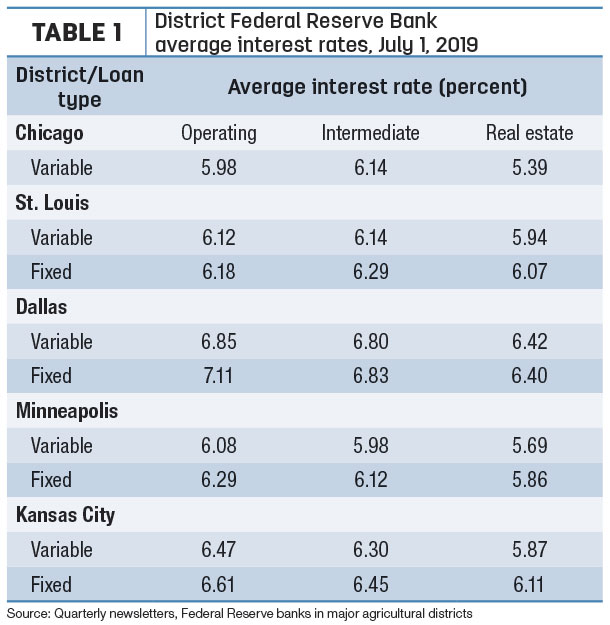

Based on quarterly lender surveys from Chicago, Dallas, Kansas City, Minneapolis and St. Louis Federal Reserve districts, interest rates on many agricultural loans as of July 1 were already headed lower, in many cases coming off decade-high levels. By district (Table 1):

-

Dallas: It was a mixed bag, with interest rates moving slightly higher on variable-rate operating and intermediate loans. Fixed-rate operating loan interest rates were unchanged, but interest rates on fixed-rate intermediate loans were lower. Both fixed-rate and variable-rate long-term real estate loans saw declines in interest rates. Finally, second-quarter 2019 interest rates on feeder cattle loans (both variable-rate and fixed-rate loans) were higher than the previous quarter.

-

Kansas City: Interest rates of variable-rate intermediate loans were up from the previous quarter, but operating and farm real estate loans were down. Interest rates for all categories of fixed-rate loans were lower than the previous quarter. Within the region, rates were generally highest in Oklahoma and Mountain States regardless of loan type. Nearly 18% of lenders responding to the quarterly survey reported denying more than a tenth of operating loan requests.

-

St. Louis: Interest rates on all six of the fixed- and variable-rate loan categories declined. Fixed-rate real estate loans were the most stable, declining 4 basis points, while all other categories declined between 10 and 12 basis points.

-

Chicago: Interest rates of variable-rate operating and farm real estate loans were down from the previous quarter; interest on feeder cattle loans rose. Credit tightening continued unabated in the second quarter of 2019, as 25% of ag lender survey respondents reported that their banks required larger amounts of collateral than a year ago, and none reported requiring smaller amounts. The portion of the district’s agricultural loan portfolio reported as having "major" or "severe" repayment problems (6.2%) had not been higher in the second quarter of a year since 1999.

-

Minneapolis: Interest rates for all categories of variable-rate and fixed-rate loans decreased modestly from the previous quarter.

-

Dave Natzke

- Editor

- Progressive Dairy

- Email Dave Natzke