Most dairy farmers are still kicking the tires, but some are already buying coverage under the new Dairy Revenue Protection (Dairy-RP) insurance program.

The policy application process and sales of federally subsidized milk revenue insurance endorsements opened on Oct. 9. A reminder: Dairy producers apply for a Dairy-RP policy, but purchase quarterly endorsements.

As of Oct. 15, 317 dairy producers had filed applications, led by 78 in Wisconsin, 58 in Idaho and 31 in Minnesota, according to the USDA’s Risk Management Agency (RMA) website.

Of those applications, 26 quarterly endorsements had been purchased, covering 222.5 million pounds of milk. Leading states in which dairy producers purchased quarterly endorsements were in Michigan and South Dakota (6 each), Idaho (5), Wisconsin (4) and Florida, Minnesota, Montana and Washington (1 each).

All but one of the endorsements was purchased at the 95 percent coverage level; the other was at 90 percent. Total premium costs on purchased endorsements were about $708,050, with USDA RMA subsidies covering about $306,700 of that.

John Newton, American Farm Bureau Federation (AFBF) chief economist and one of the creators of Dairy-RP, said AFBF was pleased with the effort of USDA staff leading up to and during deployment.

“We hope it becomes an important risk management option in the toolbox that dairy farmers consider,” Newton said via email. “It’s actuarially appropriate and an affordable tool.”

According to Ryan Yonkman, vice president at Rice Dairy LLC, curiosity in the program is running high, and educational efforts remain a critical step.

“There certainly is a lot of natural skepticism about the program and some incorrect assumptions on how much a person can protect, how often, and on the overall flexibility they have in the program,” Yonkman said. “Once we walk them through how it really works, it becomes pretty clear that this is a venue they will want access to when it comes to managing their milk price risk.”

As producers start to work through some of the unknowns, they’re dipping their toes in the water instead of diving in. Dairy-RP yield (milk per cow) forecasts are a key part of the indemnity formula.

“We are first running analysis on the yield forecasts for each state to help each producer understand what that potential yield risk looks like,” Yonkman said. “Second, the current forward curve of milk prices is not something to be to excited about, putting most of this coverage at below break-even levels for dairies at a time of year when seasonally we tend to see milk prices rally. So producers are being a little patient on when to execute, which makes sense at this point. Third, there are some who are taking the wait-and-see approach. They want to see how a quarter or two settles out before they jump in.”

According to Robin Schmahl, AgDairy LLC, there’s early interest in the program, but most dairy farmers remained guarded. Schmahl agrees that many producers are still struggling with their understanding of Dairy-RP, a problem complicated by the fact many are in fighting weather challenges in the middle of fall harvest.

“They know it is insurance but need to be able to see what level of coverage might work best for their operation, and that will take time,” Schmahl said. “Many want to give it some time to see the difference between coverage choices and how that affects premium.”

Most of Schmahl’s clients are interested in the “class” pricing option, which is somewhat less complex than the “component” policy option, he said.

Premium calculator

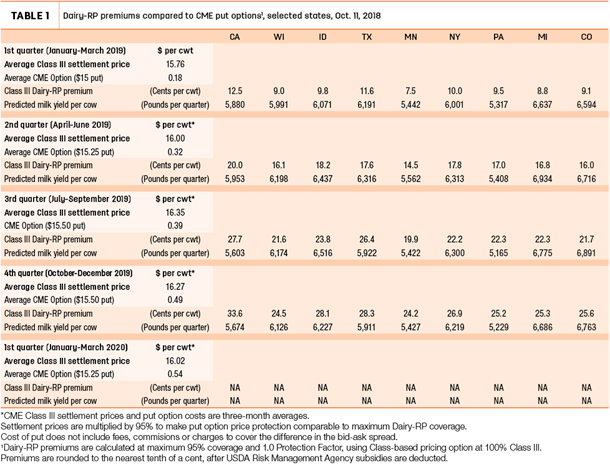

Dairy producers in each state or zone have a different Dairy-RP premium level, based on state or zone risk factors. Initial indications show Minnesota has the lowest premiums, while California has the highest (Table 1).

Click here or on the image above to open it at full size in a new window.

According to an article by Newton (How Much Will Dairy Revenue Protection Cost?), the cost of Dairy-RP will vary daily based on the state, coverage level or class price weighting factor, as well as on the futures market prices and option-implied risk. Finally, premiums will be impacted by the expected yield deviation for state-level or pooled production region milk production per cow.

USDA has established a Cost Estimator website to allow producers and their policy providers with estimated costs. (Be forewarned, you may have to change your computer’s “pop-up blocker” to gain access to the calculator.)

Some companies offering Dairy-RP policies have also created their own calculators and apps to assist producers with coverage estimates and costs.

Rice Dairy’s Yonkman said the initial premiums came in about as expected. For Schmahl, whose client base in primarily in Wisconsin, the premiums are attractive, especially with subsidies offered by the USDA’s RMA. However, he said, dairy producers must decide what they want to accomplish when weighing their participation in Dairy-RP, using CME futures contracts and options, or a combination of both plus other risk management strategies.

“From strictly a cost standpoint, [Dairy-RP] is worth exploring,” Schmahl said. “Prices, premiums and cost will change on a daily basis, but should remain attractive.”

Dairy-RP coverage offers the flexibility of purchasing protection on any milk volumes on a quarterly basis. Another caveat: Dairy-RP can provide insurance coverage on losses related to declining milk production, while CME contracts and put options protect only the milk price.

One drawback, the maximum Dairy-RP coverage is 95 percent of expected revenue. Therefore, protecting a $16 per hundredweight (cwt) Class III price under Dairy-RP protects an actual Class III price of about $15.20 per cwt. Producers could protect a higher floor price by purchasing at-the-money CME put options closer to the Class III settlement price, but at a higher cost of the puts.

CME contracts offer the flexibility of purchasing monthly contracts, but they must be purchased in 100,000- or 200,000-pound increments. Contracts carry a separate fee, with additional fees to purchase put options. Dairy farmers hedging through their co-ops may actually see a higher fee because the co-op may assume the cost of margin calls.

Schmahl urges producers to weigh their goals when making those decisions.

Costs compared

For information purposes only, Progressive Dairyman generated a spreadsheet (Table 1) attempting to compare Dairy-RP premiums for selected states with price protection offered through CME Class III put options. The analysis here looks at coverage strictly on a cost basis for a similar milk price.

Because all factors change on a daily basis, the “snapshot in time” calculations were based on numbers available at the CME close of trading on Oct. 11.

The comparisons are not exactly apples to apples because there are other variables to consider.

For put option purposes, CME settlement prices for Class III milk were multiplied by 95 percent to get a price close to the maximum price Dairy-RP coverage level. When interpreting this example, remember that the CME contracts and put options are available for individual months, and the numbers listed in Table 1 are three-month averages.

While Dairy-RP endorsements were to cover up to five quarters, as of Oct. 14, the USDA RMA website offered no premium estimates for the first quarter of 2020. Brokers contacted by Progressive Dairyman said that’s likely because there were no or limited CME trades for that quarter. ![]()

-

Dave Natzke

- Editor

- Progressive Dairyman

- Email Dave Natzke