FMMO uniform milk prices for October milk marketings were announced the week of Nov. 9. The October Class III milk price took another big jump. At $21.61 per hundredweight (cwt), it was up $5.18 from September and $2.89 more than October 2019.

Through the first 10 months of 2020, the Class III price now averages $17.89 per cwt, the second-highest average for that period dating back to 2012. Based on current futures prices, it’s headed higher and could average near $18.40 per cwt for the year.

Once again, it was the power of protein carrying the load, although values for butterfat, nonfat solids and other solids were all higher in October. The value of protein rose to $5.01 per pound, the second time it’s topped $5 in 2020, thanks to strong cheese prices fueled by USDA food box purchases.

Meanwhile, the October Class IV milk price is $13.47 per cwt, up 72 cents from September but $2.92 less than October 2019. The January-October 2020 Class IV price averaged $13.52 per cwt, down $2.71 from the same period a year ago and the lowest January-October average in the past decade.

The October Class I base price was previously announced at $15.20 per cwt, down $3.24 from September and creating another substantial Class I base-Class price inversion at $6.41 per cwt. The gap between Class III and Class IV prices also widened in October to $8.14 per cwt, equaling the gap back in June 2020.

Those price relationships were again ample incentive for Class III depooling, contributing to negative PPDs.

Uniform prices, PPD implications

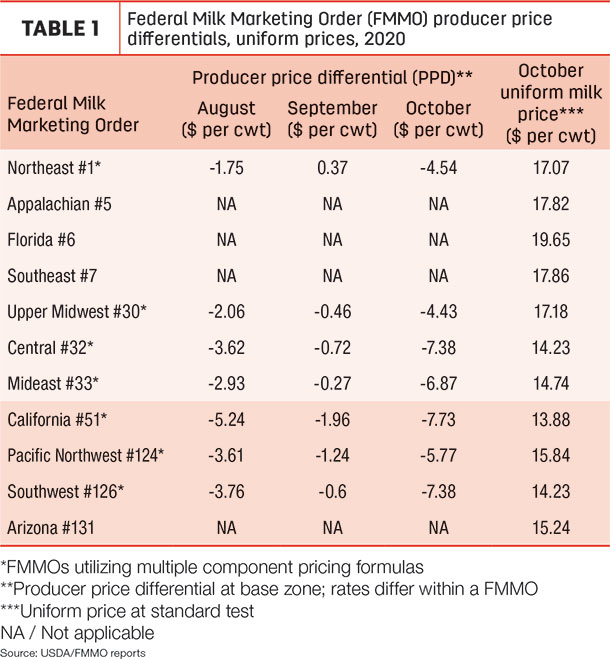

October uniform prices moved lower in eight of 11 FMMOs compared to September (Table 1), even though prices for three of four milk classes were up. That’s because depooling pulled the value of large volumes of high-value Class III milk from the pool.

The extreme inversion in Class I base-Class III prices and a wide gap between Class III and Class IV milk prices early this summer led to widespread depooling and historically negative PPDs.

After returning to some normalcy in September, October’s negative PPDs surged between $4-$6 in the seven FMMOs using multiple component pricing (Table 1). (As we’ve noted previously, PPDs have zone differentials, so they’ll vary slightly within each FMMO.). Negative PPDs were -$7 or worse in Central, California and Southwest FMMOs.

A look at the pools

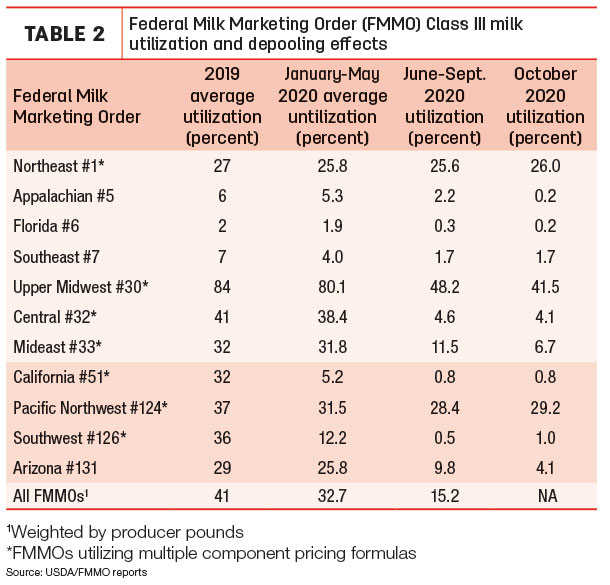

Since the amount of milk depooled is not reported, Table 2 shows Class III utilization in each order in attempt to capture depooling trends by comparing previous utilization percentages.

For example, Class III utilization averaged 84% of all milk pooled in 2019 in the Upper Midwest FMMO. That dropped to about 80% during January-May 2020, prior to the impact of the USDA’s cheese purchases under the Farmers to Families Food Box Program. Once those purchases kicked in, cash cheddar cheese prices skyrocketed, pushing Class III milk prices higher.

With incentives to depool, Class III utilization in the Upper Midwest order fell to about 48% between June-September and to 41.5% in October. Although not as dramatic, similar patterns occurred in many FMMOs. In many orders, October Class III pooling as a percentage of all milk pooled was the lowest of the year.

Prior to COVID-19’s impact on FMMO price formulas, Class III utilization as percentage of all milk pooled on FMMOs averaged about 33%. That fell to about 15% for June-September and likely declined even further in October.

Another way to estimate the extent of depooling is to monitor milk volume that was pooled. Pre-COVID-19, Class III milk pooled in all 11 FMMOs averaged about 4.34 billion pounds per month during January-May. With depooling in June-September, the volume of Class III milk pooled across all 11 FMMOs averaged just 1.51 billion pounds per month. In October, Class III pooled in all 11 FMMOS was estimated even lower at 1.31 billion pounds.

What's ahead?

How negative PPDs impact individual milk checks depends on your milk handler. In the past, Progressive Dairy has received calls from producers noting that some cheese co-ops had paid their producer members at or near the full Class III value, plus any applicable premiums. Other handlers have deducted all or portions of negative PPDs from the prices paid to their producers.

The situation will not go away in November. The Class I base price has been announced at $18.04 per cwt; Class III and Class IV futures prices as of Nov. 13 were $23.13 and $13.43 per cwt, respectively. If realized, November would again have a Class I-Class III price inversion of more than $5, and the Class III-Class IV gap would be nearly $10 per cwt.

More information

Mark Stephenson, director of dairy markets and policy at the University of Wisconsin, explained how milk is priced and discussed factors leading to negative PPDs in a recent webinar organized by Ohio State University’s College of Food, Agricultural and Environmental Sciences, in partnership with the Ohio Dairy Producers Association. ![]()

-

Dave Natzke

- Editor

- Progressive Dairy

- Email Dave Natzke