U.S. exports of nonfat dry milk/skim milk powder (NDM/SMP) have been unable to match last year’s record pace in recent months, dragging overall trade performance down, according to Alan Levitt, USDEC vice president of communications and market analysis.

U.S. suppliers shipped 166,778 tons of milk powder, cheese, butterfat, whey and lactose in October, down 11 percent from last year. U.S. exports were valued at $466 million, down 1 percent.

October 2017 exports of NDM/SMP were down 34 percent compared to the record volume of 77,566 tons in October 2016. Except for China, sales to nearly all other countries or regions were lower.

Cheese exports, up 9 percent in October, have declined from the volumes seen in the second quarter of 2017, but remain above year-ago levels. Exporters posted record-high volumes in sales to China and Central America. In addition, exports to the Middle East/North Africa (MENA) region have improved in recent months. Shipments to Australia, Japan and South Korea also continue to increase, but October exports to Mexico were the lowest in three-and-a-half years.

Whey exports have reached all-time high volumes this year.

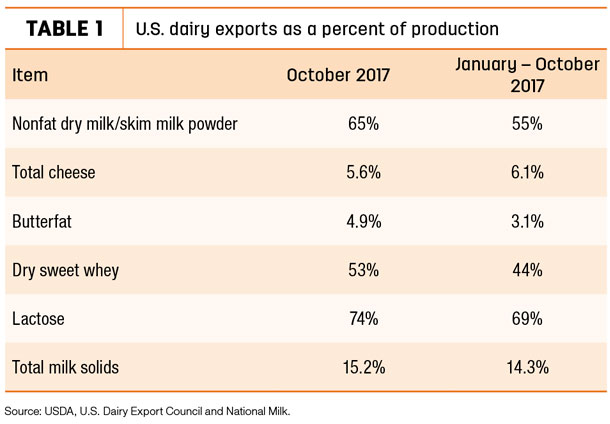

On a total milk solids basis, October U.S. exports were equivalent to 15.2 percent of U.S. milk production (Table 1); imports were equivalent to 3.5 percent of production. In the first 10 months of 2017, exports represented 14.3 percent of milk solids output.

Dairy export outlook weakens slightly

Despite an improving global economy and declining U.S. dollar against other currencies, USDA’s latest quarterly Ag Trade Outlook report reduced its dairy export forecast for fiscal year 2018 (Oct. 1, 2017 – Sept. 30, 2018). The dairy export forecast, released Nov. 30, was cut $100 million from the previous report, to $5.6 billion. USDA cited weakening global prices and intensified competition from other major dairy exporting countries.

Despite the weaker outlook, the value of fiscal year 2018 dairy product exports would still be the highest since 2014, when exports topped $7.4 billion.

Meanwhile, the fiscal year 2018 U.S. dairy import forecast held at $3.2 billion, down slightly from fiscal year 2017. Cheese imports are projected at $1.3 billion, similar to last year.

Dairy replacement exports strong

Monthly exports of U.S. dairy replacement heifers topped 2,500 head for the fourth time in 2017, with more than 1,100 heifers sent to Qatar.

U.S. exports for October totaled 2,542 head and were valued at $5.3 million. January-October exports total 24,133 head (with a value of $50.6 million) and remain on pace to yield the highest export total since 2014.

The target of a dairy embargo by many of its neighbors, Qatar has turned to the U.S. to gain dairy self-sufficiency. It purchased 1,144 head in October and has purchased more than 2,025 head in the past three months.

With an increase in milk quota earlier this summer, Canadian farmers purchased another 709 U.S. replacements during the month, bringing the January-October total to more than 5,240 head.

North American Free Trade Agreement (NAFTA) partner Mexico purchased 689 head in October, bringing that country’s year-to-date total to 6,914 head.

Tony Clayton, president of Clayton Agri-Marketing, Jefferson City, Missouri, expects a strong finish to 2017 and a fast start in 2018. In addition to more heifers sent to Qatar, recent shipments – not yet reported by USDA – have gone to Russia, Turkey and Thailand. He expects a last-minute rush for sales to Mexico, and Clayton’s company will be sending 1,800 head to Sudan in January.

Dairy cattle embryo exports totaled 370 in October, valued at $411,000. Both are the lowest monthly totals since February 2017. China was the leading market, taking 260 embryos.

Hay exports holding up

Monthly alfalfa hay exports dipped below 200,000 metric tons (MT) in October, the fourth time that’s happened in the past 18 months. Despite the slight downturn, year-to-date 2017 alfalfa hay export sales topped 2 million MT and remain well on their way to a new record annual high.

October alfalfa hay exports totaled 192,552 MT, valued at about $57 million. China was the leading buyer with 75,033 MT, although shipments declined for a second consecutive month.

Sales of other hay totaled nearly 135,056 MT, the fourth-highest monthly total of the year. Japan and South Korea remained top buyers. The other hay exports were valued at about $42.6 million.

A couple of factors will impact hay exports as 2017 comes to a close, according to Christy Mastin, international sales manager at Eckenberg Farms, Mattawa, Washington. November and December holidays reduce the number of U.S. shipping days, and the Chinese New Year celebration causes a month-long slowdown for incoming shipments. Shipments had to leave U.S. ports by mid-December to arrive before the Chinese new year.

Demand for higher-quality alfalfa has been steady from Japan and South Korea. Although domestic hay harvest was better than last year, overall hay quality isn’t back to normal. Japan and South Korea also have large inventories of timothy that will be fed through the winter, so U.S. shipments could pick up in 2018.

The USDA quarterly outlook forecasts exports of “feeds and fodders” will hit $7.5 billion, up slightly from 2016.

U.S. ag trade surplus grows

October 2017 U.S. ag exports totaled $13.2 billion, about $2.6 billion more than September but $1 billion less than October 2016.

Ag imports totaled $10.4 billion in October, up $1 billion from both September 2017 and October 2016.

The October 2017 U.S. ag trade surplus was $2.7 billion, the largest monthly total since December 2016. ![]()

-

Dave Natzke

- Editor

- Progressive Dairyman

- Email Dave Natzke