Dairy products maintain trend

Following a four-month trend, July dairy product exports were again supported by growth in shipments of nonfat dry milk and skim milk powder (NDM/SMP) to Southeast Asia, according to the U.S. Dairy Export Council (USDEC).

-

Volume basis: U.S. suppliers shipped 196,080 tons of milk powders, cheese, whey products, lactose and butterfat in July 2020, 23% more than the July 2019. Increased shipments of NDM/SMP to Southeast Asia represent roughly half of the overall year-over-year U.S. export growth between April-July 2020. Meanwhile, total whey sales to China continue to recover from the depressed levels of last year, when African swine fever decimated China’s hog herd and reduced demand for whey for feed use. Gains in these markets were partially offset by continued weakness in sales to Mexico, where overall export volume trailed last year by 18%.

-

Value basis: The value of all U.S. dairy exports in July was $554.1 million, 17% more than a year ago.

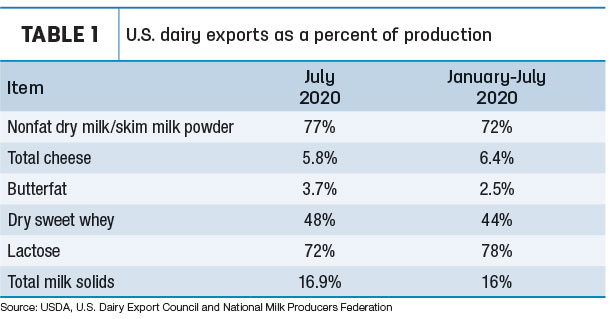

- Total milk solids basis: U.S. exports were equivalent to 16.9% of U.S. milk solids production in July. In the first seven months of the year, exports moved 16% of production (Table 1).

CWT-assisted exports

An update from the National Milk Producers Federation indicates Cooperatives Working Together (CWT) program-assisted sales approved through August total 74.255 million pounds of cheese, 6.934 million pounds of butter, 1.982 million pounds of anhydrous milkfat, 5.023 million pounds of cream cheese and 36.019 million pounds of whole milk powder. The total milk equivalent of the sales is 736.3 million pounds on a milkfat basis.

Dairy heifer exports slow to a trickle

Despite the prospect of good export opportunities earlier this year, the dairy replacement heifer market has ground to a virtual halt, according to Gerardo Quaassdorff, T.K. Exports Inc., Boston, Virginia. The USDA estimates show exports of U.S. dairy replacement heifers hit a decade low in July. Just 188 heifers changed country of residence during the month, and all of those moved north to Canada. The sales total was the lowest for any month dating back to January 2009.

Like marketing of other ag commodities, the COVID-19 pandemic has been a major factor. Not only have travel restrictions reduced marketing trips and shipments, but the impact has stretched all the way to movement of money. With more U.S. and foreign bankers working remotely, payment procedures have slowed, limiting the ability of buyers and sellers to finalize deals, Quaassdorff said. That’s impacted nearly everyone in the supply chain, including exporters, insurance companies and shippers.

Looking ahead, inquiries for both U.S. dairy and beef heifers remain strong for shipments later this year. However, interest is based on heifer prices negotiated for March-June, a period of U.S. dairy industry uncertainty and low heifer prices as U.S. dairy farmers looked to unload surplus animals.

Since then, federal financial assistance and stronger milk prices were incentive to increase U.S. domestic demand for heifers, cutting into available export numbers and raising prices. Several importing countries are also postponing purchases due to unfavorable currency exchange rates.

The U.S. remains the largest supplier of dairy heifers, and demand will continue, Quaassdorff said. Despite the disparity in prices with Europe, heifer supplies there are small. Australia’s coronavirus travel restrictions have essentially closed that market for now. So even with all those headwinds, he still sees opportunity, especially if pandemic restrictions ease.

U.S. exports of ‘other’ hay suffer

U.S. hay exports continued to slip in July. Most striking in the USDA’s monthly report, foreign shipments of “other hay” were among the lowest for any month in the 21st century. Prior to July, monthly exports of other hay have been below 102,000 metric tons only seven times dating back to January 2000, a period of 235 months.

Christy Mastin, sales representative with Eckenberg Farms, Mattawa, Washington, said the current low export volumes have their roots in the 2019 crop, when acreage for exportable timothy hay was sharply reduced. Less production meant higher prices in 2019 and that has carried over into 2020. Other hay has competition from Chinese rice straw and, most directly, Australian oaten hay, which had a good harvest last year, so prices for those alternatives are more appealing to buyers.

July’s exports of alfalfa hay were the lowest since February, in part due to heavy purchases earlier this year that have left potential buyers with adequate inventories. Additionally, with COVID-19 travel restrictions, there have been fewer marketing trips to the U.S. to check out new hay offerings. Ocean vessel availability and shipping delays remain a problem.

For more on hay exports and market conditions, check out Progressive Forage’s Forage Market Insights update.

U.S. ag trade deficit extended

July 2020 U.S. ag exports were valued at $10.3 billion. July U.S. ag imports were estimated at nearly $10.9 billion, resulting in a $600 million ag trade deficit. It marked a fifth straight month of deficit ag trade, and the sixth month in the first seven months of 2020.

In year-to-date fiscal year 2020 (October 2019-July 2020), the U.S. ag trade surplus stands at about $1.13 billion, about $2.6 billion less than the same period a year earlier. On a calendar year basis, the numbers are worse. The January-July 2020 trade balance is a deficit $3.5 billion.

Other dairy trade news

Here’s a look at other trade issues affecting U.S. dairy:

- The USDA’s quarterly Ag Trade Outlook paints an optimistic picture for dairy. Fiscal year 2020 (Oct. 1, 2019-Sept. 30, 2020) exports are forecast to hit t $6.5 billion. If realized, it would be the second-highest dairy export total on record and the highest since the $7.4 billion in dairy product exports in 2014. The forecast for fiscal year 2021 (Oct. 1, 2020-Sept. 30, 2021) is even higher at $6.6 billion.

However, the forecast isn’t as rosy for the overall U.S. ag trade balance. Global economic pressures and other factors point to the smallest U.S. agricultural trade surplus ($3.3 billion) in more than four decades. Read: Economic Update: USDA dairy trade forecast up, but ag trade surplus smallest in decades.

- First it was Congress, and more recently, members of the U.S. Senate sent a letter to the U.S. Trade Representative’s Office and the USDA, urging government officials to actively enforce dairy provisions of the U.S.-Mexico-Canada Agreement (USMCA). In applauding the letter, the leaders of USDEC and NMPF allege Canada has begun implementing the trade agreement in a way that thwarts U.S. market access. They also raised concerns regarding how Mexico will translate its commitments to safeguard common name cheeses into action.

- The critical role that U.S. dairy exports play in Wisconsin’s economy and beyond took center stage at a virtual town hall. The session was part of a series of “AgTalks” co-hosted by NMPF, USDEC and Farmers for Free Trade. Moderated by Tom Vilsack, president and CEO of USDEC, a panel representing all aspects of Wisconsin’s dairy supply chain shared how expanding dairy trade opportunities will bring tangible benefits to dairy farmers, processors, exporters and rural communities.

- The U.S. “Phase I” trade deal with China is still in its infancy, and the American Farm Bureau Federation (AFBF) has given it a six-month checkup. As of September, agricultural exports to are up enough to provide hope that China will move closer to its commitment to purchase $80 billion in ag products from the U.S. during 2020 and 2021. Zippy Duvall, AFBF president, looks at the trade with China, the U.S.-Mexico-Canada Agreement (USMCA) and other trade developments in “Early signs that trade is coming back.”

-

Dave Natzke

- Editor

- Progressive Dairy

- Email Dave Natzke