September 2017 U.S. milk production grew 1.1 percent compared to the same month a year earlier, the smallest year-over-year increase since May 2016. Declining cow numbers and a meager increase in milk output per cow slowed the overall growth rate, according to the USDA’s latest Milk Production report.

USDA: September recap

Reviewing the USDA estimates for September 2017 compared to September 2016:

• U.S. milk production: 17.12 billion pounds, up 1.1 percent

• U.S. cow numbers: 9.4 million, up 69,000 head

• U.S. average milk per cow per month: 1,827 pounds, up 6 pounds

• 23-state milk production: 16.18 billion pounds, up 1.2 percent

• 23-state cow numbers: 8.737 million, up 73,000 head

• 23-state average milk per cow per month: 1,851 pounds, up 6 pounds

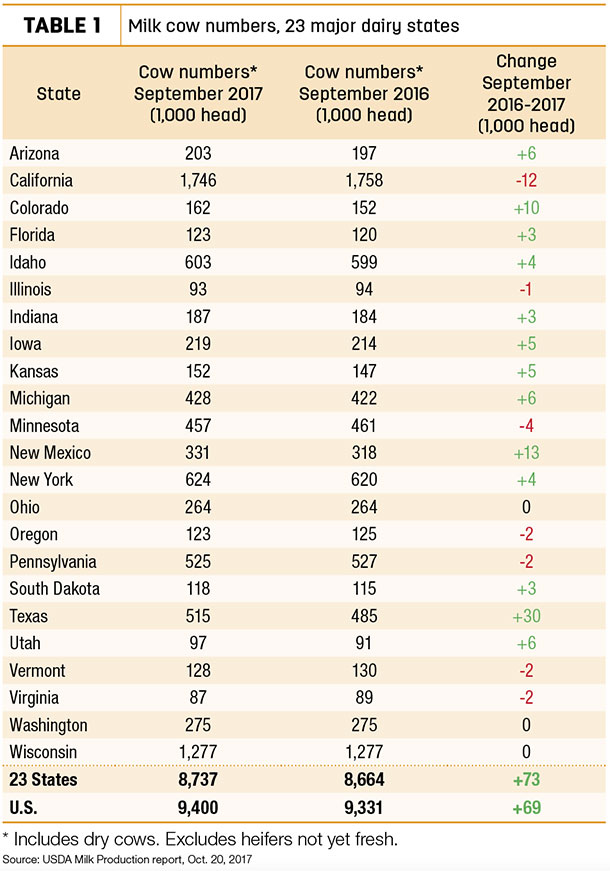

Cow numbers

Nationally, September milk cow numbers were down 4,000 head from August’s revised estimate, but still 69,000 head more than September 2016 (Table 1).

Compared to a year earlier, largest growth was in Texas (+30,000 head), New Mexico (+13,000 head) and Colorado (+10,000 head). California cow numbers were down 12,000 head.

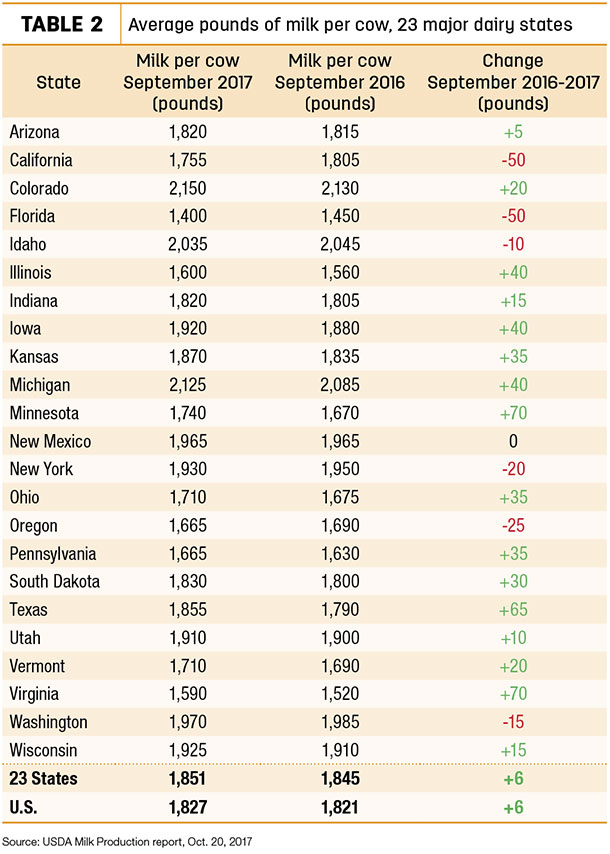

Milk per cow

Monthly milk output per cow declined on the West Coast, with California (-50 pounds), Oregon (-25 pounds) and Washington (-15 pounds) down from September 2016. Florida (-50 pounds), New York (-20 pounds) and Idaho (-10 pounds) also posted declines (Table 2). Virginia (+70 pounds), Texas (+65 pounds) and Illinois, Iowa and Michigan (each +40 pounds) led those with increased output per cow.

Milk production

On a percentage basis, September milk production was up 10 percent in Texas, 7.4 percent in Colorado, 5.2 percent in Kansas and 4 percent in New Mexico. Wisconsin was up just 0.8 percent, while California milk production was down 3.4 percent.

Foot off the gas

The biggest story in the latest USDA report is milk per cow, according to Mark Stephenson, director of dairy policy analysis at the University of Wisconsin – Madison, and Bob Cropp, dairy economics professor emeritus. They discussed the dairy situation in their monthly podcast.

In part, the slowdown in milk production per cow reflects nearly ideal conditions a year ago, Cropp said. This year’s small gains could be due a combination of regional factors, from weather to the quality of first- and second-crop hay.

“Producers at least have their foot off the gas, if not tapping on the brakes a little bit,” said Stephenson, citing the small increase in milk production in September.

While the slowdown should lend support for milk prices, the outlook for 2018 remains clouded by uncertainty, hinging on the strength of exports and global milk production, Cropp said.

“It would take higher-than-expected domestic sales of milk and dairy products or higher dairy exports to push 2018 milk prices higher than what is now forecasted,” Cropp noted in his monthly dairy situation and outlook report.

Near-term, higher cheese prices will offset lower dry whey prices, resulting in an October Class III price near $16.60 per cwt, up about 30 cents from September. Unless cheese prices rally, the Class III price for November and December will stay in the $16s and average about $16.25 per cwt for the year. Looking into 2018, Class III prices could stay in the high $15s for the first half of the year, and reaching the $16s during the second half.

Declining nonfat dry milk prices will lower the October Class IV price near $14.90 per cwt. The Class IV price will stay in the higher $14s in November and December, averaging about $15.40 cwt for the year. The Class IV price for 2018 may stay in the $14s for most of the year, Cropp said.

USDA outlook

The USDA’s monthly Livestock, Dairy and Poultry Outlook report now forecasts the fourth quarter 2017/first quarter 2018 cow herd to be down about 5,000 head compared to the same quarters last year. Nonetheless, the USDA raised milk production forecasts for both 2017 and 2018.

Anticipated milk production in 2017 is set at 216.2 billion pounds. If realized, 2017 production would be up about 1.8 percent from 2016’s total of 212.4 billion pounds. Looking ahead to 2018, the USDA forecasted production at 220.4 billion pounds, about 1.9 percent more than 2017’s estimate.

Dairy cow slaughter, prices

While the size of the U.S. dairy herd is larger, the pace of 2017 dairy cow culling remains ahead of a year earlier, according to monthly USDA data. For September 2017, federally inspected milk cow slaughter was estimated at 249,600 head, 4,500 more than September 2016, but 16,000 less than August 2017.

Through the first nine months of 2017, dairy cows slaughtered under federal inspection were estimated at 2.236 million head, about 84,100 more than January-September 2016. Total cow slaughter (beef and dairy combined) for January-September 2017 was estimated at 4.27 million head, about 284,400 more than the same period a year earlier.

The USDA’s monthly Livestock, Dairy and Poultry Outlook report forecasts national average fourth-quarter 2017 cutter cow prices are forecast to weaken, in a range of $61 to $69 per hundredweight (cwt). That would result in a 2017 average of just $66.25 per cwt, down from $70 per cwt in 2016 and $99.56 per cwt in 2015. Little if any improvement is forecast for 2018, with cutter cow prices expected to remain in a range of $61 to $70 per cwt for the entire year.

In his latest weekly MarginSmart Dairy Analyzer newsletter, Mark Linzmeier, tracks seasonal cull cow price patterns, confirming weakness in the fourth quarter each year as more culled beef cows head to market. Read also: Weekly Digest: Watch seasonal cull cow price patterns

Citing price information from Wisconsin auction markets, Linzmeier also noted a substantial price spread – $17 to $30 per cwt – between the top 20 percent and bottom 20 percent of cull cows sold. He recommends avoiding selling low-weight, thin cows in the fourth quarter of the year. Instead, dry them up and add weight, selling them in the first quarter of 2018. Producers who do that may realize an additional $100 to $250 per head after feed cost.

Regional: Pennsylvania dairy outlook

Based on calculations from Penn State’s Robert Goodling, October 2017 Pennsylvania milk income over feed cost margins will be near the year’s high, at about $13.49 per cwt. This improving margin should continue through the end of the year. Regionally, significant numbers of producers are enjoying excellent corn silage tonnage and grain yields. For Pennsylvania dairy farms hit hard with last year’s drought, the ability to feed their own corn grain, rather than purchase grain, will provide a welcome boost to the milk margin through next year.

Another positive regional trend is that the year-over-year milk production increase in the Northeast federal milk marketing order had slowed by mid-summer. However, with abundant crops, and cooler autumn weather, the milk spigot will re-open, Goodling said.

Looking ahead, Pennsylvania milk prices are expected to decline at least $1.50 per cwt by next summer. That predicted drop in milk price provides a challenge for profitability, even If crop prices were to remain the same. Despite large forecasted harvests and supplies, futures price for soybean meal have been trending upward, pressured by domestic and export demand. ![]()

-

Dave Natzke

- Editor

- Progressive Dairyman

- Email Dave Natzke