Increased volatility has pushed Dairy-RP and Livestock Gross Margin for Dairy (LGM-Dairy) premiums higher. The same is true for CME options if you were buying milk put options. Price ranges have been larger, therefore the expectation of bigger price swings continues in the future.

Class III has had the most volatility, hence the premiums have been the highest. Class III has higher prices, hence the tendency to have higher volatility. Class IV volatility has not been pushed higher because the market has been calm, and Class IV prices have been low.

In Dairy-RP, coverage is generally available for milk produced four or five quarters out in the future. A normal distribution of premiums would be the first available quarter is cheaper than the second quarter, the second is cheaper than the third quarter, and so on.

Currently however, due to uncertainty in the market, premiums over the next four quarters of Dairy-RP Class III coverage are nearly all the same. For example, for a sample Wisconsin herd, the premium for Class III coverage for the next available quarter Q2 of 2021 (April-June 2021) is $0.4301 per hundredweight (cwt), the premium for Q3 of 2021 is $0.4285 per cwt, the premium for Q4 of 2021 is $0.4108 per cwt, and the premium for the fourth quarter out (Q1 of 2022) is $0.4470 cwt. The pricing is flat.

For Class IV coverage under Dairy-RP, the premiums follow a more normal pattern, moving higher in future quarters. The longer length of coverage means higher premiums.

For the same sample Wisconsin herd, for Class IV coverage for the next available quarter (Q2, April-June 2021) the premium is $0.2107 per cwt, Q3 of 2021 premium is $0.2953 per cwt, the Q4 of 2021 premium is $0.3767 per cwt, and the Q1 of 2022 premium is $0.3476 cwt. This slope higher is what you would expect.

The takeaway: Comparing the premiums for the two classes, premiums are higher in Class III because of many days of futures prices being limit-up or limit-down. Big price ranges create big uncertainty each day and day to day.

To preview quarterly premiums and estimate a quote based on your state or region and desired Dairy-RP coverage, click here.

One other note: Dairy-RP indemnity payments for Q4 2020 should be processed soon. A preliminary look indicates a similar theme as last quarter’s payments. It looks like Class IV coverage will be the “winner” again. When the Class IV Dairy-RP was purchased will determine how much indemnity is paid. More information will be available next month.

Risk management calendar

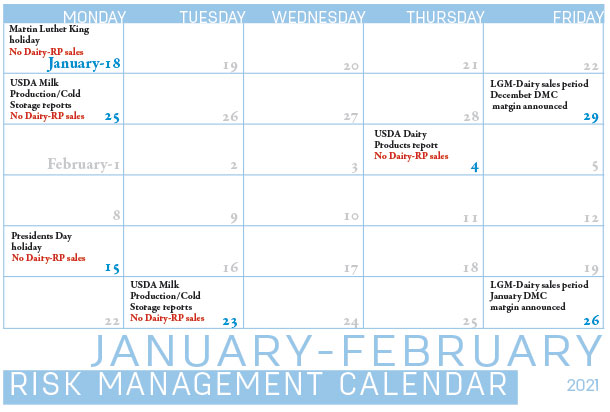

As a reminder, Dairy-RP coverage is generally available for milk produced four or five quarters out in the future. Currently, coverage is available for the final three quarters of 2021 and the first quarter of 2022. Dairy-RP is available every day except holidays and USDA report days that could impact markets (see calendar). Dairy-RP is also not available on days when applicable futures contracts move limit-up or limit-down.

Click here or on the calendar above to view it at full size in a new window.

LGM-Dairy is not only a milk price put option, but a call option on the price of corn and soybean meal, providing protection on falling milk prices and rising feed costs. The next LGM-Dairy sales period is Jan. 29. Coverage is available for up to 10 months, so you will be able to buy coverage for March 2021-January 2022. You need to select coverage in two-month increments to get the premium subsidy. ![]()

Dairy-RP and LGM-Dairy coverage is available through a licensed and trained crop insurance agent. Ron Mortensen with Dairy Gross Margin LLC provides monthly updates on Dairy-RP and LGM-Dairy coverage for the readers of Progressive Dairy.

-

Ron Mortensen

- Co-Owner

- Dairy Gross Margin LLC