Monthly year-over-year output growth has now been under 1% for nine consecutive months, and negative in three of the last four months. Previous periods when milk production growth was less than 1% was in seven of eight months to end 2014, and nine of 11 months from June 2011-April 2012.

June 2018-19 recap at a glance

Heavy cow culling and slow growth in milk output per cow held down June 2019 milk production. Reviewing the USDA estimates for June 2019 compared to June 2018:

- U.S. milk production: 18.23 billion pounds, down 0.3%

- U.S. cow numbers: 9.323 million, down 91,000 head

- U.S. average milk per cow per month: 1,955 pounds, up 12 pounds

- 24-state milk production: 17.35 billion pounds, up 0.1%

- 24-state cow numbers: 8.778 million, down 62,000 head

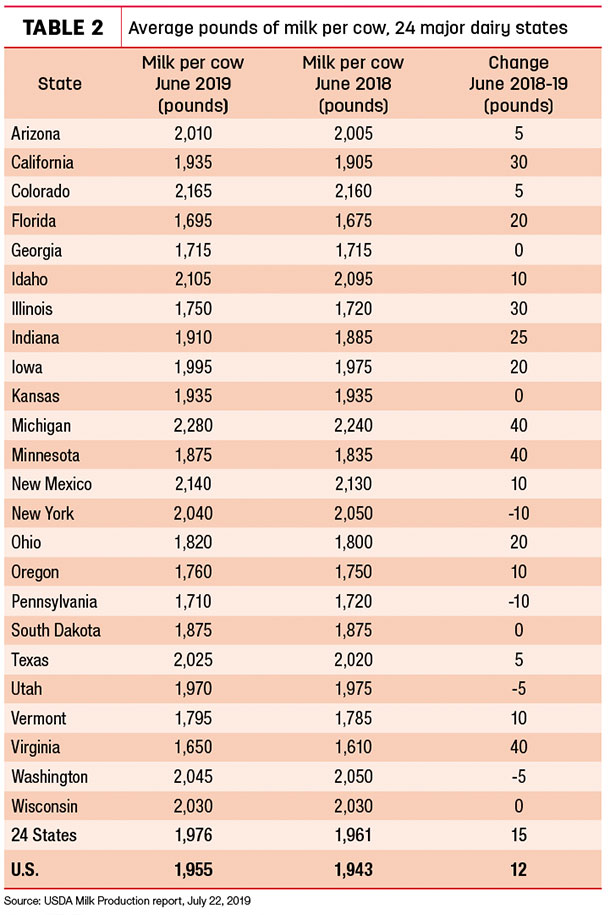

- 24-state average milk per cow per month: 1,976 pounds, up 15 pounds

Source: USDA Milk Production report July 22, 2019

After a small increase in May, U.S. dairy cow numbers declined 10,000 head in June, to 9.323 million head. That’s 91,000 less than a year ago, and the smallest U.S. dairy herd since February 2016.

The month-to-month decline in the 24 major dairy states was even more pronounced. June cow numbers in those states totaled 8.778 million head, down 12,000 head from May and 62,000 fewer than a year earlier.

U.S. dairy farmers continue to move dairy cull cows to slaughter at a high rate. Federally inspected milk cow slaughter was estimated at 1.644 million through June 29, 2019, about 79,200 head more than a similar date a year earlier, according to the USDA.

Nine states increased cow numbers compared to June 2018 (Table 1), with the largest jumps in Texas (+29,000 head), Colorado (+10,000) and Idaho (+9,000). In contrast, Pennsylvania (-31,000) and Ohio (-14,000) led decliners, with New Mexico, Arizona, Virginia, Illinois, Indiana and California each down 7,000 to 11,000 head. Iowa, Minnesota and Wisconsin were down a combined 15,000 head.

Although most declines were small, cows in eight states yielded steady to lower milk output per cow in June compared to the same month a year earlier (Table 2). Biggest gains were in Michigan, Minnesota and Virginia, where output was up 40 pounds per cow. Michigan led all states in milk production per cow for the month.

Among all major states, Texas led in terms of milk volume growth in June 2019, up 61 million pounds (5.6%) from a year earlier. Pennsylvania production was down 58 million pounds (-6.5%).

California milk production was up 39 million pounds, while Wisconsin output was down 12 million pounds.

With June production estimates in the books, U.S. milk production during the April-June quarter totaled 55.8 billion pounds, down 0.1 percent from the same quarter last year. The average number of milk cows in the U.S. during the quarter was 9.33 million head, 15,000 head less than the January-March quarter, and 89,000 head less than the same period last year.

Bullish outlook continues

Both the USDA’s Milk Production and Cold Storage reports were positive for milk prices, according to Bob Cropp, dairy economics professor emeritus with the University of Wisconsin – Madison.

Looking at the Milk Production report, not only were cow numbers down about 1% from a year ago, but milk per cow grew just 0.6%. Milk production is likely to continue below year-ago levels for the remainder of the year, Cropp said.

And, although butter stocks increased normally between May and June, stocks were 2.6% lower than a year ago. American and other cheese stocks declined from May on the strength of domestic and export sales. Growing export sales to Southeast Asia offset lower cheese sales to Mexico, contributing to a continued improvement in milk prices, he said.

Substantial declines in milk production in the Southeast are impacting milk flow in the Midwest, said Mark Stephenson, director of dairy policy analysis at UW-Madison. Less Michigan milk is moving into Wisconsin and instead is heading to fill fluid needs in the Southeast, he explained.

Both Cropp and Stephenson see stronger milk prices in the latter half of 2019, carrying over into 2020. But while Cropp sees fourth-quarter 2019 prices hitting $18 per cwt, and 2020 prices averaging 50 cents to $1 higher than the 2019 average, Stephenson is even more optimistic. He projects 2020 prices could nudge into the $20s. Both higher feed prices and constraints on farmer capital will hold down milk production growth, they agreed.

The USDA’s latest milk production forecast changed little from a month ago, but the 2019 price outlook improved slightly. Although down slightly from last month’s forecast, projected average 2020 milk prices are higher than 2019. (Read: USDA raises 2019 milk price forecast slightly) ![]()

-

Dave Natzke

- Editor

- Progressive Dairy

- Email Dave Natzke