click here or on the image above to view i at full size in a new window.

As of Jan. 3, 2022 (covering January-November 2021 milk marketings), total 2021 indemnity payments had topped $1.91 billion, averaging more than $63,000 per dairy operation.

Hay cost calculations

One provision affecting nearly all program participants in 2021 was the change in the DMC feed cost formula to reflect the actual cost of high-quality alfalfa hay.

Since 2019, the USDA used a blend price, averaging monthly prices for all alfalfa hay and premium dairy quality alfalfa hay on a 50-50 basis. Under the new formula, the USDA uses the premium dairy-quality alfalfa hay price at 100%.

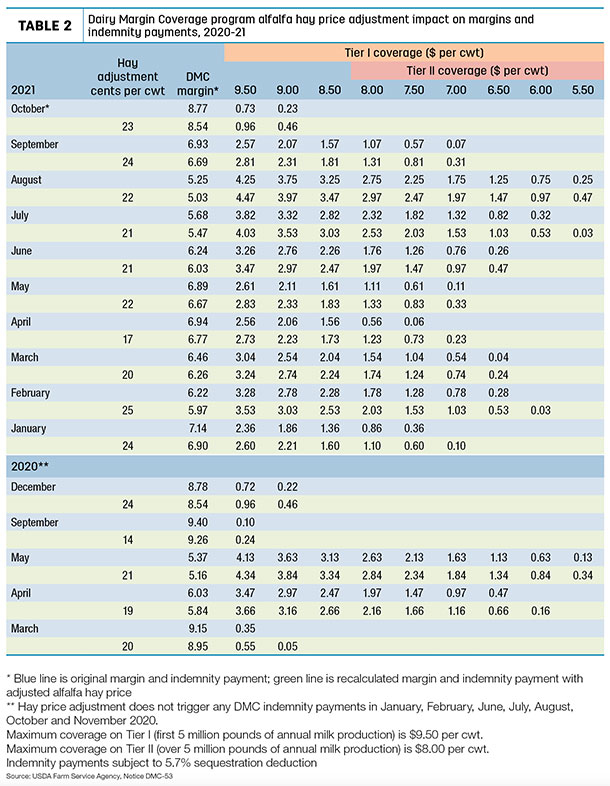

With that adjustment, the USDA recalculated DMC feed costs and margins retroactive to January 2020 (Table 2), issuing annual lump sum indemnity payments for each year.

Click here or on the image above to view i at full size in a new window.

Indemnity payments were made in five months in 2020. The difference in the DMC hay price and the premium dairy-quality hay price during the five affected months averaged about $14.50 per ton. Multiplied by the DMC hay cost factor of 0.0137, that equates to about 19.865 cents in the total DMC feed cost for five months. Spread out over the full year, that averages a little more than 8 cents per cwt.

The hay price adjustment affected indemnity payments for every month through October 2021. The difference in the alfalfa and premium alfalfa hay prices averaged about $15.95 per ton or about 21.85 cents per cwt of milk in the monthly total feed costs.

Based on those estimates, the retroactive payments would be about $825 per million pounds of milk for 2020 and about $1,820 per million pounds of milk for the first 10 months of 2021. The 2020 payments were subject to a 5.9% sequestration deduction; the 2021 payments were subject to a 5.7% sequestration deduction.

Starting with the November 2021 DMC margin announcement, the revised feed cost calculation will use only the price for premium dairy-quality alfalfa hay, so there will be no additional separate hay price adjustment indemnity payments going forward.

Supplemental DMC

The Supplemental DMC provision allows small and mid-sized producers to use actual 2019 milk marketings – instead of the original baseline marketings in years 2011, 2012 and 2013 – enrolling supplemental pounds up to a maximum of 5 million pounds. The adjusted baseline is effective retroactive to January 2021 and runs through the life of the current farm bill and DMC program, including 2022 and 2023 DMC coverage years.

Participation requires proof of 2019 milk marketings and a revision to a producer’s 2021 DMC contract, before 2022 program year enrollment.

A dairy operation’s supplemental production history is determined by subtracting the current DMC production history from the dairy operation’s milk marketings for the 2019 calendar year, with the result multiplied by 75%.

Once the supplemental production history is established, it will be a separate record. Continuation of the supplemental production history beyond 2023 would likely require inclusion in the 2023 Farm Bill.

Standard-rate DMC premiums are required on enrolled supplemental production; no discounted premiums are being allowed.

2022 enrollment

The sign-up period for the 2022 DMC program is open until Feb. 18, 2022. Due to concerns over COVID-19 variants, producers are urged to set up set up appointments with their local FSA offices.

Producers must certify that the operation is commercially marketing milk, sign all required forms and pay the $100 administrative fee.

Any payments DMC participants received for either the hay adjustment or supplemental production history cannot be applied to 2022 DMC premiums. Producers do have the option to have 2022 premiums’ fees deducted from indemnity payments. The payment sequestration deduction rate of 5.7% continues into 2022. ![]()

-

Dave Natzke

- Editor

- Progressive Dairy

- Email Dave Natzke