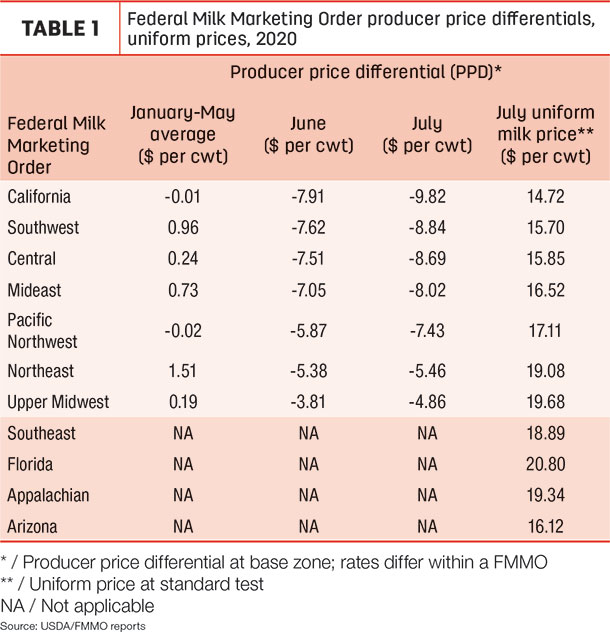

Federal Milk Marketing Order (FMMO) administrators have rolled out their monthly calculations, and the good news is statistical uniform prices for July milk are higher in all 11 of them (Table 1). Compared with June prices, July uniform prices are up $0.62-$4.07 per hundredweight (cwt).

The largest increases ($3.51-$4.07 per cwt) were in the Southeast, Florida and Appalachian FMMOs, where Class I milk utilization is the highest, Class I base prices continue to recover from June’s low and the effects of Class III depooling are smaller.

The outlier in the July uniform price among the four FMMOs not using multiple component pricing was Arizona, up just 62 cents from June. There was substantially more depooling in the Arizona FMMO in July compared with June.

The uniform price increases in most of the seven FMMOs implementing multiple component pricing are more subdued, from $1.59-$3.42 per cwt. For the most part, it’s in those FMMOs where the impact of depooling is the largest and the resulting negative producer price differentials (PPDs) are deep.

Once again, there was an outlier in this group: the Northeast FMMO, which saw a $3.42 increase in the July uniform price and just an 8-cent increase in the negative PPD compared to June.

While most FMMOs allow depooling in any month and then allow “repooling” the following month with some volume restrictions, the Northeast FMMO’s “Dairy Farmers for Other Markets” provision discourages depooling by having the strictest repooling provisions of all FMMOs, noted Ed Gallagher, head of risk management for Dairy Farmers of America (DFA).

Protein value a record

As in June, it was the price of cheese driving disorder in an otherwise orderly market. In July, the value of protein hit a record-high $5.62 per pound. That pushed the July FMMO Class III milk price to $24.54 per cwt, which was substantially higher than the Class I base price ($16.56 per cwt), the Class II price ($13.79 per cwt) and the Class IV milk price ($13.76 per cwt).

While the difference between the Class III and Class I base price in July ($7.98 per cwt) shrunk a little from June ($9.62 per cwt), the difference between the July Class III price and the Class IV price grew to $10.78 per cwt.

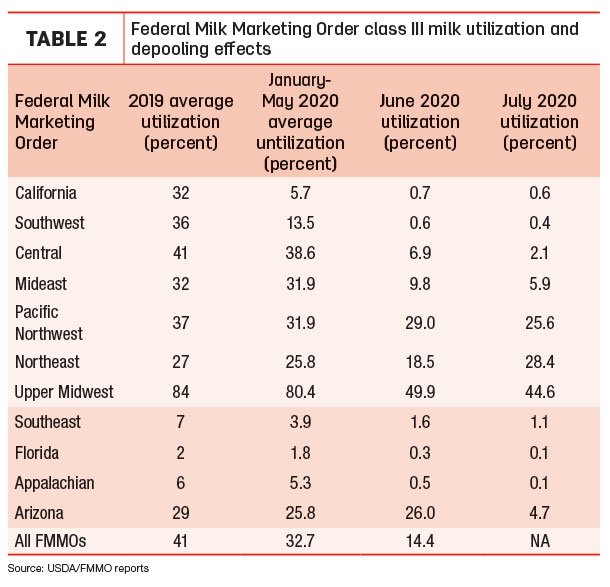

That class price disparity again provided ample incentive for Class III depooling. With the exception of the Northeast, depooling increased from June to July, and Class III utilization as a percent of all milk uses was lower in all other FMMOs (Table 2).

Through the first five months of 2020, Class III milk pooled in all 11 FMMOs averaged more than 4.34 billion pounds per month. With depooling, that fell to 1.37 billion pounds in June, and based on the FMMO administrator reports, Class III milk pooled in July was about 1.41 billion pounds. That’s down more than 4 billion pounds from July 2019.

As a result, PPDs added another $1-$2 to the negative side in July in those six FMMOs (Table 1). And because PPDs have a location adjustment factor, some producers in California will see negative PPDs greater than -$10 per cwt, with others in the Southwest and Central FMMOs in the negative $8.60-$9 range.

FMMO payment settlement dates vary by order, with most payments from milk buyers due to FMMO administrators between Aug. 13-17. From there, FMMO administrators pay milk handlers and suppliers (co-ops and others), which then pay milk producers, generally within a day or two.

As we noted last month, what dairy farmers might see in their milk checks may be vastly different than their neighbors’, depending on their milk handler. With the higher uniform prices, most should see an improvement in their milk check. As in June, however, many will not feel the full impact of the record-high value of protein due to depooling and negative PPDs.

Incentives to depool and the negative PPDs should start to subside next month. The August Class I base price is already announced at $19.78 per cwt, up $3.22 from July. Class II, III and IV milk prices will be announced on Sept. 2.

Read also: Depooling and record-large negative PPDs continue Into July, by American Farm Bureau Federation economist John Newton. ![]()

-

Dave Natzke

- Editor

- Progressive Dairy

- Email Dave Natzke