This article was #6 in PDmag's Top 25 most-well read articles in 2010. Summary: At the American Dairy Products Institute (ADPI) annual conference this spring, Harish Damodaran, an agribusiness journalist with The Hindu Business Line in India, shared how recent growth is an indicator for what could become exponential growth in a country where milk is loved. Because this article was so popular, we asked Dale Kleber of ADPI a follow-up question:

Q. How will India’s growing industry impact the U.S. dairy industry?

A . When Wille Sutton, an infamous bank robber in the in the U.S. during the 1930s and 40s, was asked why he robbed banks, he is said to have replied "Because that is where the money is."

The U.S. dairy industry has to view the domestic markets in India (and China) in a similar way. Why do they need to need to be there? Why do they need to study what kinds of dairy products Indian consumers prefer? Why do they need to learn how to get these products into India at a competitive price? Why do they need to become reliable, long-term trading partners with Indian companies and not just opportunistic exporters when the price is right? Because that where the growth is.

India is where the world's population surging and the per capita demand for dairy protein is growing... and it appears that India's domestic dairy industry finds it challenging to meet this growing demand by itself.

—Dale Kleber, chief executive officer, American Dairy Products Institute

Click a link below to read other articles in the Top 25:

Margin outlook not as strong for 2011: http://bit.ly/PDTop25_7 Carcass composting project unearthed in California: http://bit.ly/PDTop25_8

5 things I can't do without: Leon Leavitt: http://bit.ly/PDTop25_9

CityBoy cartoon Issue 18 2008: http://bit.ly/PDTop25_10

Students obtain “hands-on” experience through summer dairy program: http://bit.ly/PDTop25_11

Sorghum: An economical forage for dairy producers http://bit.ly/PDTop25_12

Running out of time: U.S. must become a global dairy supplier http://bit.ly/PDTop25_13

Should I exit the dairy industry? http://bit.ly/PDTop25_14

Crossbreeding study participants share observations, opinions: http://bit.ly/PDTop25_15

Every herd has metritis: http://bit.ly/PDTop25_16

World Dairy Expo video: http://bit.ly/PDTop25_17

5 Things I can't do without: Darin Dykstra: http://bit.ly/PDTop25_18

Let's agree on a few things about MPCs: http://bit.ly/PDTop25_19

Oregon State cows monitored 24-7: http://bit.ly/PDTop25_20

Brubakers find many benefits with methane digester: http://bit.ly/PDTop25_21

How to adjust rations to incorporate BMR corn silage: http://bit.ly/PDTop25_22

Time to reclaim animal well-being as our issue: http://bit.ly/PDTop25_23

3 open minutes with Doug Maddox and Gary Genske: http://bit.ly/PDTop25_24

3 open minutes with David Martosko of HumaneWatch: http://bit.ly/PDTop25_25

ARTICLE

With more than 17 percent of people in the world calling it home, India ranks No. 2 for most populated countries behind China. When it comes to milk production, however, they are No. 1.

At the American Dairy Products Institute (ADPI) annual conference this spring, Harish Damodaran, an agribusiness journalist with The Hindu Business Line, shared how recent growth is an indicator for what could become exponential growth in a country where milk is loved.

“There’s no doubt we are growing,” Damodaran said. “Income has doubled in the past five years, powered in part by the rising middle class.”

“With rising incomes, people not only consume more; the composition of their consumption also changes,” he said. Diets in India are changing to favor foods like milk, eggs, meat, fruits and beverages.

“Meeting these demands pose huge production challenges in terms of pressure on land, water and even labor resources. It will alter farming in India,” said Damodaran.

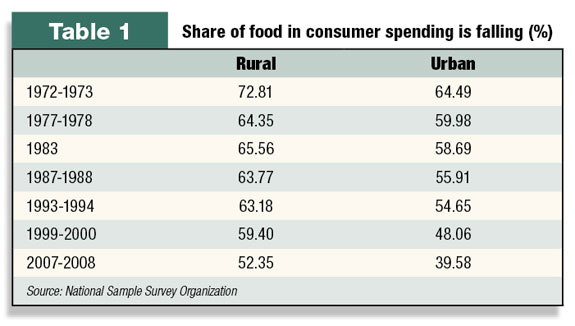

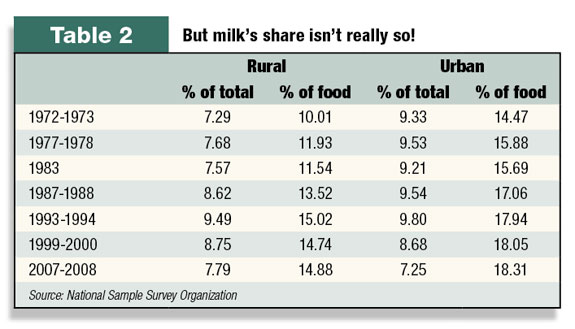

The share of food in consumer spending has fallen in the last 35 years by about 20 to 25 percent ( Table 1 ), but the percent spent on milk and dairy products has grown in that time. Today, one-fifth of the urban Indian food budget goes towards dairy ( Table 2 ).

“Indians take naturally to milk,” he said. A significant portion of the population is lacto-vegetarian, plus milk is part of the country’s socio-cultural and religious traditions. Many of the indigenous sweets consumed during festivals and social ceremonies are made with milk. Ghee (clarified butter) is commonly used in replacement of animal fats, which are generally avoided.

The dairy industry in India is largely unorganized to meet such demand. Organized dairies handle barely a fifth of India’s total milk output, selling fluid milk, powders/baby foods, ghee, ice cream, butter and cheese. The remaining 80 percent is produced for rural self-consumption, mainly consumed as fluid milk or used for making sweets. If fully tapped, this latter segment is estimated at more than $15 billion in potential sales.

Damodaran added that milk-based ethnic sweets have promise in the U.S. as well and doesn’t figure that the organized dairies in India will take advantage of such an opportunity, most likely because there is plenty of opportunity at home.

Milk production

Since the 1970s, Indian milk production has outpaced the population increase in the country. This is due to the creation of appropriate marketing associations, the Green Revolution and technology advances in breeding and equipment.

“Once a national market for milk emerged, the rural producer had every incentive to keep an additional buffalo, feed his existing animal better and invest in A.I./veterinary support to sell an extra liter or two. Earlier, this extra liter had no market. Ergo, producing beyond what could be consumed at home or sold in the neighborhood made little sense,” Damodaran said.

Most Indian dairymen consider themselves crop farmers with cows, with grain production being the focus of the farm. Animals are fed with herbage and crop residues not edible by humans. The Green Revolution not only enhanced the availability of grains, but also the straws, stovers and other byproducts used for cattle feed.

At one time, the main purpose of owning a cow was to produce bullocks for working up farmland. Milk was just a byproduct. Since they were genetically selected over centuries for characteristics other than milk production, the bulk of indigenous cattle have no recognizable breed traits. Farmers today are viewing cows as milk animals and crossbreeding with high-milk-yielding Western breeds.

Tractorization, or the steady mechanization of agricultural operations, has decreased the share of animal (and human) power from 95 percent in 1961 to 15 percent now.

Like tractors, buffalo are on the rise in India. Today, 56 percent of the milk comes from buffalo. They yield 1,400 to 2,000 kilograms per lactation, between 600 kilograms from non-descript cows and 2,200 from crossbreds. The real value comes in the fat content of the buffalo milk, which is twice that of the fat in milk from cows.

The Indian dairy model

As mentioned earlier, unlike the U.S. where dairying is a full-time affair, “pure” dairy farming is practically non-existent in India. It is a subsidy to the primary crop-growing activity to utilize the feed wastes and surplus family labor.

The animals feed on crop residues that are otherwise wasted and the family labor has virtually zero opportunity cost. “These keep production costs very low,” Damodaran said. “Costs are also kept low by small herd sizes and very little capital being invested in farms...Any money earned over and above pocket-paid expenses constitutes a return. While the Western model aims at economies of scale to cut costs, the very absence of scale keeps production costs low for the Indian farmer.”

Even though every Indian farmer only has one or two milk animals, the milk from the country’s 122.5 million cows and buffalo add up and become a large amount at the aggregate level. “This explains why milk, despite being a residual product of regular crop agriculture, is India’s No. 1 crop by value,” he said.

The future

India’s present dairy model has been sustained by family labor and feedstuff residues, but pressure is developing on both fronts.

The surplus labor reserves are depleting. The next generation is seeking more education and non-farm jobs, he said.

Obtaining livestock feed is also becoming a problem. Animals are currently fed with green fodder from common property and forestlands, cultivated green fodder, dry fodder from crop residues and feed concentrates.

Community lands are disappearing with the encroaching population; and forest lands are being conserved and no longer a reliable source.

Cultivated fodder is limited to less than 10 million hectares or 5 percent of India’s arable area.

It is estimated that crop residues provide 60 percent of the total dry matter intake of India’s livestock; but even that is under threat as the mechanization of harvest reduces straw recovery by half. Straw is also being diverted for biofuel, paper, packaging and other industrial applications. Due to this, straw prices have doubled in the last three to four years.

Prices are also increasing for feed concentrates.

“Feed prices have risen 25 percent in the last few years,” Damodaran said. “Official projections point to a widening feed gap.”

In the long run, dairying will need to be done on a full-time basis, yet only on a limited scale.

“We cannot afford 100-plus animals and excessive mechanization. We pay a lot for diesel and electricity,” he said. Those options are not viable for India.

Hatsun Agro, a company in Chennai, India, has demonstrated the feasibility of pure dairying by five-acre farmers raising 25 to 30 cows and exclusively growing high-yielding protein-rich fodder. By this, they rely less on costly purchased concentrate feeds.

Hatsun’s project also emphasizes selective mechanization to reduce production costs. Thus far, it has helped create 165 farms of this type.

India has a huge domestic market that is growing. Through breeding and selective technologies, milk yields can be raised considerably. With a more organized milk-handling system, farmers will be able to benefit from higher yields.

“Seventy-five percent of organized milk procurement now takes place in western and southern India. The north and east, producing two-thirds of India’s milk, have massive under-exploited dairy potential,” he said.

The increasing labor and fodder costs could well erode the industry’s long-term competitiveness; and a strong rupee may worsen matters.

Damodaran said the Indian government is ignoring the dairy sector, which needs greater policy support.

“Indians love milk so much,” he said, and some things will need to change for the supply to meet demand. PD

-

Karen Lee

- Midwest Editor

- Email Karen Lee