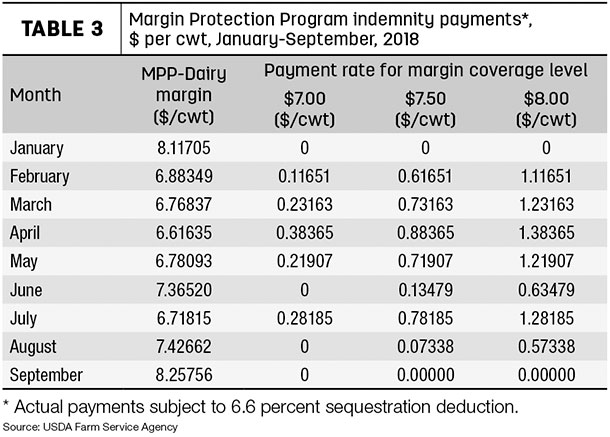

September 2018’s Margin Protection Program for Dairy (MPP-Dairy) calculations indicate margins improved somewhat, thanks to a combination of a slightly higher U.S. average milk price and lower soybean meal price, which offset higher prices for corn and alfalfa hay. There will be no MPP-Dairy payments at any level for the month.

Milk price up 80 cents

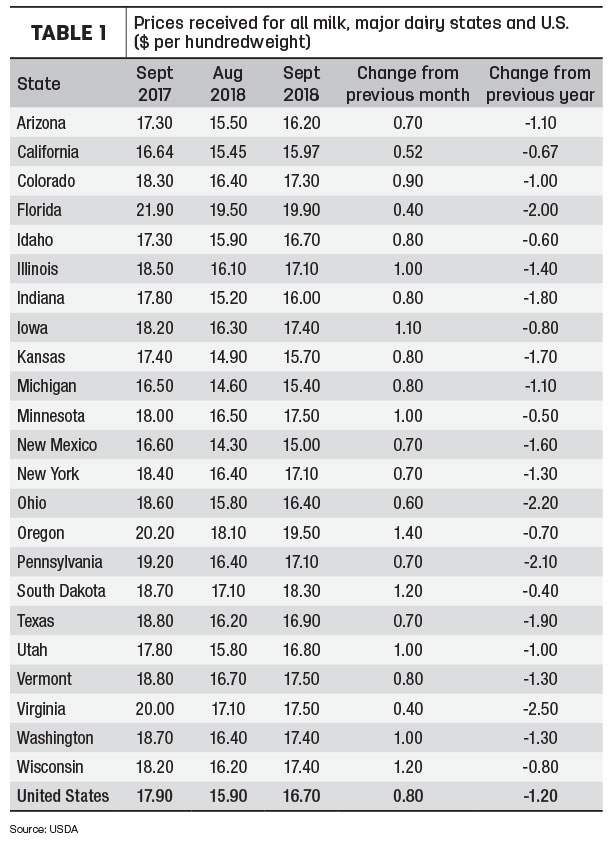

The September U.S. average milk price rose 80 cents per cwt from August to $16.70 per hundredweight (cwt) (Table 1), but was still $1.20 less than September 2017. Through the first nine months of 2018, the average milk price stands at $15.92 per cwt compared to $17.59 per cwt in the same period of 2017.

Compared to a month earlier, September milk prices among the 23 major dairy states were all higher, led by gains of $1 per cwt or more in Illinois, Iowa, Minnesota, Oregon, South Dakota, Utah, Washington and Wisconsin.

Compared to a year earlier, September 2018 milk prices were down at least $2 per cwt or more in four states, led by Florida, Ohio, Pennsylvania and Virginia.

Florida’s average of $19.90 per cwt remained the nation’s high. The lows were in Michigan and New Mexico at $15.40 and $15 per cwt, respectively.

Feed prices mixed

September 2018 U.S. average feed costs declined about 3 cents from August to $8.44 per cwt of milk sold (Table 2). The soybean meal price fell about $14.18 per ton from August to $318.32 per ton, the lowest average since November 2017. In contrast, the U.S. average corn price rose 3 cents per bushel to $3.39 per bushel, and the alfalfa hay price increased $3 per ton to $180 per ton. Corn and alfalfa hay prices had declined for three consecutive months prior to September’s increases.

MPP-Dairy margin tops $8.25 per cwt

The combination of lower overall feed costs and the higher milk price helped boost the national average milk income over feed cost margin to about $8.26 per cwt in September, the highest since December 2017. As a result, dairy farmers who enrolled in MPP-Dairy at any level will not see a payment for September (Table 3).

In addition, based on current futures prices, MPP-Dairy payments are likely finished for the foreseeable future. As of Oct. 29, the Program on Dairy Markets and Policy projected October 2018 to July 2019 margins will stay in a narrow range near $8.50 per cwt.

Congress is considering changes to MPP-Dairy as part of the 2018 Farm Bill. Those changes could raise the top insurable margin to $9 per cwt and adjust premium costs.

Dairy-RP participation growing

A new program, the Dairy Revenue Protection program, kicked off Oct. 9.

As of Oct. 29, 510 dairy producers had filed applications, and 122 quarterly endorsements had been purchased, covering 1.34 billion pounds of milk.

Read: Dairy-RP activity surpasses 1.3 billion pounds of milk

What’s in the mailbox?

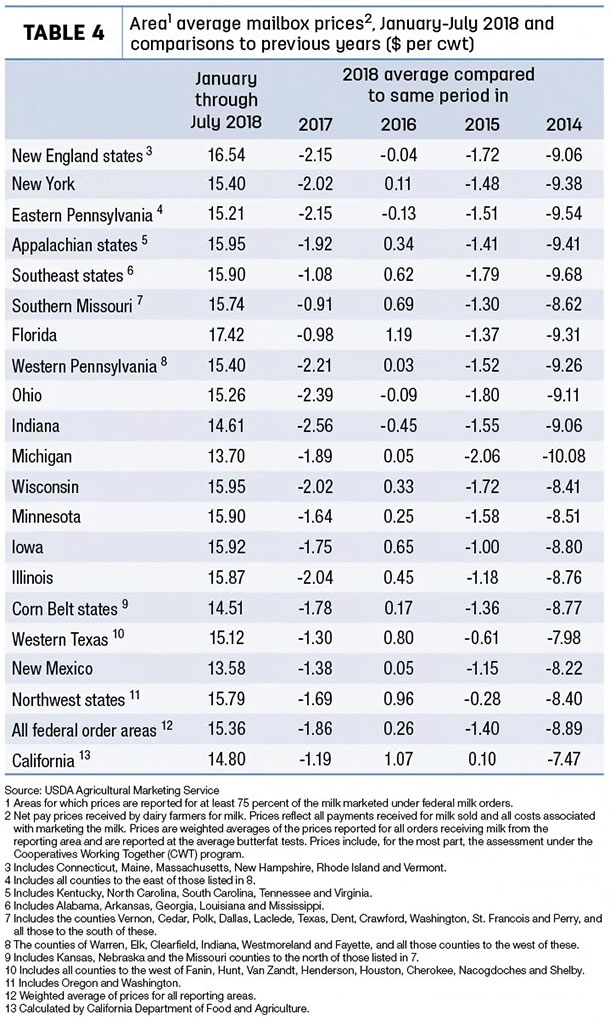

We hate to be the bearer of bad news, but the trip to the mailbox hasn’t been fun so far in 2018.

In July 2018, mailbox milk prices – approximating the net price received by dairy farmers for milk after adding any premiums and deducting costs associated with hauling and marketing – for selected reporting areas in all Federal Milk Marketing Order (FMMO) areas averaged $15.55 per cwt, down 78 cents from the June 2018 average and down $1.96 per cwt from the July 2017 average. Mailbox prices in July 2018 ranged from a high of $18.07 in the Florida reporting area to $13.15 in the New Mexico reporting area.

Through the first seven months of 2018 (Table 4), the average all FMMO mailbox price was about $1.86 per cwt less than the same period in 2017. For those with a longer memory, average mailbox prices were running $8.89 per cwt less than the record highs of 2014.

So far in 2018, New Mexico and Michigan dairy producers have seen mailbox milk price averages under $13.75 per cwt.

January-September dairy cow slaughter maintains pace

Federally inspected milk cow slaughter was estimated at 247,400 head in September, according to the monthly USDA Livestock Slaughter report, released Oct. 25.

With two fewer weekdays and Saturdays than August 2018, the September 2018 total was down 32,300 head from the previous month. September 2018 also had one less weekday compared to September 2017, and slaughter was down 2,200 head compared to a year earlier.

Through the first nine months of 2018, the culling total is 2.34 million head, about 99,200 head more than the same period a year ago. January-September dairy cow culling was higher only once in the past decade – in 2013.

The USDA’s latest Milk Production report indicated there were 9.37 million cows in U.S. dairy herd in September 2018. Based on the slaughter estimates, about 2.6 percent of the herd was culled during the month. Cow culling so far in 2018 has averaged about 10,000 head per day (including weekdays and Saturdays), up about 400 head per day from a year ago. ![]()

-

Dave Natzke

- Editor

- Progressive Dairyman

- Email Dave Natzke