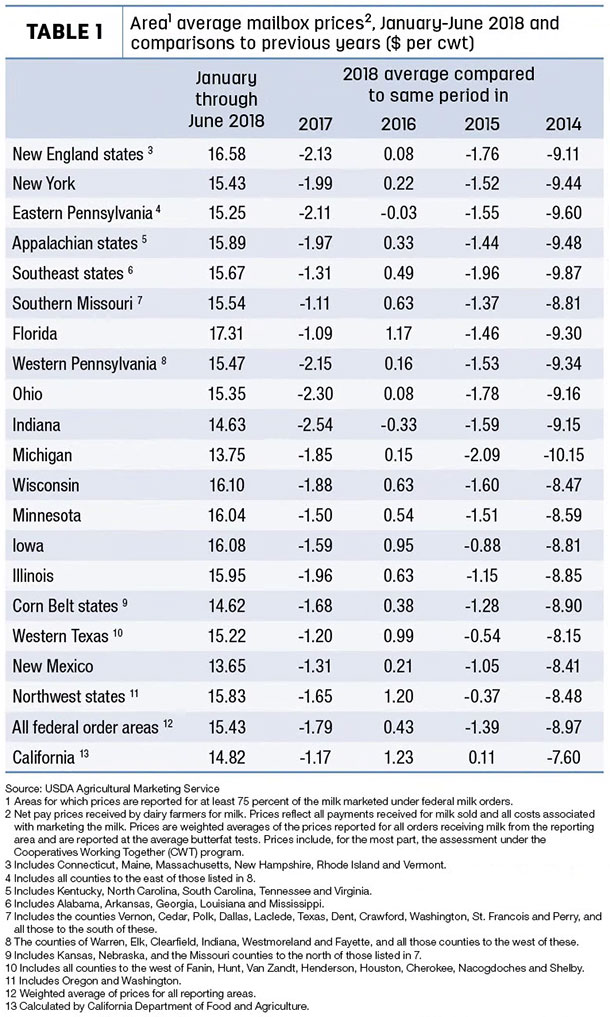

Through the first six months of 2018, average Federal Milk Marketing Order (FMMO) “mailbox prices” – approximating the net price received by dairy farmers for milk after adding any premiums and deducting costs associated with hauling and marketing – were about $1.79 per hundredweight (cwt) less than the same period in 2017 (Table 1). For those with a longer memory, average mailbox prices were running $9 per cwt less than the record highs of 2014.

So far in 2018, New Mexico and Michigan dairy producers have seen mailbox milk price averages under $14 per cwt.

California 4a, 4b prices improve slightly

California’s September Class 4a price is $14.09 per cwt, up 4 cents from August but $1.60 less than September 2017. The year-to-date 2018 average stands at $13.57 per cwt compared to $15.32 per cwt a year ago.

The September 4b price is $15.62 per cwt, up 56 cents from August and 74 cents than September 2017. The January-September 2018 average stands at $14.34 per cwt compared to $15.24 per cwt a year ago.

September Class III, IV prices higher

September 2018 federal order Class III and Class IV milk prices moved higher. The September Class III price is $16.09 per cwt, up $1.14 from August but still 27 cents less than September 2017. The year-to-date Class III price average stands at $14.62 per cwt, down $1.49 from the same period a year earlier.

The September Class IV price is $14.81 per cwt, up 18 cents from August but $1.05 less than September a year ago. The January-September Class IV price average is $13.95 per cwt, down $1.55 from the same period a year earlier.

Global Dairy Trade prices lower again

Global Dairy Trade (GDT) dairy product prices were lower during the auction held Oct. 2. Among major products, the cheddar cheese price was down 1.2 percent to $3,468 per metric ton (MT); the butter price was down 5.9 percent to $4,016 per MT; skim milk powder was down 0.3 percent to $1,982 per MT; and the whole milk powder was down 1.2 percent to $2,753 per MT. The overall index was down 1.3 percent.

The next GDT auction is Oct. 16.

August cull cow prices dip

U.S. cull cow prices fell to a eight-month low in August, according to the USDA National Ag Statistics Service Ag Prices report.

August 2018 cull cow prices (beef and dairy combined) averaged $63 per cwt, down $3.80 from July and $13.30 per cwt less than August 2017.

Year-to-date, the cull cow price average is $65.95 per cwt, down $5.80 per cwt from January-August 2017.

USDA finds less corn, more soybeans in storage

The USDA released its latest Grain Stocks report estimates, finding less corn remaining from the 2017 harvest in storage, but more soybeans.

Old crop corn stocks in all positions on Sept. 1, 2018, totaled 2.14 billion bushels, down 7 percent from a year earlier. Of the total stocks, 620 million bushels were stored on farms, down 21 percent from a year earlier. Off-farm stocks, at 1.52 billion bushels, were up 1 percent from a year ago. The June-August 2018 indicated disappearance was estimated at 3.16 billion bushels compared with 2.94 billion bushels during the same period last year.

Old-crop soybeans stored in all positions on Sept. 1, 2018, totaled 438 million bushels, up 45 percent from a year earlier. Soybean stocks stored on farms totaled 101 million bushels, up 15 percent from a year ago. Off-farm stocks, at 337 million bushels, were up 58 percent from last September. Indicated disappearance for June-August 2018 totaled 781 million bushels, up 18 percent from the same period a year earlier.

Cottonseed quality impacted by Hurricane Florence

It’s too early to get a clear assessment, but early reports estimate about half of North Carolina’s cotton crop was lost to Hurricane Florence, according to Nigel Adcock with Cottonseed LLC. In terms of cottonseed availability, this would remove about 100,000 tons of cottonseed from an area that typically serves export markets and dairy farmers in New York, Pennsylvania, Ohio and Michigan.

In addition to quantity, dairy buyers should also be wary of cottonseed quality, including sprouted seeds and increased risks of molds and mycotoxins, Adcock said.

Of the 17 major cotton-producing states, North Carolina ranks seventh in terms of acreage and produced an estimated 217,000 tons of cottonseed in 2017.

Outside of North Carolina, small areas in eastern Georgia were impacted by the storm.

The latest USDA National Ag Statistics Service (NASS) Crop Progress report was based on known conditions as of Sept. 23. On that date, nearly 26 percent of North Carolina’s cotton crop had been rated good to excellent, down from 48 percent a week earlier. And about 71 percent of the crop’s cotton bolls were open, about equal to the 2013-17 average, making it susceptible to moisture damage.

Overall, the U.S. cotton crop condition remained little changed from the previous week: 29 percent of the crop remains in poor or very poor condition, while 39 percent is in good or excellent condition.

The next USDA Crop Production report is scheduled for Oct. 11, 2018. Last month’s report, released prior to Hurricane Florence, raised cottonseed harvest projections to 6.156 million tons, up 135,000 tons from August’s outlook. Depending on storm-related losses, the 2018 U.S. cottonseed harvest still has the potential to be the second-largest this decade.

As result of the ongoing trade war between the U.S. and China, container freight rates have been sliding, Adcock said. It’s possible that additional downside potential remains once production gets into full swing. ![]()

-

Dave Natzke

- Editor

- Progressive Dairyman

- Email Dave Natzke