As the first quarter of 2013 comes to a close, the outlook for dairy producers remains extremely hopeful for the balance of the year into early 2014 as forward margin projections are very strong.

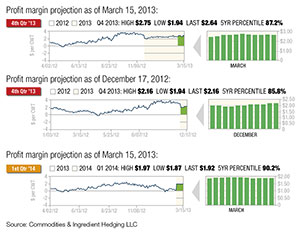

In fact, from a historical perspective, current price levels project profit margins at or above the 90th percentile of the past 10 years in both the third quarter and fourth quarter, while margins for the first quarter of 2014 are projected at the 87th percentile of the previous 10 years.

This means that dairies have only been more profitable less than 10 percent of the time for each of these respective periods over the previous 10 years. As such, there are tremendous opportunities currently being offered to milk producers who are proactive in their marketing strategies.

While only time will tell whether or not these margin projections come to fruition later in the year, current expectations for a large drop in feed costs based upon deferred futures prices coupled with the anticipation for higher milk prices have combined to create a very favorable landscape for forward margins.

Click here or on the image at right to open it in a new window.

The figures reflect both the current outlook for dairy margins through the first quarter of 2014 as well as comparison figures to these same forward profit margin projections back in December.

Milk prices appear to be drawing support from expectations that drought in Oceania will support dairy product prices moving forward through the spring and summer.

The New Zealand government is now describing the current drought which covers the entire North Island as the worst in the past 30 years, with parts of the South Island quite dry as well.

The North Island is responsible for approximately 65 percent of the country’s milk production, and the impact could have serious implications for exports of whole milk powder, for which New Zealand is the world’s largest producer.

While the U.S. is not a large producer or exporter of whole milk powder, its prominence in global trade is bound to have a big impact on world milk and dairy product prices, and it seems that the futures market is anticipating this as well.

New Zealand dairy cow slaughter is already 45 percent ahead of the five-year average, according to Agrifax, and declining whole milk powder availability will open up opportunities for other global exporters to meet demand.

U.S. dairy product exports increased during January, with milkfat and butter exports up 23 percent from December and 44 percent above a year ago. Cheese and curd exports were also higher, up 5 percent from December and 13 percent above January 2012.

While nonfat dairy milk powder exports were down from December and 2012, the U.S. will have a significant opportunity to increase skim milk powder exports moving forward if other global exporters increase their volumes of whole milk powder in response to the drought in New Zealand.

On a negative note, the USDA recently announced that due to sequestration, NASS will stop releasing its monthly milk production report, along with the July semi-annual cattle inventory report.

The milk production report in particular has been an important part of the price discovery process for both milk and dairy products, and its absence will surely be missed by industry participants.

While there is some latitude on the part of the Obama administration on where the budget axe falls in Congress, and some type of deal may be worked out in current negotiations to address the debt ceiling that could spare or modify cuts at the USDA, for now at least, the report will cease after the monthly report for February.

It remains to be seen what impact there will be on the market without the benefit of the monthly data, although the loss of transparency on the supply side may bring about more price volatility as we move forward into the spring and summer months.

It is fortunate that milk prices have firmed recently due to the production issues in Oceania as feed costs remain quite high. The USDA’s latest March WASDE report left corn ending stocks unchanged, although the line-item balance sheet adjustments were noteworthy.

The USDA reduced the export forecast as expected by 75 million bushels from February due to the ongoing poor pace of sales and shipments, and also raised the import forecast by 25 million bushels as supply dislocations and price discrepancies will allow increased imports into the Southeastern feed market.

These adjustments were completely offset, though, by an increase in the feed and residual estimate by 100 million bushels from February.

It is extremely rare for the USDA to adjust feed and residual usage in front of a quarterly stocks report, and the move speaks to the conviction of strength in domestic livestock demand.

Click here or on the image at right to open it in a new window.

The increase also helps to confirm the historically strong basis levels being reported in the domestic cash market, in some cases currently trading at record levels for this time of the year.

On the world balance sheet, meanwhile, Argentina’s corn crop was reduced 500,000 tons from February to 26.5 million tons.

While the adjustment isn’t expected to impact the country’s export projection, the change does tighten the global balance sheet with concern that further cuts may be forthcoming in future reports.

On the soybean balance sheet, Argentina’s production was cut 1.5 million tons, which is projected to lower the country’s soybean meal production and exports by one million tons each and tighten availability of feed on the global market.

The U.S. domestic soybean balance sheet was left unchanged from February, with ending stocks remaining historically tight at 125 million bushels. While the old crop situation remains very tight, expectations for the new crop supply/demand balance are significantly different.

The USDA does not release their first balance sheet for the 2013-2014 crop year until May, although the recent annual Outlook Forum projected corn ending stocks next year of 2.177 billion bushels and soybean ending stocks of 250 million bushels.

The corn stocks-to-use ratio would increase from the current projection of 5.6 percent to a much more comfortable 16.7 percent, while soybeans would increase from 4.1 percent to 7.6 percent next year if such a scenario were achieved.

The futures market clearly reflects these expectations heading into the planting season, with both new crop corn and soybeans trading at a historically wide $1.50 discount to old crop prices.

As a result of higher prices projected for milk futures and lower costs projected for feed, forward dairy margins are quite favorable right now from a historical perspective.

While much can happen between now and when these margins will actually be realized in the future, outstanding opportunities presently exist to protect very strong levels of profitability for a dairy.

There are many ways this can be accomplished – through physical contracting in the local cash market and/or through the use of exchange-traded alternatives.

Regardless of the preferred method, it is important to realize that these opportunities rarely last for very long. It would be prudent to put a plan in place now to help secure these forward margins before the opportunity disappears. PD

Whalen is a senior risk manager and director of education for Commodity & Ingredient Hedging based in Chicago, Illinois.

Chip Whalen

Vice President of Education and Research

Commodities & Ingredient Hedging LLC