It’s almost “last call” for dairy producers interested in enrolling in the Dairy Margin Coverage (DMC) and Supplemental DMC programs for 2022. The sign-up period closes on March 25 at USDA Farm Service Agency offices.

A jump to an eight-year high in milk prices outpaced increasing feed costs, and there were no indemnity payments at any level for January milk marketings.

Read: January DMC margin hits $11.54 per cwt.

Despite improving margins, dairy producers are being urged to reevaluate non-participation in 2022 due to market uncertainty related to the Russian military action in Ukraine and escalating corn and soybean prices. The DMC Decision Tool has now been updated to include estimated Premium dairy hay prices for 2022.

Read: Dairy producers urged to evaluate DMC enrollment decisions.

USDA milk production report, outlook

The USDA’s February preliminary milk production estimate will be released on March 21. Check back with Progressive Dairy for numbers and analysis.

The USDA’s monthly World Ag Supply and Demand Estimates (WASDE) report forecasts a year-over-year decline in U.S. milk production. Released on March. 9, the WASDE report revised the 2022 milk production estimate down 1.2 billion pounds from last month’s forecast to 226 billion pounds. If realized, 2022 production would be down 300 million pounds (0.1%) from the 2021 production of 226.3 billion pounds. The reduction was based on lower dairy cow numbers and slower growth in milk per cow.

For 2022, the projected Class III milk price was raised 35 cents from last month’s estimate to $20.65 per hundredweight (cwt). That would be up $4.57 (27%) from the 2021 average of $17.08 per cwt.

The projected annual average Class IV price was raised another $1.40 to $23.70 per cwt, up $7.61 (47%) from the 2021 average of $16.09 per cwt.

The projected all-milk price for 2022 was raised to $25.05 per cwt, up $1.50 from last month’s forecast and up $6.36 (34%) from the 2021 average of $18.69 per cwt.

Read: USDA forecasts milk production decline, sharply higher prices in 2022.

Dairy margins mixed to end February

Dairy margins were mixed over the second half of February as nearby milk prices traded sideways while deferred contracts rose along with projected feed costs, according to Commodity & Ingredient Hedging LLC.

A continuation of declining milk production and tight dairy product inventories remain supportive features for the market. The USDA’s monthly Cold Storage report reflected slower than normal growth in both cheese and butter inventories during January. Prices at the Global Dairy Trade (GDT) auction continued higher, as declining world production is also supporting dairy product prices.

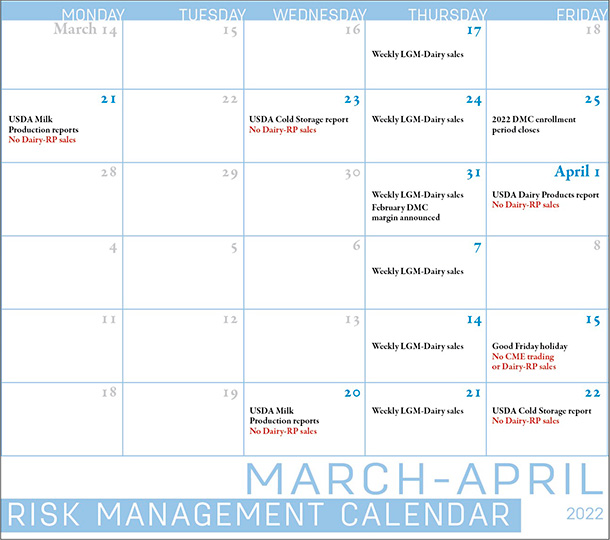

Click here or on the calendar above to view it at full size in a new window.

Other tools

Dairy Revenue Protection (Dairy-RP) and Livestock Gross Margin for Dairy (LGM-Dairy) are two federally subsidized risk management programs administered by USDA’s Risk Management Agency. Both Dairy-RP and LGM-Dairy and Dairy-RP are sold and delivered solely through private crop insurance agents.

-

Dairy-RP: Dairy-RP coverage cannot be purchased on days when major USDA dairy reports that could impact markets, including Milk Production, Cold Storage and Dairy Product reports (see Calendar). Dairy-RP is also not available on days when applicable futures contracts move limit-up or limit-down, or on days when Chicago Mercantile Exchange trading is closed due to holidays. The period to purchase Dairy-RP coverage for the second quarter of 2022 closed on March 15. Dairy-RP policies are currently available for the third quarter of 2022 through the third quarter of 2023.

- LGM-Dairy: Sales periods for the LGM-Dairy program are open on a weekly basis. Unlike Dairy-RP, LGM-Dairy is available even if a sales period falls on the day of a USDA report.

Other resources

-

Protecting Your Profits webinars are March 23, April 27. Zach Myers, risk education manager with Pennsylvania Center for Dairy Excellence (CDE), will host monthly “Protecting Your Profits” webinars on March 23 and April 27, both at 12-1 p.m. (Eastern time). The monthly sessions take a deeper dive into factors impacting milk markets and risk management. Advance registration is not necessary. Each webinar is available via podcast or phone. To participate, click here or phone: (646) 558-8656. When prompted, enter meeting ID 848 3416 1708 and passcode 474057.

-

Upcoming reports impacting milk checks include the Federal Milk Marketing Order (FMMO) uniform price and producer price differentials for February milk marketings, released by March 14; USDA’s latest Milk Production (March 21) and Cold Storage (March 23) reports; and the February Dairy Margin Coverage (DMC) program margin and indemnity payments, March 31. With the potential to impact corn, soybean and other feedstuff markets, the USDA’s 2022 Prospective Plantings report is also released March 31.

-

Dave Natzke

- Editor

- Progressive Dairy

- Email Dave Natzke